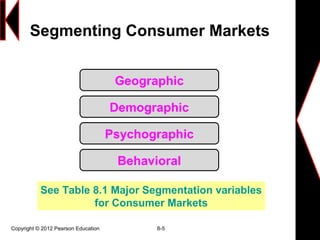

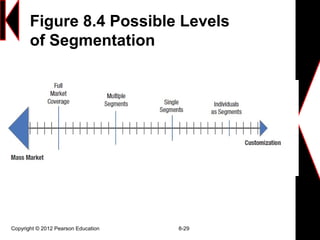

This document discusses market segmentation and targeting. It defines a market segment as a group of customers who share similar needs and wants. It describes different ways to segment markets, including geographic, demographic, psychographic, and behavioral segmentation. Effective segmentation involves identifying distinct customer groups, selecting one or more segments to target, and establishing the benefits of the offering for those segments. The document provides examples of segmentation frameworks and outlines the steps in the segmentation and targeting process.