Recommended

PPT

Identifying market segments & targets

PPT

PPTX

Marketing Fundamentals Part 2 Target Market & Segmentation

PDF

ch 08 market segmentation.pdf business related

PPT

PPTX

PDF

Neha Kumari Jatav BBA 2nd Year

PDF

Ch 08 identifying market segments and targets

PDF

PPT

PPT

BBCT1013Marketing Chapter 6-Segmentation, Targeting and Positioning.ppt

PPT

PPT

Marketing management Chapter 3: Market segmentation, targeting, Positioning

PPT

PPT

PPTX

Chapter 5 Marketing Management

PPTX

Kotler framework 5e_07_sppt

PPTX

Marketing management 5.pptx

PPT

MF Strategic Marketing Market segmentation, target market and positioning

PPT

PPTX

PPT

Market Segmentation in Consumer Behavior

PPTX

Marketing segment, target

PDF

Unit 2 Market Segmentation, Targeting, Differentiation & Positioning.pdf

PPT

Marketing Managment Kotler mm14 ch07_dppt

PDF

PPTX

PDF

Vaibhav Khurana BBA-1st Year

PPTX

Keynote: The Modern CMO: Architect of Growth. Guardian of Credibility.

PDF

How To Buy Verified Cash App Accounts - Secure Your Transactions.pdf

More Related Content

PPT

Identifying market segments & targets

PPT

PPTX

Marketing Fundamentals Part 2 Target Market & Segmentation

PDF

ch 08 market segmentation.pdf business related

PPT

PPTX

PDF

Neha Kumari Jatav BBA 2nd Year

PDF

Ch 08 identifying market segments and targets

Similar to Chapter- Five (Identifying Market Segments)

PDF

PPT

PPT

BBCT1013Marketing Chapter 6-Segmentation, Targeting and Positioning.ppt

PPT

PPT

Marketing management Chapter 3: Market segmentation, targeting, Positioning

PPT

PPT

PPTX

Chapter 5 Marketing Management

PPTX

Kotler framework 5e_07_sppt

PPTX

Marketing management 5.pptx

PPT

MF Strategic Marketing Market segmentation, target market and positioning

PPT

PPTX

PPT

Market Segmentation in Consumer Behavior

PPTX

Marketing segment, target

PDF

Unit 2 Market Segmentation, Targeting, Differentiation & Positioning.pdf

PPT

Marketing Managment Kotler mm14 ch07_dppt

PDF

PPTX

PDF

Vaibhav Khurana BBA-1st Year

Recently uploaded

PPTX

Keynote: The Modern CMO: Architect of Growth. Guardian of Credibility.

PDF

How To Buy Verified Cash App Accounts - Secure Your Transactions.pdf

PDF

_Top 7 Mistakes to Avoid When Buying Google Ads Accounts.pdf

PDF

_Top 7 Tips for Buying Verified PayPal Accounts.pdf

PDF

_5 Trusted Strategies to Buy Verified Wise Accounts Safely & Legally.pdf

PPTX

Explore Hubspot’s Customer Agent for B2B

DOCX

_18 Buying USA LinkedIn Accounts Can Boost Your Social.docx

PDF

How to Buy Twitter Accounts_ A Step-by-Step Guide (2).pdf

DOCX

How to Buy Verified OnlyFans Accounts Work in 2026.docx

DOCX

Buy Verified PayPal Accounts for Secure Online Use docx

PDF

Top 5 Trusted Websites to Buy Verified PayPal Accounts Safely in 2026

PDF

17 Guide to Buying Verified Binance Accounts in the US.pdf

DOCX

Buy Verified PayPal Account Online_ A Comprehensive ....docx

PDF

A Comprehensive Guide to Buy Verified PayPal Accounts in the US.pdf

PDF

Best 9 Sites to Buy Hotmail Accounts (Aged & PVA).pdf

PDF

Equinox Gold - January Investor Presentation.pdf

PDF

Equinox Gold - Corporate Presentation - Jan 2026

PDF

OIL CHECK 500 Portable - Air Quality Monitoring System

PDF

Kirill Klip GEM Royalty TNR Gold Lithium Presentation

PPTX

Exterior Front Entry Door Design Trends, 2025–2026

Chapter- Five (Identifying Market Segments) 1. Copyright © 2003 Prentice-Hall, Inc.

