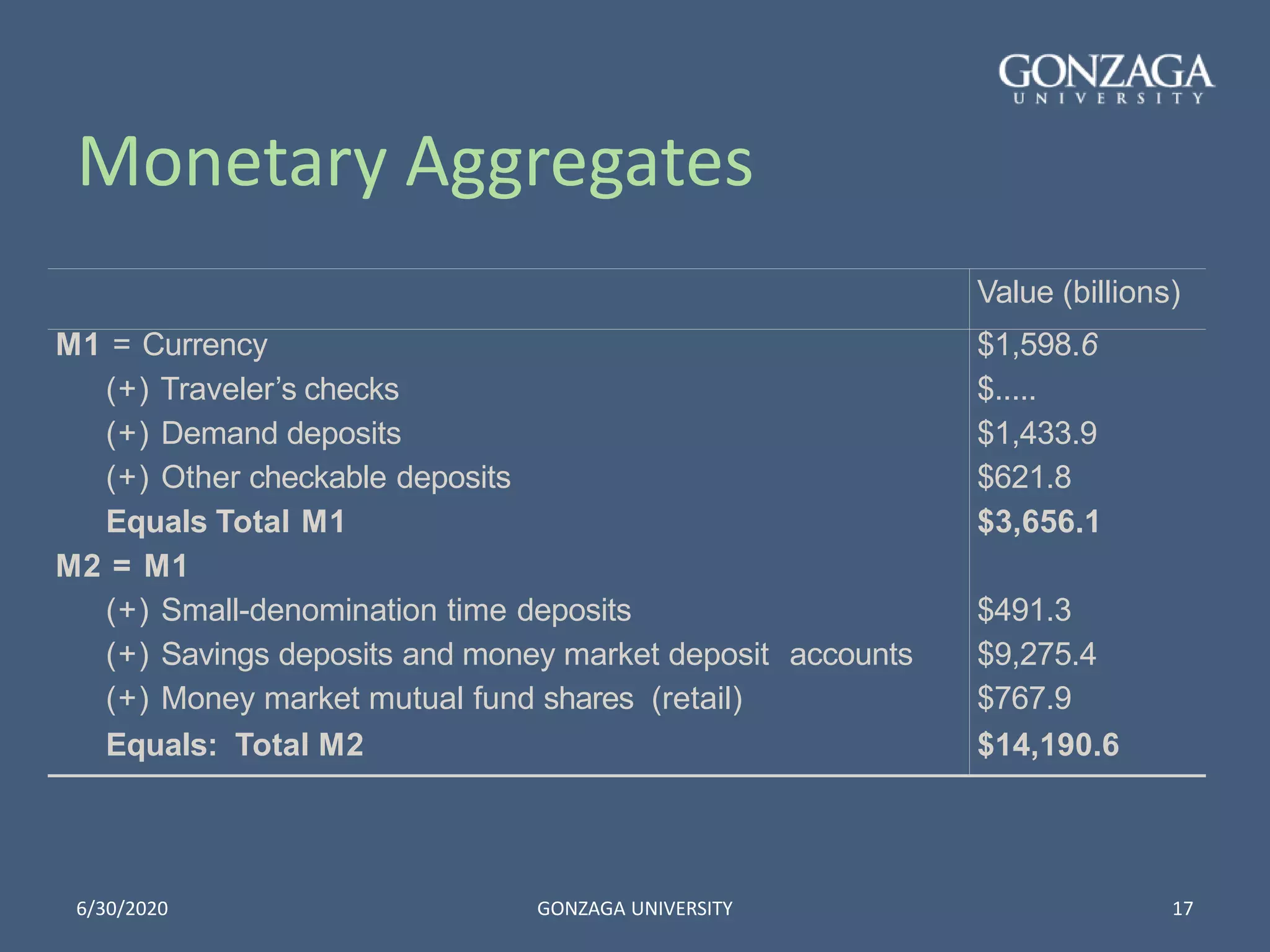

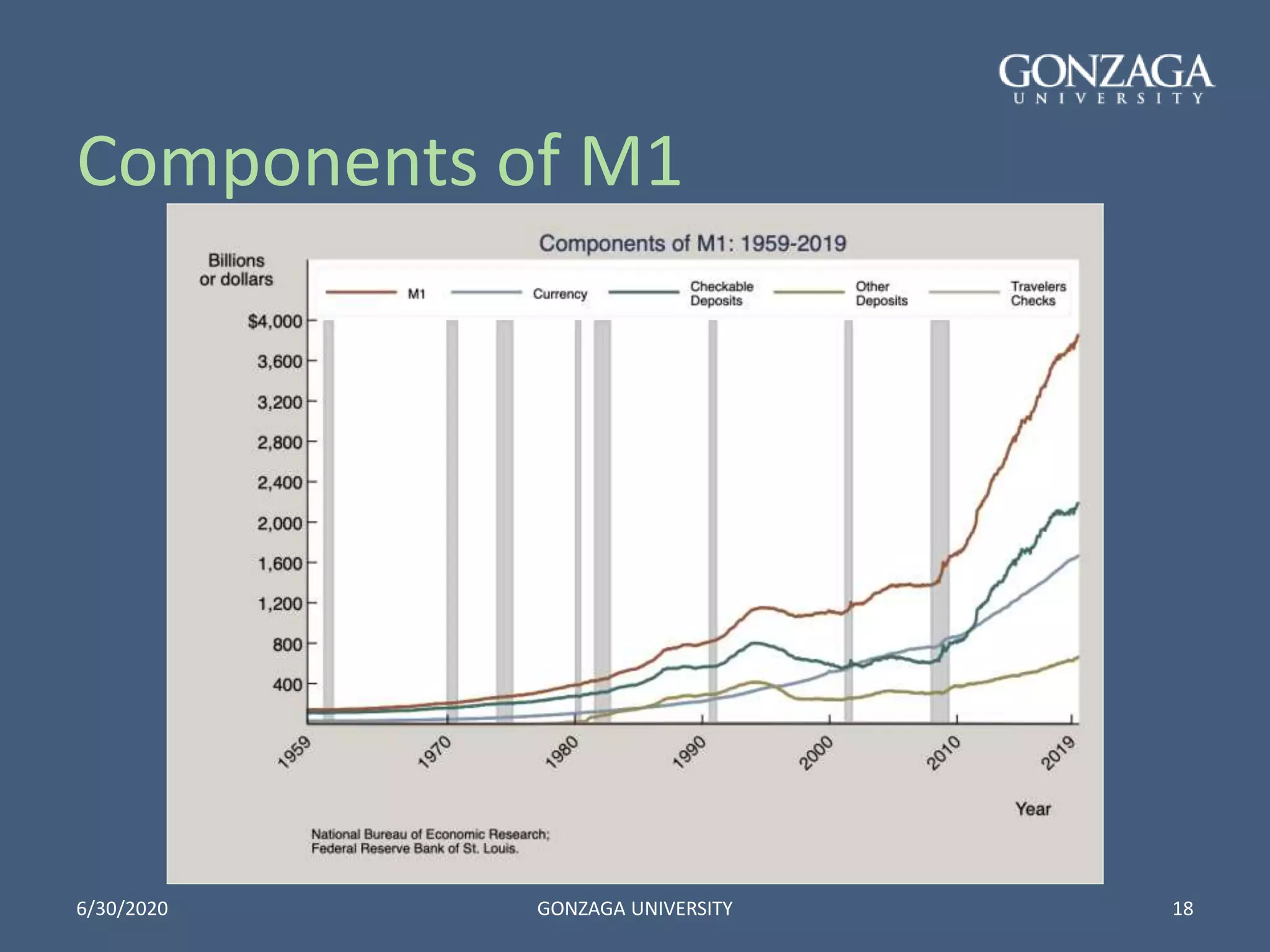

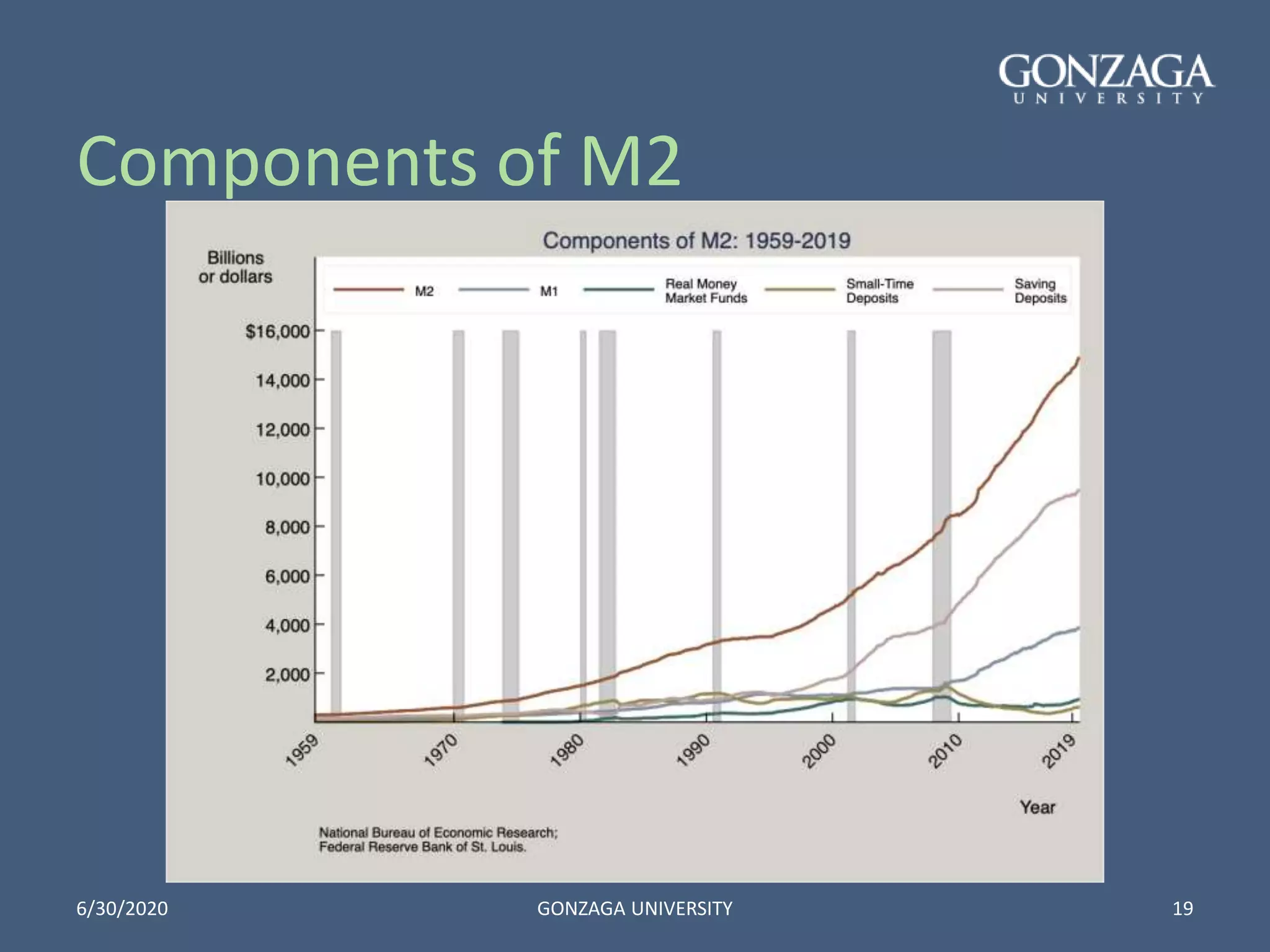

