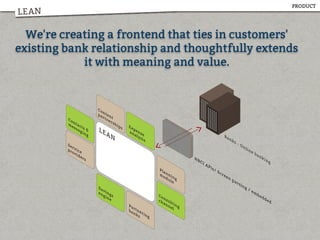

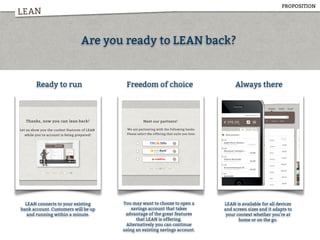

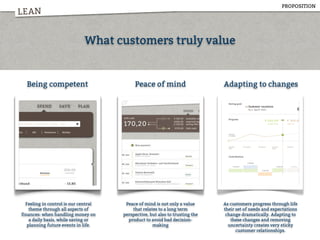

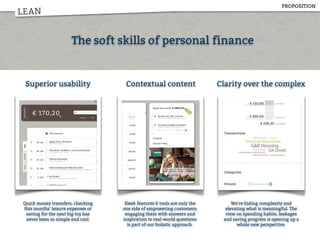

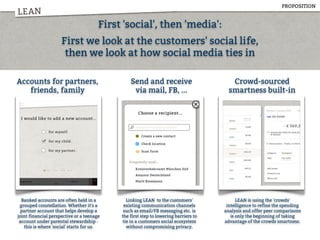

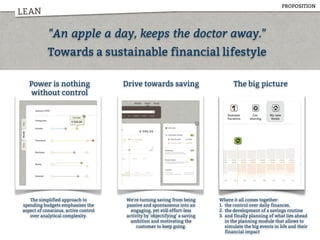

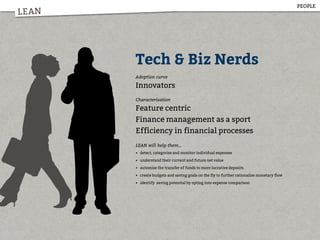

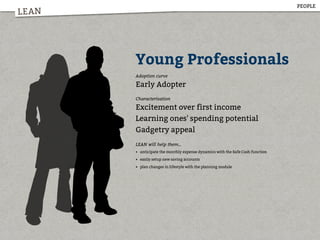

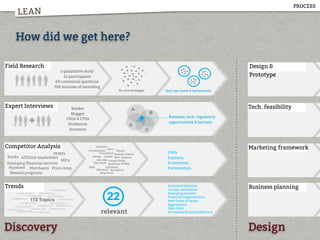

This document provides an overview of LEAN, a proposed new financial service. It believes in empowering customers by giving them the right tools and technology to take control of their finances. LEAN's mission is to provide an effortless way for customers to improve their financial health, wealth and happiness. It aims to bridge gaps in traditional banking relationships and provide true value across a customer's lifetime. LEAN will connect to customers' existing bank accounts and extend services by tying in other financial products and tools. It conducted research including interviews with experts to identify opportunities and design an initial product model and proposition.