3-1

Chapter 5

Identifying Market Segments and

Targets

2. Copyright © 2003 Prentice-Hall, Inc.

10-2

Chapter Objectives

The following topics will be covered in this chapter:

Bases for Segmenting Consumer Markets

- Geographic Segmentation

- Demographic Segmentation

- Psychographic Segmentation

- Behavioral Segmentation

Bases for Segmenting Business Markets

Market Targeting

3. Copyright © 2003 Prentice-Hall, Inc.

10-3

Market Segmentation

Target marketing requires marketers to take three

major steps:

Identify and profile distinct groups of buyers who differ

in their needs and preferences (market segmentation).

Select one or more market segments to enter (market

targeting).

For each target segment, establish and communicate the

key distinctive benefit(s) of the company’s market

offering (market positioning).

4. Copyright © 2003 Prentice-Hall, Inc.

10-4

Bases for Segmenting Consumer

Markets

Bases for Segmenting Consumer Markets

Geographic Segmentation

Demographic Segmentation

Psychographic Segmentation

Behavioral Segmentation

5. Copyright © 2003 Prentice-Hall, Inc.

10-5

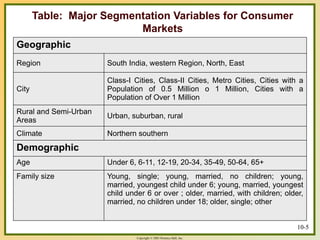

Table: Major Segmentation Variables for Consumer

Markets

Geographic

Region South India, western Region, North, East

City

Class-I Cities, Class-II Cities, Metro Cities, Cities with a

Population of 0.5 Million o 1 Million, Cities with a

Population of Over 1 Million

Rural and Semi-Urban

Areas

Urban, suburban, rural

Climate Northern southern

Demographic

Age Under 6, 6-11, 12-19, 20-34, 35-49, 50-64, 65+

Family size Young, single; young, married, no children; young,

married, youngest child under 6; young, married, youngest

child under 6 or over ; older, married, with children; older,

married, no children under 18; older, single; other

10-5

6. Copyright © 2003 Prentice-Hall, Inc.

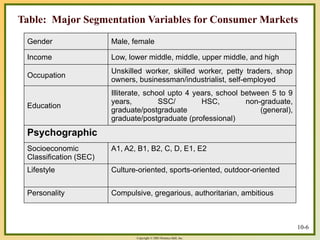

Table: Major Segmentation Variables for Consumer Markets

Gender Male, female

Income Low, lower middle, middle, upper middle, and high

Occupation

Unskilled worker, skilled worker, petty traders, shop

owners, businessman/industrialist, self-employed

Education

Illiterate, school upto 4 years, school between 5 to 9

years, SSC/ HSC, non-graduate,

graduate/postgraduate (general),

graduate/postgraduate (professional)

Psychographic

Socioeconomic

Classification (SEC)

A1, A2, B1, B2, C, D, E1, E2

Lifestyle Culture-oriented, sports-oriented, outdoor-oriented

Personality Compulsive, gregarious, authoritarian, ambitious

10-6

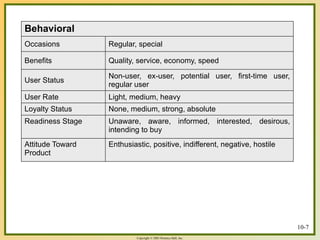

7. Copyright © 2003 Prentice-Hall, Inc.

Behavioral

Occasions Regular, special

Benefits Quality, service, economy, speed

User Status

Non-user, ex-user, potential user, first-time user,

regular user

User Rate Light, medium, heavy

Loyalty Status None, medium, strong, absolute

Readiness Stage Unaware, aware, informed, interested, desirous,

intending to buy

Attitude Toward

Product

Enthusiastic, positive, indifferent, negative, hostile

10-7

8. Copyright © 2003 Prentice-Hall, Inc.

10-8

Segmenting Consumer Markets

1. Geographic Segmentation:

Nations

States

Regions

Countries

Cities or

Neighborhoods

Geo-clustering

9. Copyright © 2003 Prentice-Hall, Inc.

10-9

Segmenting Consumer Markets

2. Demographic Segmentation

Age and Life –Cycle Stages: Johnson & Johnson,

Disney, MTV, Aastha Channel

Life Stage

Gender

Income

Generation

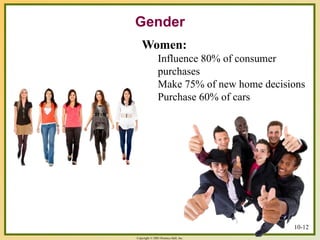

10. 11. 12. Copyright © 2003 Prentice-Hall, Inc.

