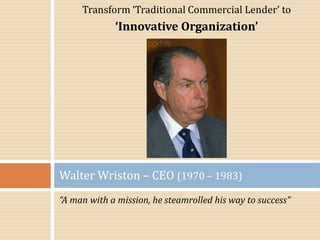

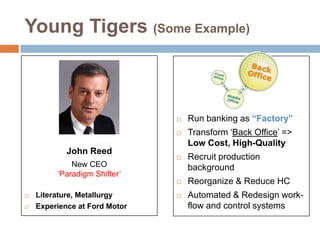

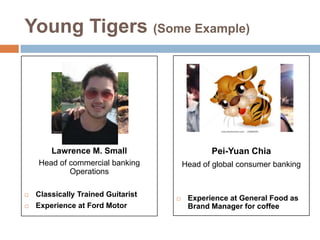

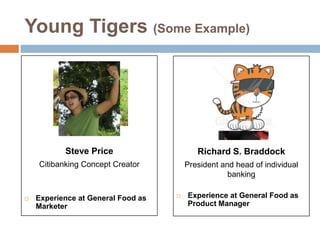

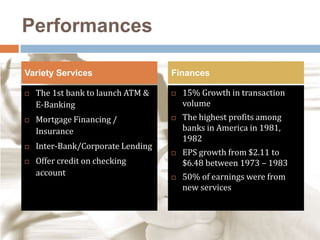

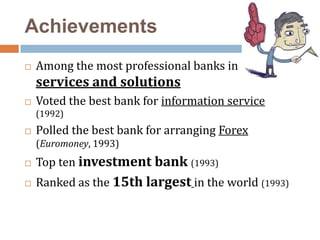

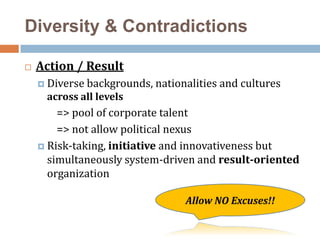

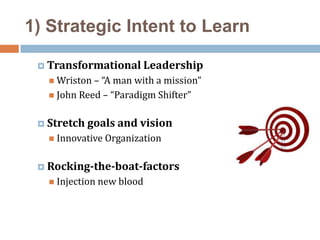

CITI Corp established in 1812 and grew to become the largest bank in America through innovation between 1970-1993. Under CEO Walter Wriston, it transformed from a traditional commercial lender to an innovative organization by offering new services, recruiting young managers from outside, and bringing in new technologies. Key strategies included emphasizing customer responsiveness, experimentation and learning from failures, managing information across its global network, and fostering a meritocratic culture that rewarded risk-taking and entrepreneurship. These changes helped CITI become a leader in areas like ATMs, credit cards, and global corporate banking.