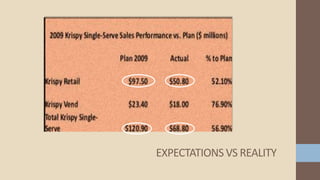

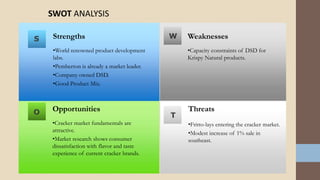

The document discusses the case of Pemberton Products, a division of Candler Enterprises, entering the salty cracker market with the acquisition of Krispy Inc. It highlights the strategic importance of addressing taste deficiencies and expanding the product line, leading to the successful relaunch of the brand as Krispy Natural, which featured new flavors and whole wheat ingredients. The marketing strategies employed included effective advertising, premium pricing with competitive visual pricing, and a focus on distribution effectiveness.