Gender

Women:

Influence 80% of consumer

purchases

Make 75% of new home decisions

Purchase 60% of cars

10-12

13. 14. Copyright © 2003 Prentice-Hall, Inc.

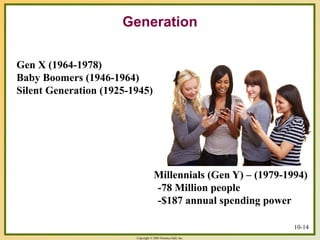

Generation

Gen X (1964-1978)

Baby Boomers (1946-1964)

Silent Generation (1925-1945)

Millennials (Gen Y) – (1979-1994)

-78 Million people

-$187 annual spending power

10-14

15. Copyright © 2003 Prentice-Hall, Inc.

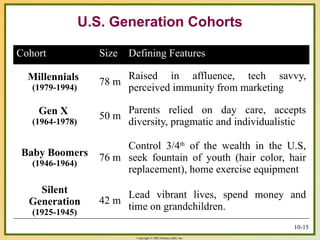

Cohort Size Defining Features

Millennials

(1979-1994)

78 m

Raised in affluence, tech savvy,

perceived immunity from marketing

Gen X

(1964-1978)

50 m

Parents relied on day care, accepts

diversity, pragmatic and individualistic

Baby Boomers

(1946-1964)

76 m

Control 3/4th

of the wealth in the U.S,

seek fountain of youth (hair color, hair

replacement), home exercise equipment

Silent

Generation

(1925-1945)

42 m

Lead vibrant lives, spend money and

time on grandchildren.

U.S. Generation Cohorts

10-15

16. 17. Copyright © 2003 Prentice-Hall, Inc.

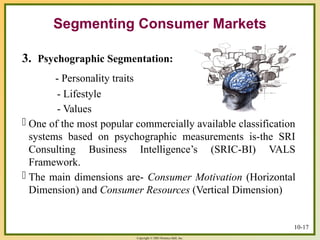

10-17

Segmenting Consumer Markets

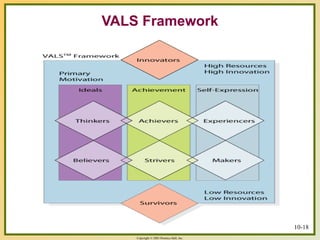

3. Psychographic Segmentation:

- Personality traits

- Lifestyle

- Values

- One of the most popular commercially available classification

systems based on psychographic measurements is-the SRI

Consulting Business Intelligence’s (SRIC-BI) VALS

Framework.

- The main dimensions are- Consumer Motivation (Horizontal

Dimension) and Consumer Resources (Vertical Dimension)

18. 19. Copyright © 2003 Prentice-Hall, Inc.

Consumers are inspired by one of the three primary motivations-

Ideals: those primarily motivated by ideals are guided by knowledge

and principles.

Achievement: those primarily motivated by achievements are guided

by products and services that demonstrate success to their peers..

Self-expression: those primarily motivated by self-expression are

guided social or physical activity, variety and risk.

The four groups with higher resources are:

Innovators-Successful, sophisticated, active, ‘take-charge’ people

with high self-esteem. Purchases often reflect cultivated tastes for

relatively upscale, niche-oriented products and services.

Thinkers- Mature, satisfied, and reflective people who are motivated

by ideals and who value order, knowledge and responsibility. They

seek durability, functionality and value in products.

VALS Framework

10-19

20. Copyright © 2003 Prentice-Hall, Inc.

10-20

• Achievers- Successful, goal-oriented people who focus on career and

family. They favor premium products that demonstrate success to their peers.

• Experiencers- Young, enthusiastic, impulsive people who seek variety and

excitement. They spend a comparatively high proportion of income on

fashion, entertainment and socializing.

The other four groups with lower resources are:

Believers- Conservative, conventional and traditional people with concrete

beliefs. They prefer familiar products and are loyal to established brands.

Strivers- Trendy and fun-loving people who are resource-constrained. They

favor stylish products that emulate the purchases of those with greater

material wealth.

Makers- Practical, down-to-earth, self-sufficient people who like to work

with their hands. They seek products with a practical or functional purpose.

