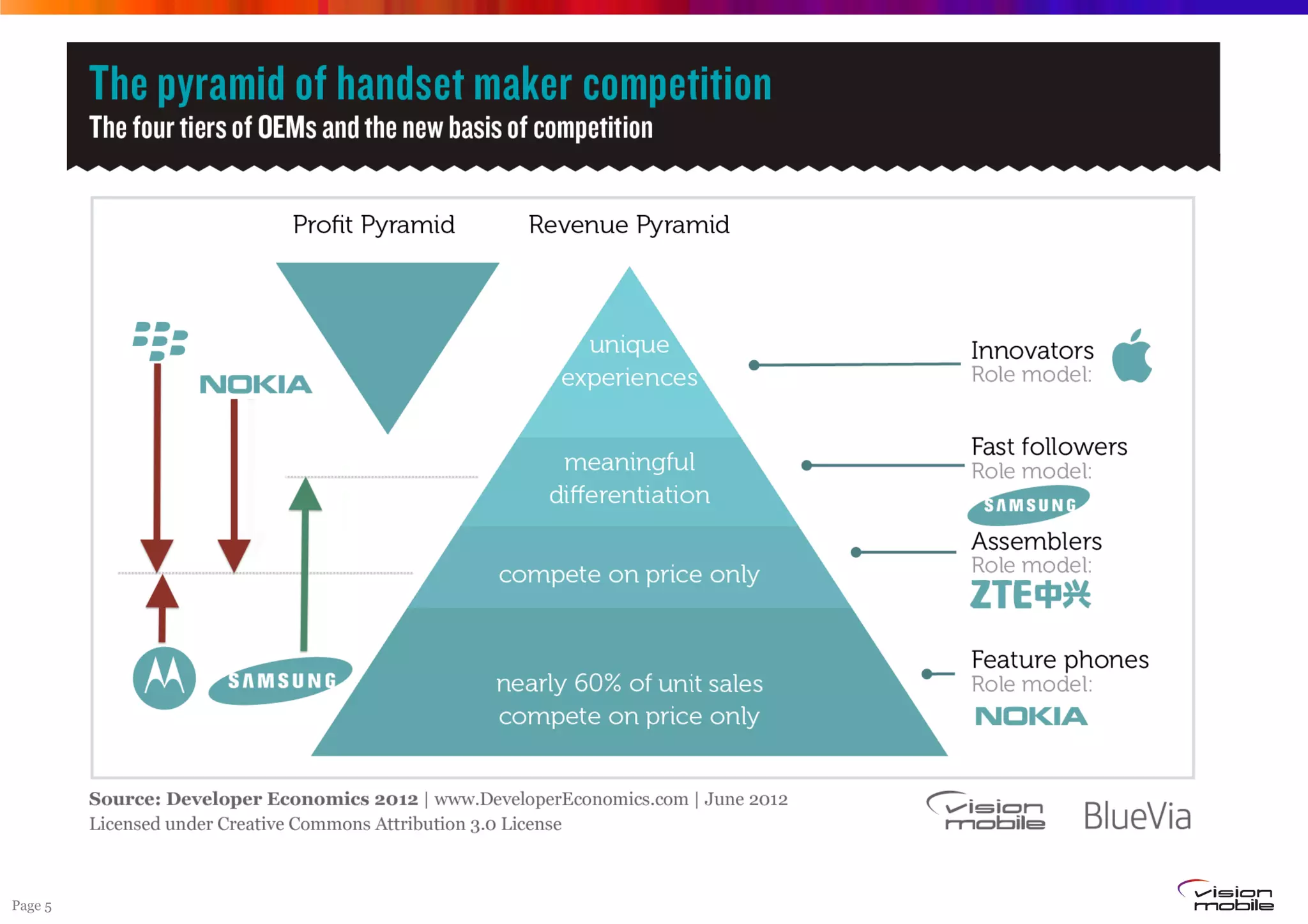

