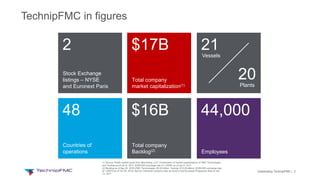

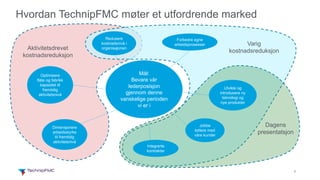

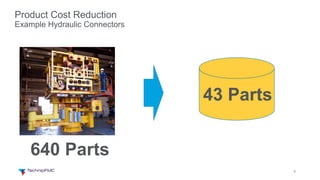

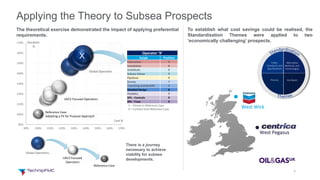

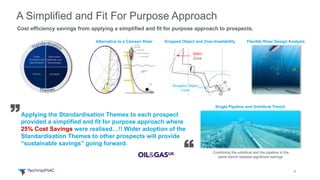

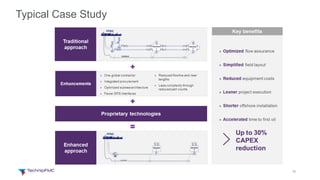

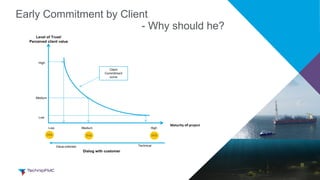

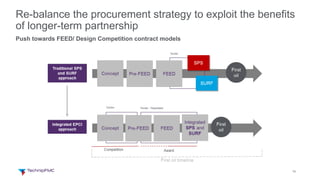

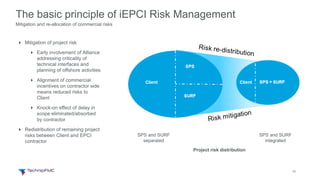

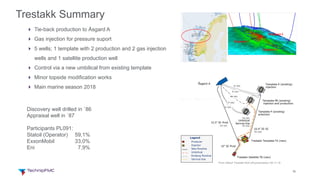

This document discusses strategies for achieving sustainable cost reductions in the offshore oil and gas industry. TechnipFMC outlines several approaches they are taking, including optimizing assets, reducing costs through technology improvements and integrated contracts, and working more closely with customers. An example project called Dvalin demonstrates how standardizing requirements and working in a more integrated way between client and contractor can yield 25% cost savings. Integrated Engineering, Procurement, Construction and Installation (iEPCI) contracts are presented as a way to better allocate risks between clients and contractors. The conclusion is that while market factors can temporarily reduce costs, long-term sustainable reductions require permanent changes like those discussed.