Survivors- Elderly, passive people who are concerned about change. They

are loyal to their favorite brands.

VALS Framework

21. Copyright © 2003 Prentice-Hall, Inc.

10-21

Segmenting Consumer Markets

4. Behavioral Segmentation:

Decision Roles-

- Initiator, ex- doctors

- Influencer, ex- pharmaceutical companies

- Decider, ex-patients’ relatives

- Buyer, ex-patients’ relatives

- User, ex-patient

Behavioral Variables-

Occasions, ex- Archies & Hallmarks

Benefits, ex- Clinic, Pantene, Sunsilk, Head & Shoulder

Needs and Benefits

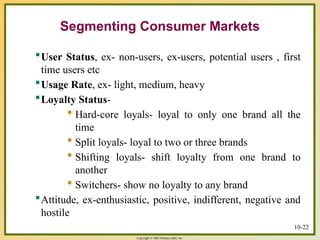

22. Copyright © 2003 Prentice-Hall, Inc.

10-22

User Status, ex- non-users, ex-users, potential users , first

time users etc

Usage Rate, ex- light, medium, heavy

Loyalty Status-

Hard-core loyals- loyal to only one brand all the

time

Split loyals- loyal to two or three brands

Shifting loyals- shift loyalty from one brand to

another

Switchers- show no loyalty to any brand

Attitude, ex-enthusiastic, positive, indifferent, negative and

hostile

Segmenting Consumer Markets

23. 24. Copyright © 2003 Prentice-Hall, Inc.

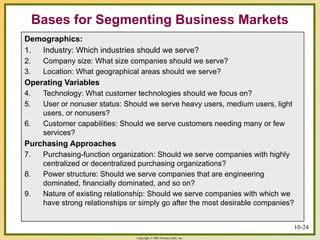

10-24

Bases for Segmenting Business Markets

Demographics:

1. Industry: Which industries should we serve?

2. Company size: What size companies should we serve?

3. Location: What geographical areas should we serve?

Operating Variables

4. Technology: What customer technologies should we focus on?

5. User or nonuser status: Should we serve heavy users, medium users, light

users, or nonusers?

6. Customer capabilities: Should we serve customers needing many or few

services?

Purchasing Approaches

7. Purchasing-function organization: Should we serve companies with highly

centralized or decentralized purchasing organizations?

8. Power structure: Should we serve companies that are engineering

dominated, financially dominated, and so on?

9. Nature of existing relationship: Should we serve companies with which we

have strong relationships or simply go after the most desirable companies?

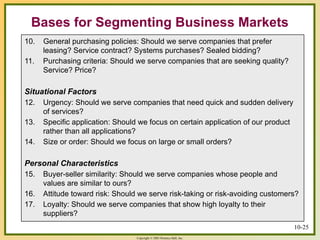

25. Copyright © 2003 Prentice-Hall, Inc.

10-25

Bases for Segmenting Business Markets

10. General purchasing policies: Should we serve companies that prefer

leasing? Service contract? Systems purchases? Sealed bidding?

11. Purchasing criteria: Should we serve companies that are seeking quality?

Service? Price?

Situational Factors

12. Urgency: Should we serve companies that need quick and sudden delivery

of services?

13. Specific application: Should we focus on certain application of our product

rather than all applications?

14. Size or order: Should we focus on large or small orders?

Personal Characteristics

15. Buyer-seller similarity: Should we serve companies whose people and

values are similar to ours?

16. Attitude toward risk: Should we serve risk-taking or risk-avoiding customers?

17. Loyalty: Should we serve companies that show high loyalty to their

suppliers?

26. Copyright © 2003 Prentice-Hall, Inc.

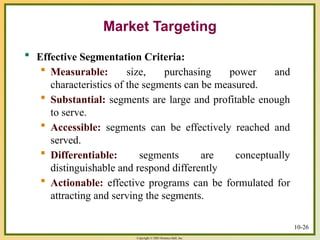

Market Targeting

Effective Segmentation Criteria:

Measurable: size, purchasing power and

characteristics of the segments can be measured.

Substantial: segments are large and profitable enough

to serve.

Accessible: segments can be effectively reached and

served.

Differentiable: segments are conceptually

distinguishable and respond differently

Actionable: effective programs can be formulated for

attracting and serving the segments.