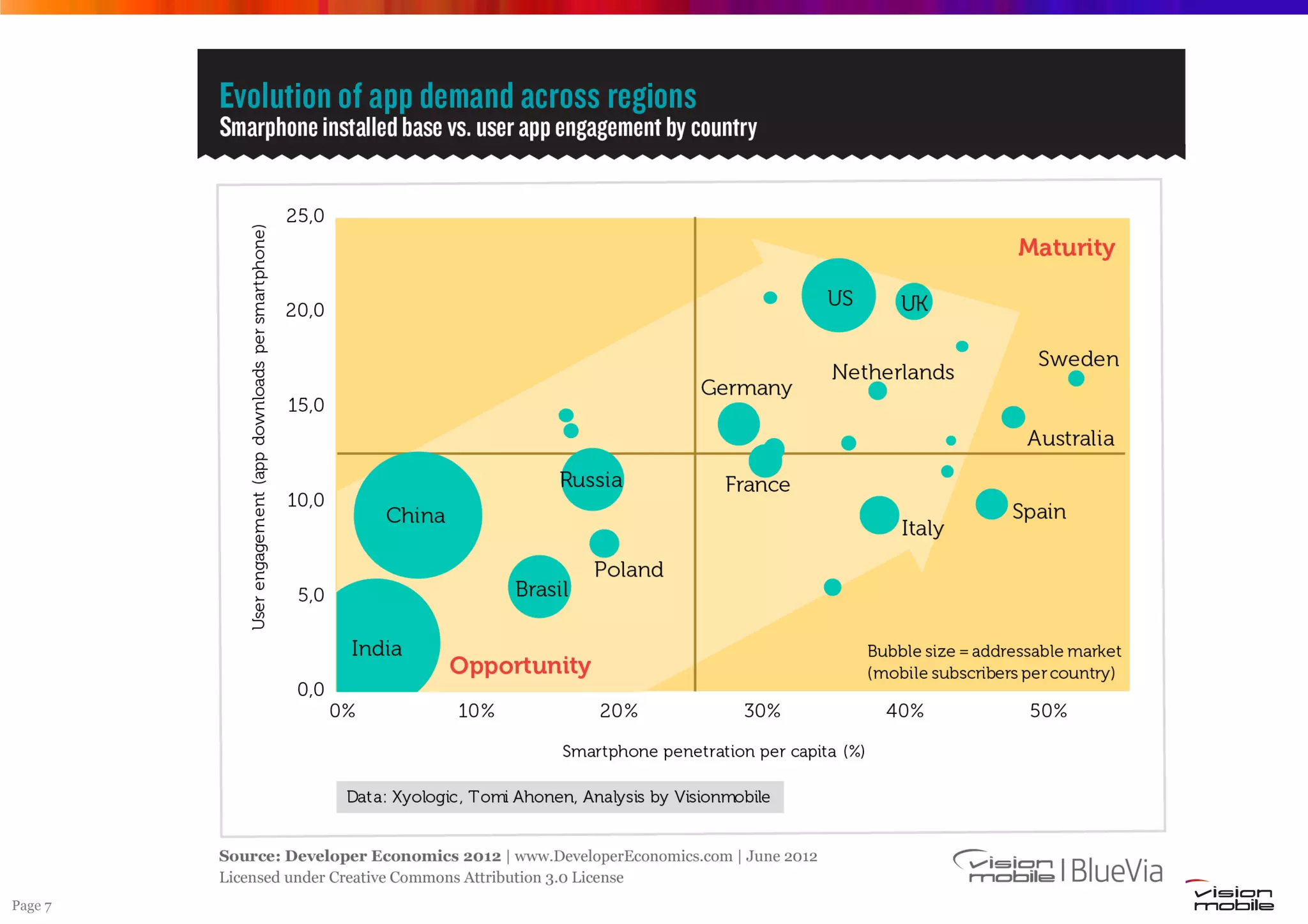

