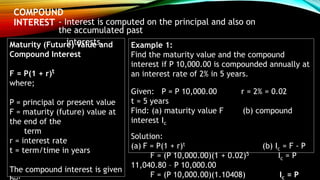

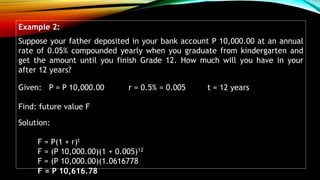

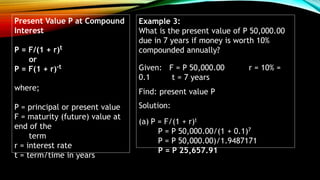

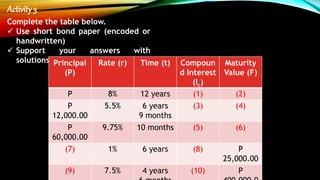

This document discusses compound interest, which is interest calculated on the principal amount as well as on accumulated interest from previous periods. It provides formulas for calculating the maturity value, compound interest, and present value given the principal, interest rate, and time. It includes three examples calculating these values in different compound interest scenarios. It concludes with an activity asking the reader to complete a table calculating compound interest, maturity value, and other values for given principal amounts, interest rates, and time periods using the formulas provided.