10-26

27. Copyright © 2003 Prentice-Hall, Inc.

10-27

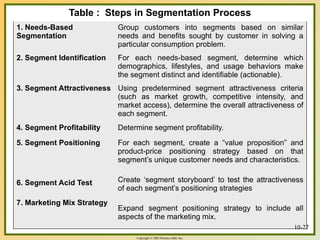

Table : Steps in Segmentation Process

1. Needs-Based

Segmentation

Group customers into segments based on similar

needs and benefits sought by customer in solving a

particular consumption problem.

2. Segment Identification For each needs-based segment, determine which

demographics, lifestyles, and usage behaviors make

the segment distinct and identifiable (actionable).

3. Segment Attractiveness Using predetermined segment attractiveness criteria

(such as market growth, competitive intensity, and

market access), determine the overall attractiveness of

each segment.

4. Segment Profitability Determine segment profitability.

5. Segment Positioning

6. Segment Acid Test

7. Marketing Mix Strategy

For each segment, create a “value proposition” and

product-price positioning strategy based on that

segment’s unique customer needs and characteristics.

Create ‘segment storyboard’ to test the attractiveness

of each segment’s positioning strategies

Expand segment positioning strategy to include all

aspects of the marketing mix.

10-27

28. Copyright © 2003 Prentice-Hall, Inc.

10-28

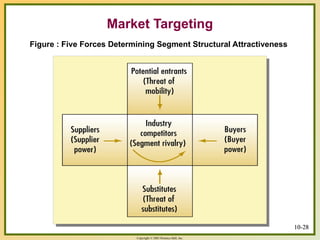

Market Targeting

Figure : Five Forces Determining Segment Structural Attractiveness

10-28

29. Copyright © 2003 Prentice-Hall, Inc.

10-29

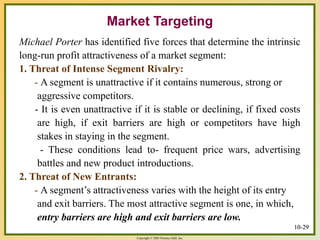

Market Targeting

Michael Porter has identified five forces that determine the intrinsic

long-run profit attractiveness of a market segment:

1. Threat of Intense Segment Rivalry:

- A segment is unattractive if it contains numerous, strong or

aggressive competitors.

- It is even unattractive if it is stable or declining, if fixed costs

are high, if exit barriers are high or competitors have high

stakes in staying in the segment.

- These conditions lead to- frequent price wars, advertising

battles and new product introductions.

2. Threat of New Entrants:

- A segment’s attractiveness varies with the height of its entry

and exit barriers. The most attractive segment is one, in which,

entry barriers are high and exit barriers are low.

10-29

30. Copyright © 2003 Prentice-Hall, Inc.

10-30

Market Targeting

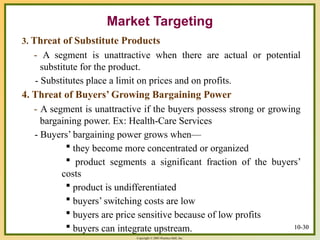

3. Threat of Substitute Products

- A segment is unattractive when there are actual or potential

substitute for the product.

- Substitutes place a limit on prices and on profits.

4. Threat of Buyers’ Growing Bargaining Power

- A segment is unattractive if the buyers possess strong or growing

bargaining power. Ex: Health-Care Services

- Buyers’ bargaining power grows when—

they become more concentrated or organized

product segments a significant fraction of the buyers’

costs

product is undifferentiated

buyers’ switching costs are low

buyers are price sensitive because of low profits

buyers can integrate upstream. 10-30

31. Copyright © 2003 Prentice-Hall, Inc.

10-31

Market Targeting

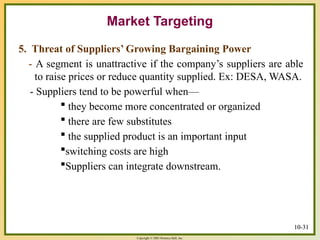

5. Threat of Suppliers’ Growing Bargaining Power

- A segment is unattractive if the company’s suppliers are able

to raise prices or reduce quantity supplied. Ex: DESA, WASA.

- Suppliers tend to be powerful when—

they become more concentrated or organized

there are few substitutes

the supplied product is an important input

switching costs are high

Suppliers can integrate downstream.