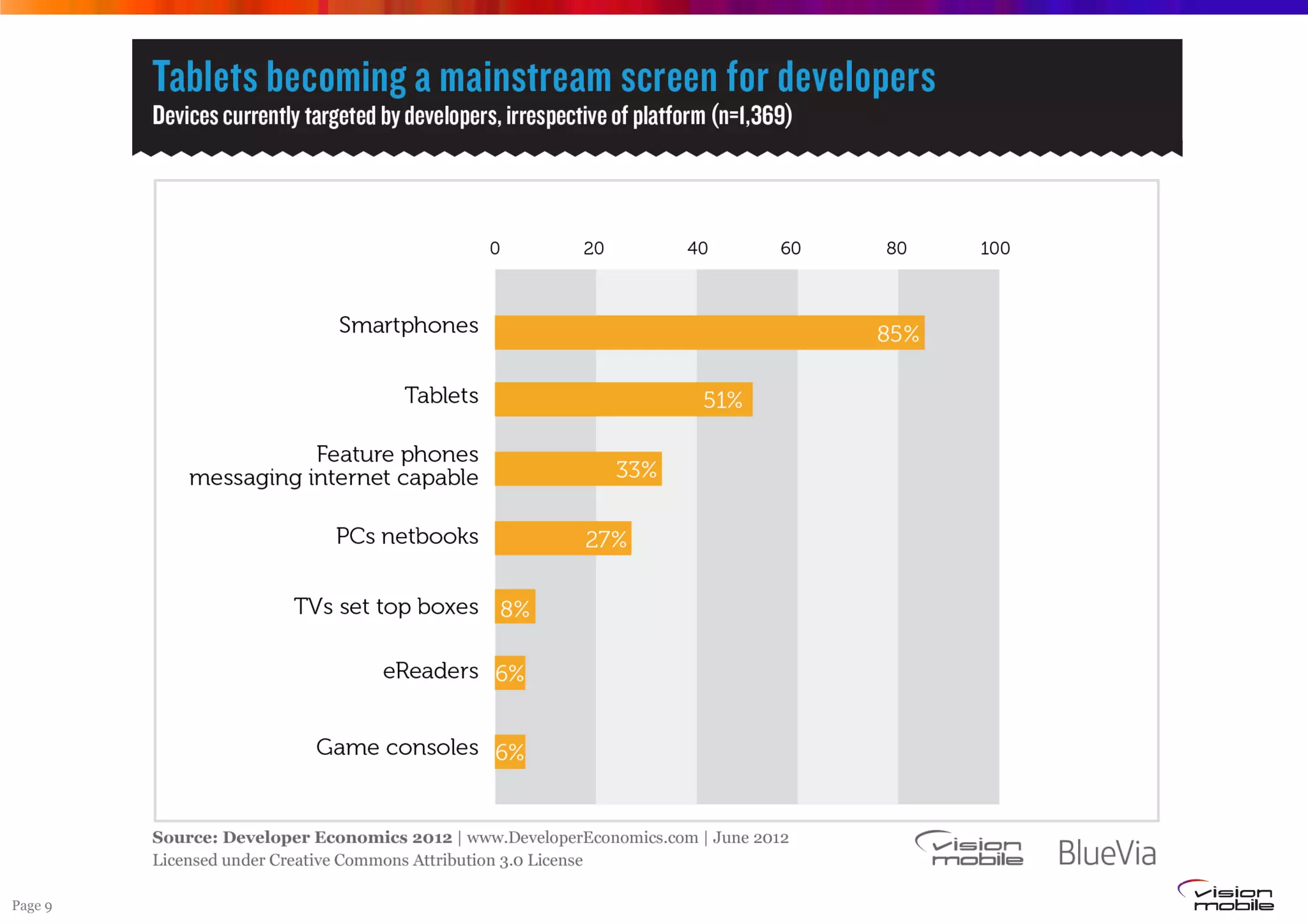

