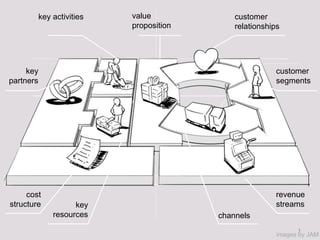

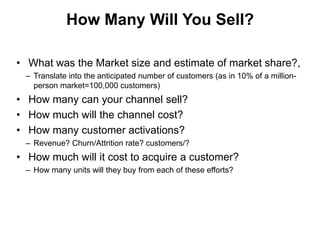

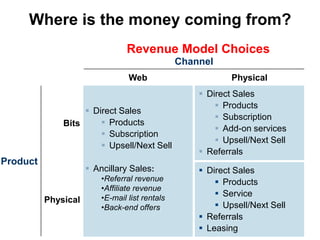

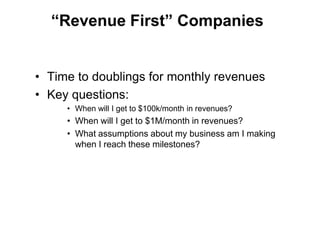

The document discusses revenue streams and models for startups. It covers:

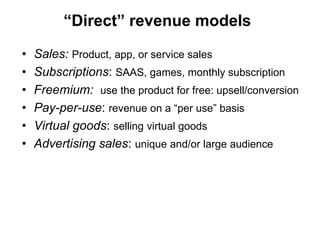

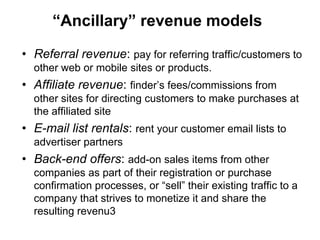

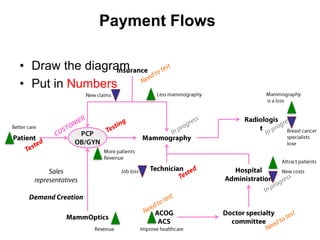

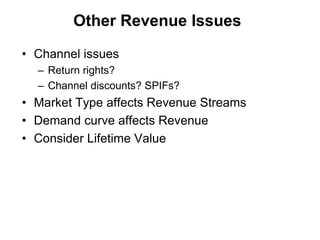

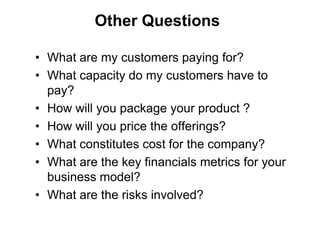

1) Different types of revenue streams like direct sales, subscriptions, advertising, and ancillary revenues from referrals or affiliate programs.

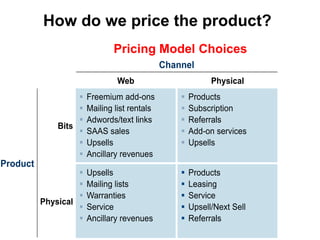

2) Revenue models for web/mobile like direct sales, subscriptions, freemium, pay-per-use, and virtual goods.

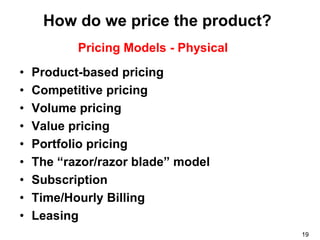

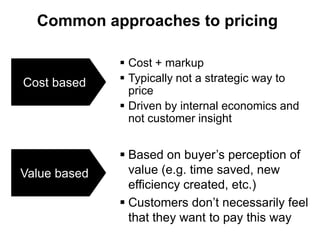

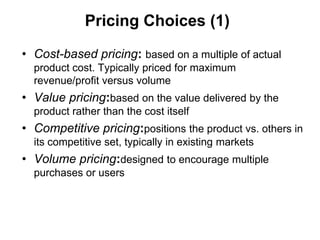

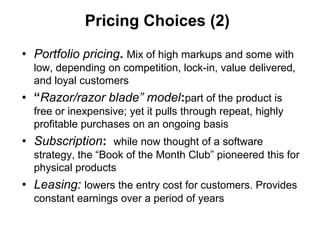

3) Pricing models like cost-based, value-based, competitive pricing, volume pricing, and portfolio pricing. It discusses factors to consider like competition and market type.