10-31

32. Copyright © 2003 Prentice-Hall, Inc.

10-32

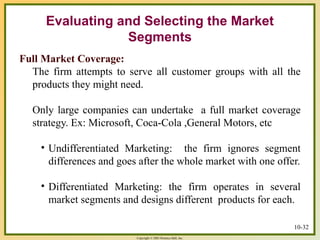

Full Market Coverage:

The firm attempts to serve all customer groups with all the

products they might need.

Only large companies can undertake a full market coverage

strategy. Ex: Microsoft, Coca-Cola ,General Motors, etc

• Undifferentiated Marketing: the firm ignores segment

differences and goes after the whole market with one offer.

• Differentiated Marketing: the firm operates in several

market segments and designs different products for each.

Evaluating and Selecting the Market

Segments

33. Copyright © 2003 Prentice-Hall, Inc.

Evaluating and Selecting the

Market Segments

34. Copyright © 2003 Prentice-Hall, Inc.

10-34

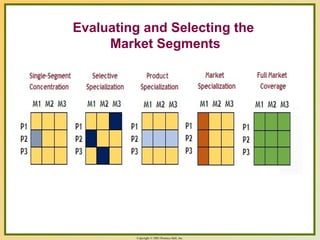

Single-Segment Concentration

A firm selects and serves only one segment. Ex- Maternity

Hospitals & Clinics

Selective Specialization/ Multiple Segment Specialization

A firm selects a number of segments, each objectively

attractive and appropriate. Ex- P&G’s Crest Toothpaste

Market Specialization

Here the company takes up a particular market segment for

supplying all relevant products to the target group. For

example, the company X can implement Market

Specialisation strategy by producing all sorts of home

appliances like TV, washing machine, refrigerator and micro

oven for middle class people.

Evaluating and Selecting the Market

Segments

35. Copyright © 2003 Prentice-Hall, Inc.

10-35

Product Specialization

When a company sells certain products to several different

types of potential customers. Ex- Microscope producers for

university, government and commercial laboratories.

Evaluating and Selecting the Market

Segments

36. Copyright © 2003 Prentice-Hall, Inc.

Ethical Choice of Market Targets

- Marketers must target segments carefully to avoid

consumer backlash

- Singles and elderly people may not want to be

identified as singles or olds.

10-36

Market Targeting

37. Editor's Notes #10 Wants and abilities change with age. Companies such as Crest and Colgate offer products that target kids, adults and older consumers. #11 Life stage defines a person’s major concern, such as going through a divorce, going into a second marriage, taking care of an older parent, deciding to cohabit with another person, deciding to buy a new home, and so on. These life stages present opportunities for marketers who can help people cope with their major concerns.. #12 Men and women have different attitudes and behaviors due in part to genetics and socialization. Women are more communal-minded, men more self-expressive and goal directed. A recent study found that men need to be invited to touch a product, whereas women are more likely to pick up without prompting. #13 Income segmentation is used in categories such as clothing, travel, financial services, and automobiles. Income does not always predict the best customers – blue collar workers were among the first adopters of color TVs as it offered entertainment at a lower cost than going to movies or restaurants.

Increasingly, companies are finding their markets are hourglass shaped as middle-market U.S. consumers migrate toward both discount and premium products. #14 Each generation or cohort is profoundly influenced by the times in which it grows up—the music, movies, politics, and defining events of that period. Members share the same major cultural, political, and economic experiences and have similar outlooks and values. Marketers often advertise to a cohort by using the icons and images prominent in its experiences. They also try to develop products and services that uniquely meet the particular interests or needs of a generational target. #16 Multicultural marketing is an approach recognizing that different ethnic and cultural segments have sufficiently different needs and wants to require targeted marketing activities, and that a mass market approach is not refined enough for the diversity of the marketplace. Multicultural marketing can result in different marketing messages, media, channels, and so on.

Hispanic Americans are the largest minority group in America and have an annual purchasing power estimated to exceed $1 trillion. By 2020, 17% of Americans are projected to be of Hispanic origin.

African Americans have had a significant economic, social, and cultural impact on the U.S. life. African Americans are the most fashion-conscious of all racial and ethnic groups, but strongly motivated by quality and selection. Children have a strong influence on product selection.

The Asian American market has been called the “invisible market” because, compared to Hispanic Americans and African Americans, it has traditionally received a relatively small portion of multicultural marketing dollars.

The next slide contains Table 8.4 that offers a profile of these three markets.