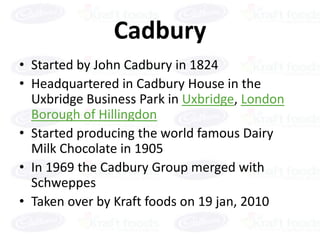

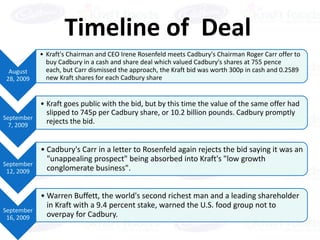

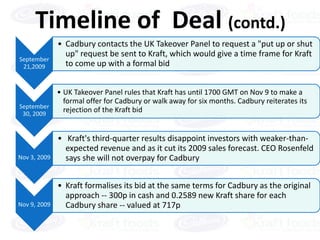

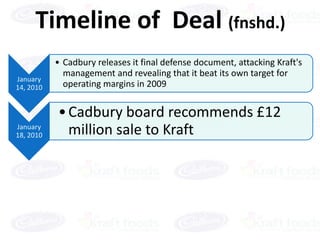

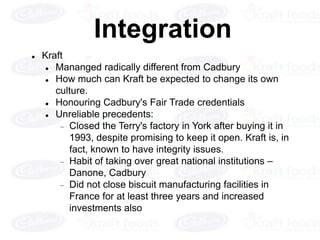

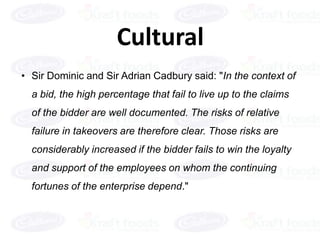

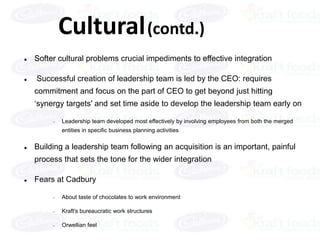

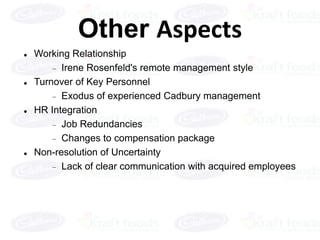

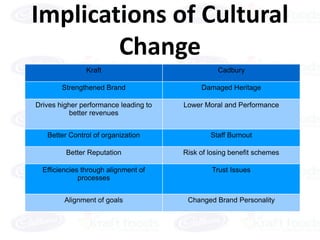

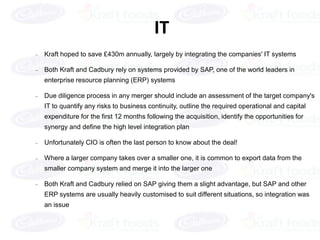

Kraft Foods acquired Cadbury in 2010 in a $19 billion deal. This allowed Kraft to enter emerging markets like India and China where Cadbury had a strong presence. It also gave Kraft access to Cadbury's distribution network in developing countries. However, integrating the two company's cultures posed challenges due to their different management styles and work environments.