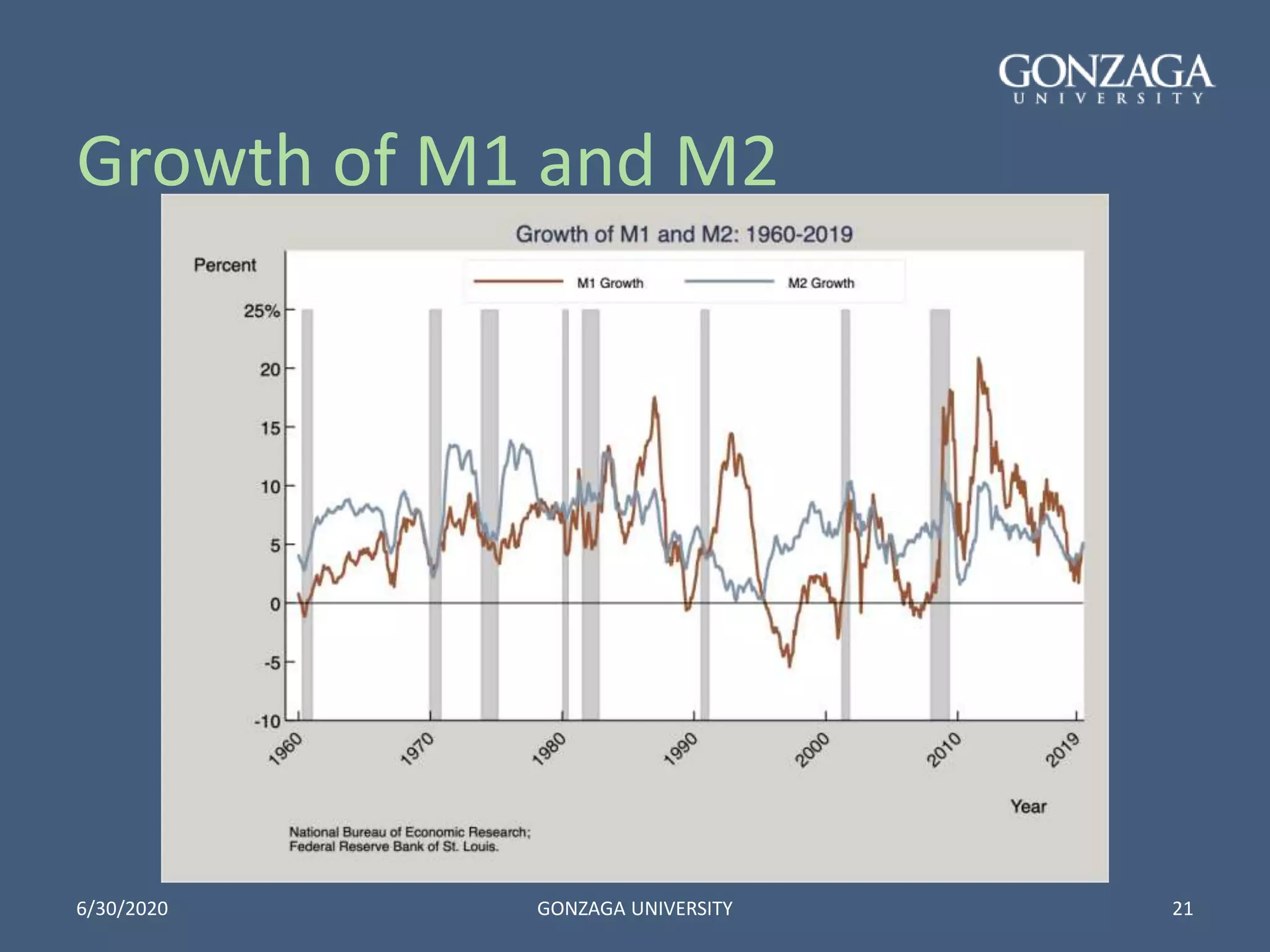

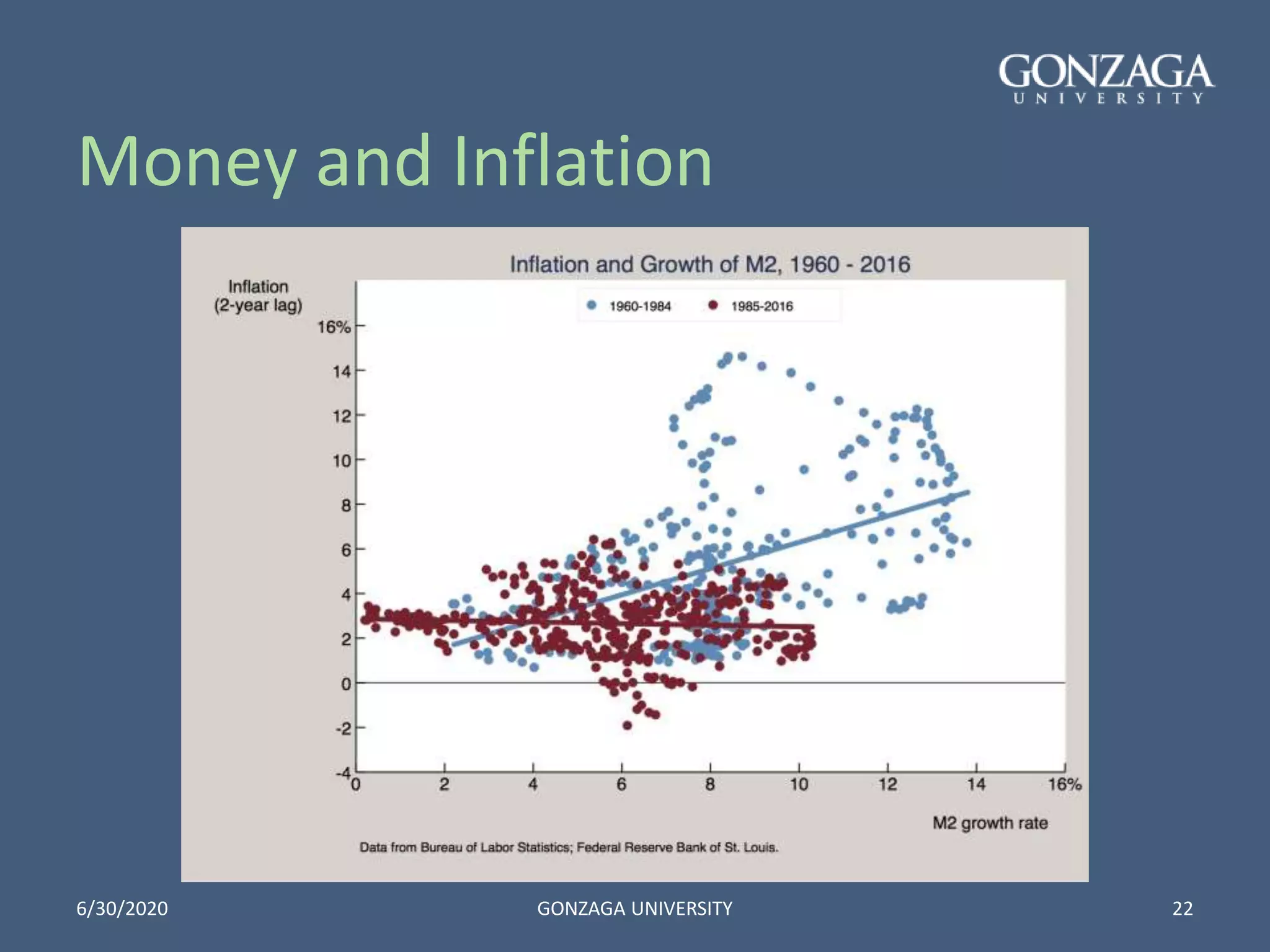

