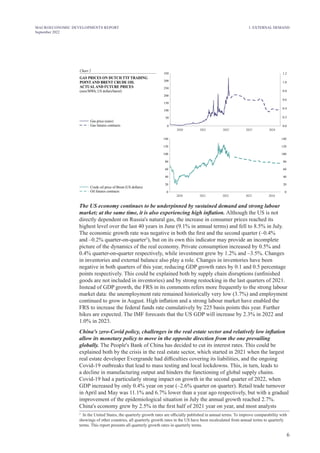

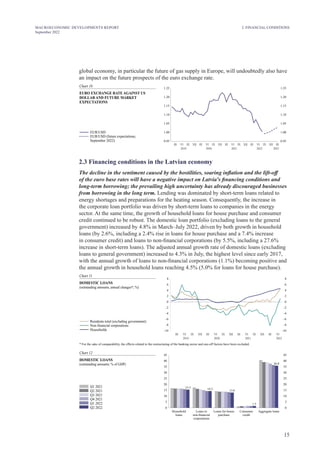

The September 2022 macroeconomic developments report highlights the significant impact of rising energy and food prices, primarily due to the war in Ukraine, which has led to increased inflation forecasts for Latvia. Central banks, including the ECB, are tightening monetary policy in response to inflation above the Euro area average, while external demand is hampered by geopolitical risks and declining consumption. The report also notes the possibility of a recession as household purchasing power declines amidst high inflation and tightening financial conditions.