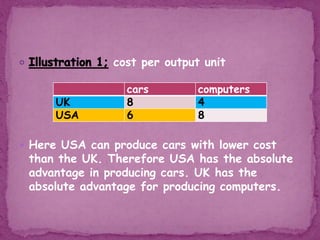

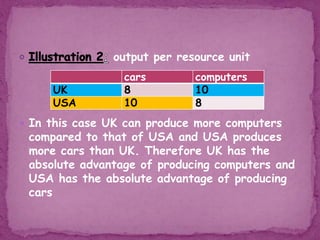

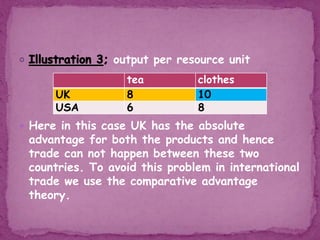

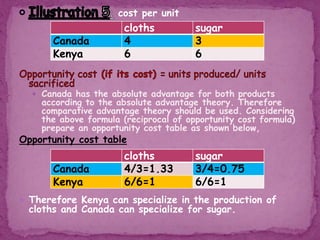

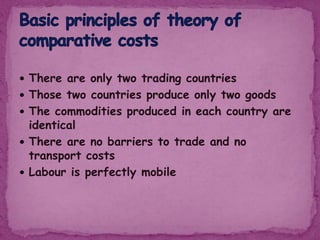

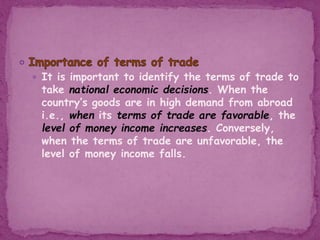

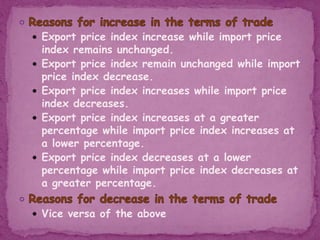

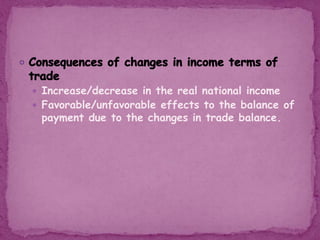

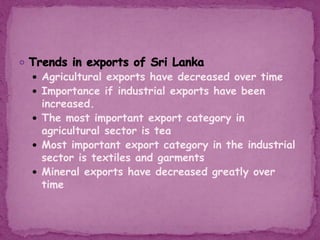

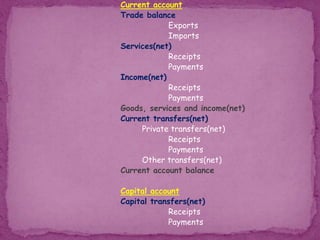

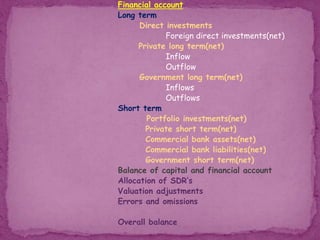

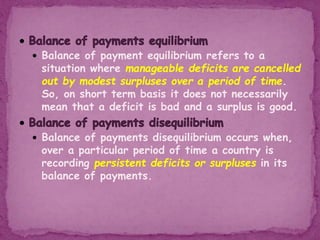

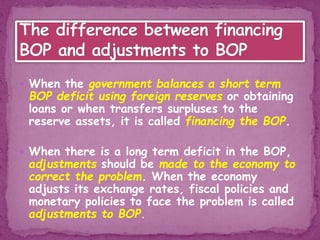

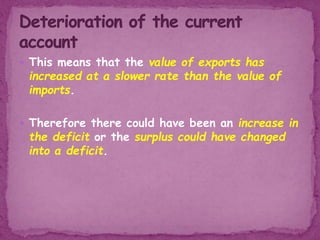

This document discusses international trade and the balance of payments. It defines domestic and international trade, and explains the benefits of international trade such as increased competition and more affordable products. Absolute advantage and comparative advantage theories of international trade are explained using examples. Factors that can change a country's comparative advantage over time are also discussed. The unrealistic assumptions of the Heckscher-Ohlin model are summarized. The document also outlines the structure of exports and imports for Sri Lanka and explains how they have changed over time. Finally, it provides an overview of the components of a country's balance of payments, including the current account, capital account, and financial account.