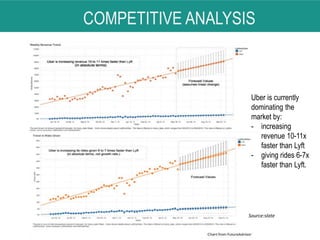

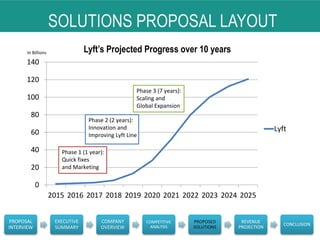

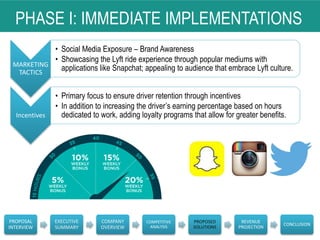

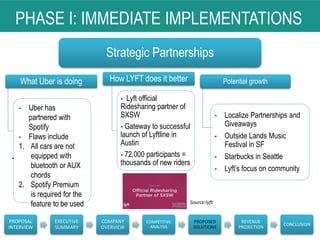

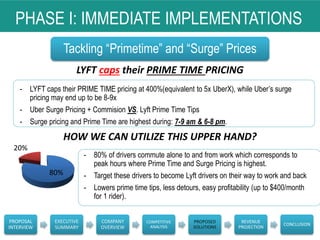

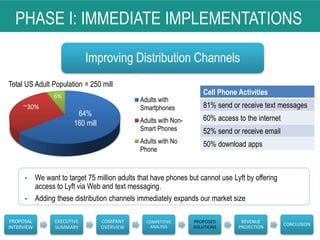

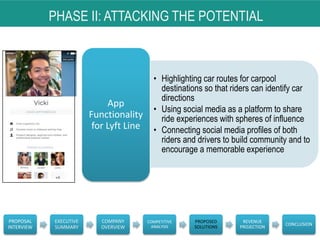

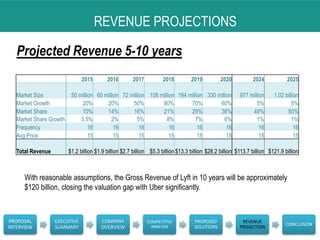

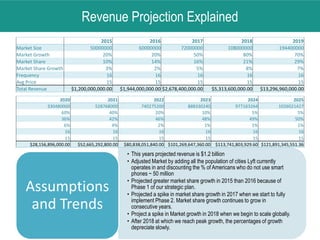

The document presents a proposal from Lyft for closing the valuation gap with Uber by focusing on their carpool service, Lyft Line, which outperforms Uber's Uberpool. It outlines strategies including enhancing driver and customer incentives, employing effective marketing, and establishing strategic partnerships to strengthen Lyft's market presence and facilitate global scalability. Projections indicate that with these efforts, Lyft's revenue could grow significantly, approaching $121.9 billion by 2025.