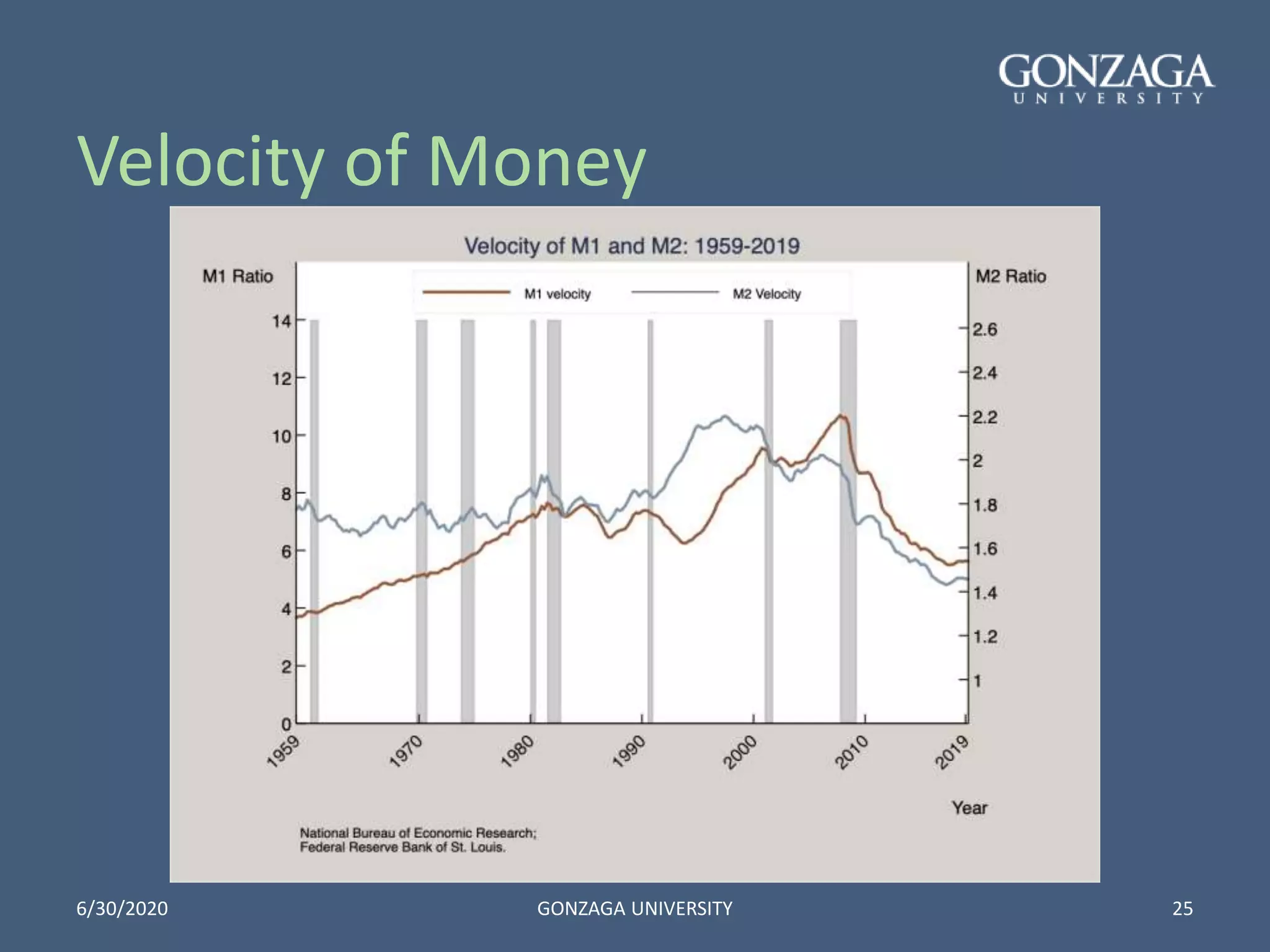

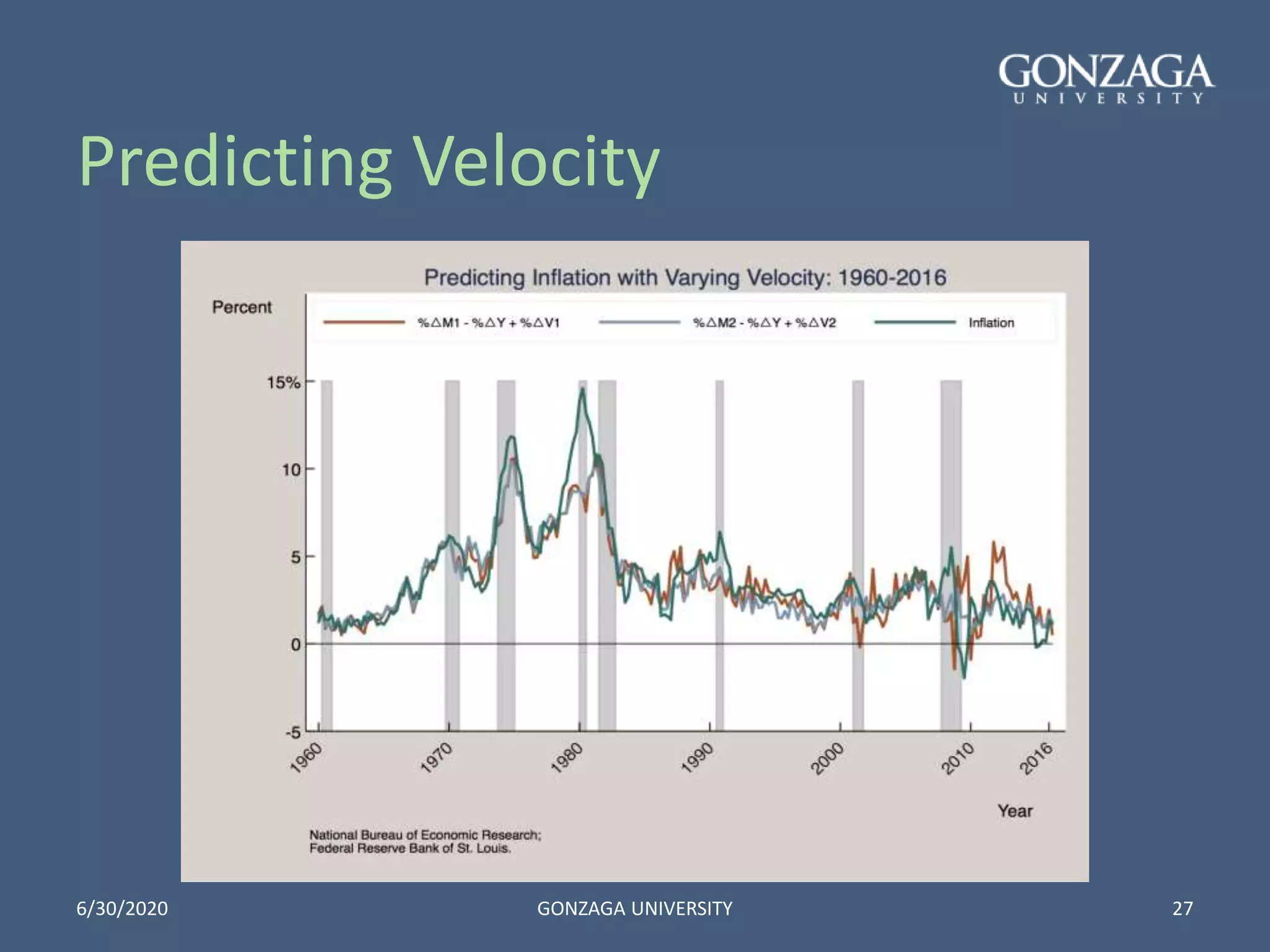

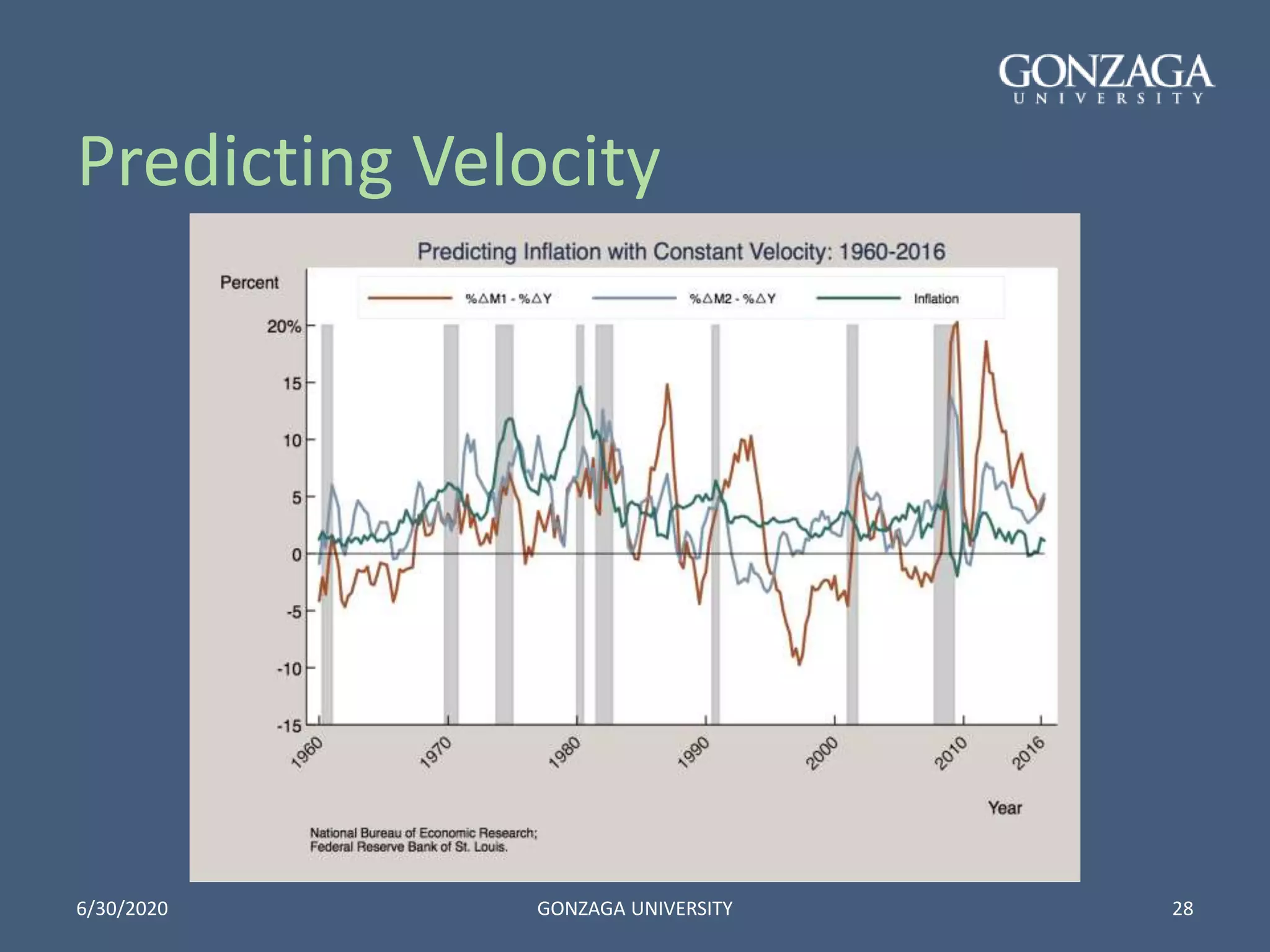

This document discusses money, inflation, and their relationship. It defines money as an asset used to purchase goods and services that serves as a medium of exchange, unit of account, and store of value. The document outlines different monetary aggregates (M0, M1, M2) and explains how too much money growth can lead to inflation according to the quantity theory of money. While money and inflation are linked in the long run, the relationship breaks down in the short run, allowing monetary policy to influence output.