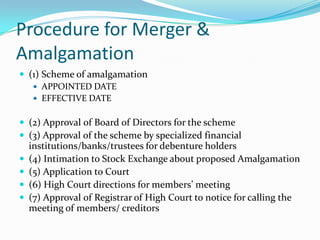

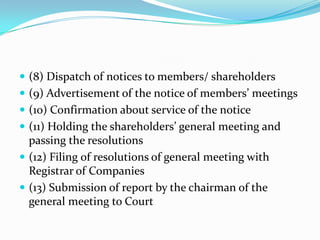

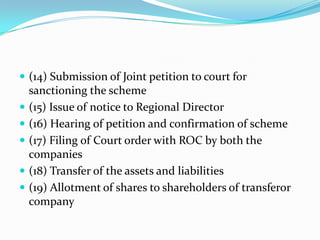

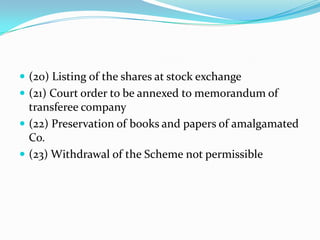

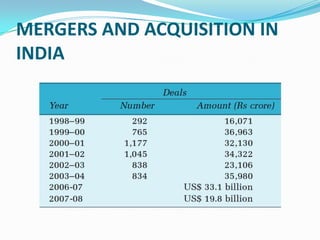

The document outlines the legal procedures for mergers and amalgamation in India. It discusses 23 steps in the process, including getting board approval, notifying stock exchanges, applying to the High Court, holding shareholder and creditor meetings, getting High Court sanction, transferring assets and liabilities, and filing documents with the registrar of companies. It also lists the largest mergers and acquisitions deals in India, led by Tata Steel's acquisition of Corus for $12.2 billion.