The document discusses several theories of international trade, including:

1. Mercantilism held that a nation's wealth depends on accumulating gold and silver, and that governments should promote exports and discourage imports to achieve a trade surplus.

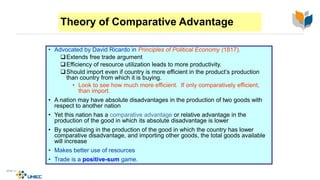

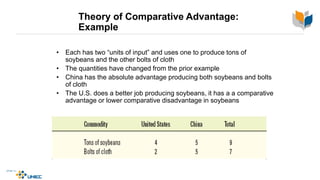

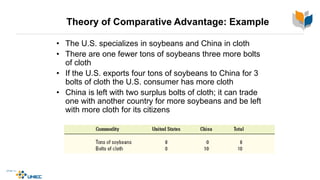

2. Comparative advantage theory proposed by Ricardo states that countries should specialize and trade for goods they are relatively less efficient in producing to increase total global output. Even if less efficient overall, a country benefits from importing goods where its disadvantage is lower.

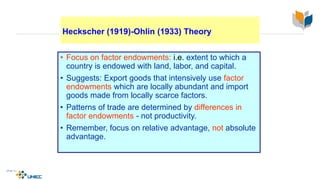

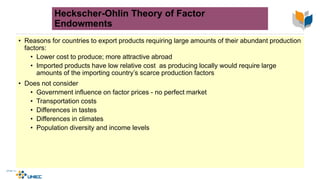

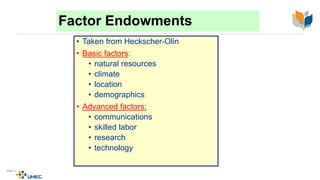

3. Heckscher-Ohlin theory proposes that patterns of trade are determined by differences in factor endowments (e.g. land, labor, capital), with countries exporting goods intensive in their locally abundant factors