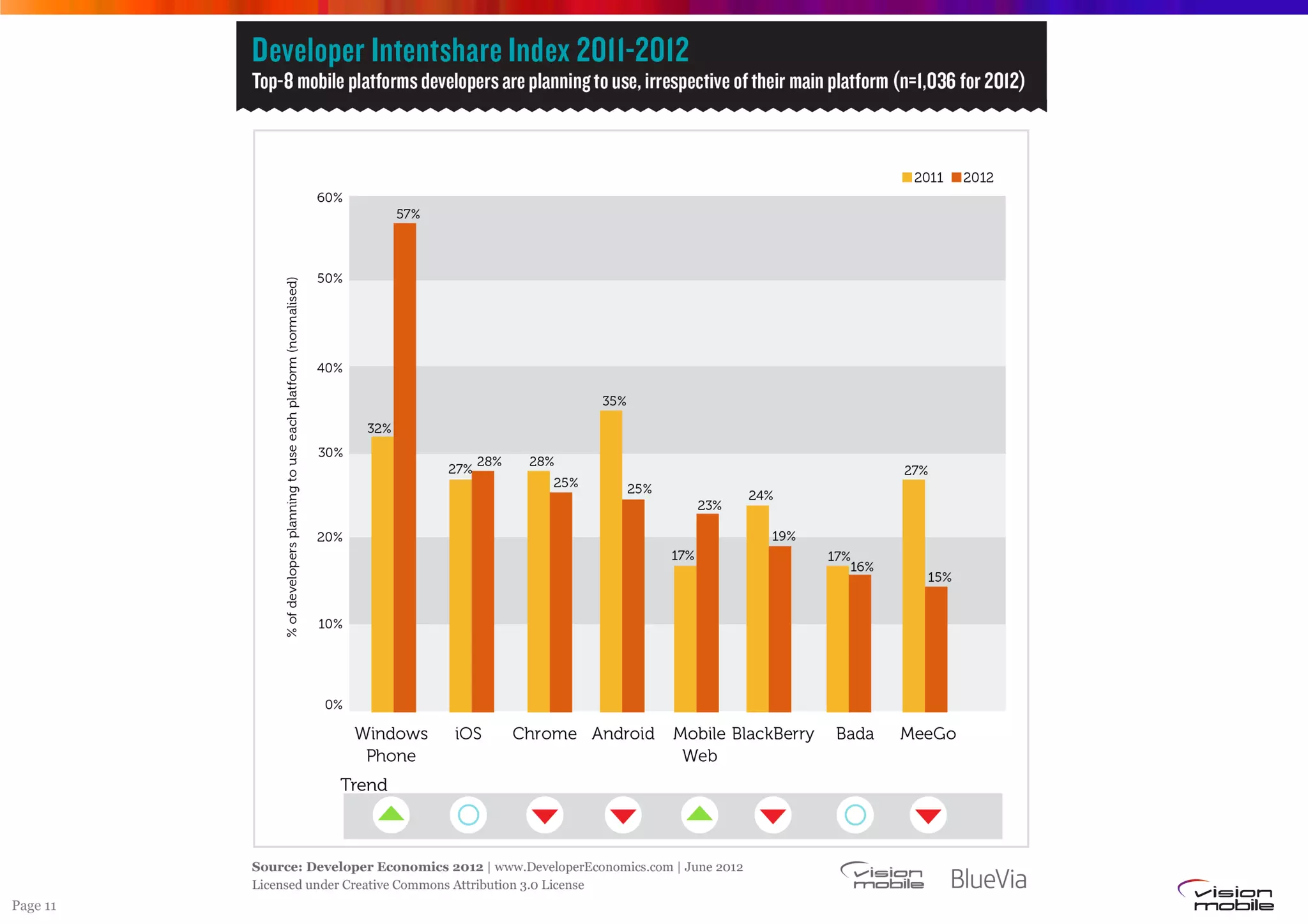

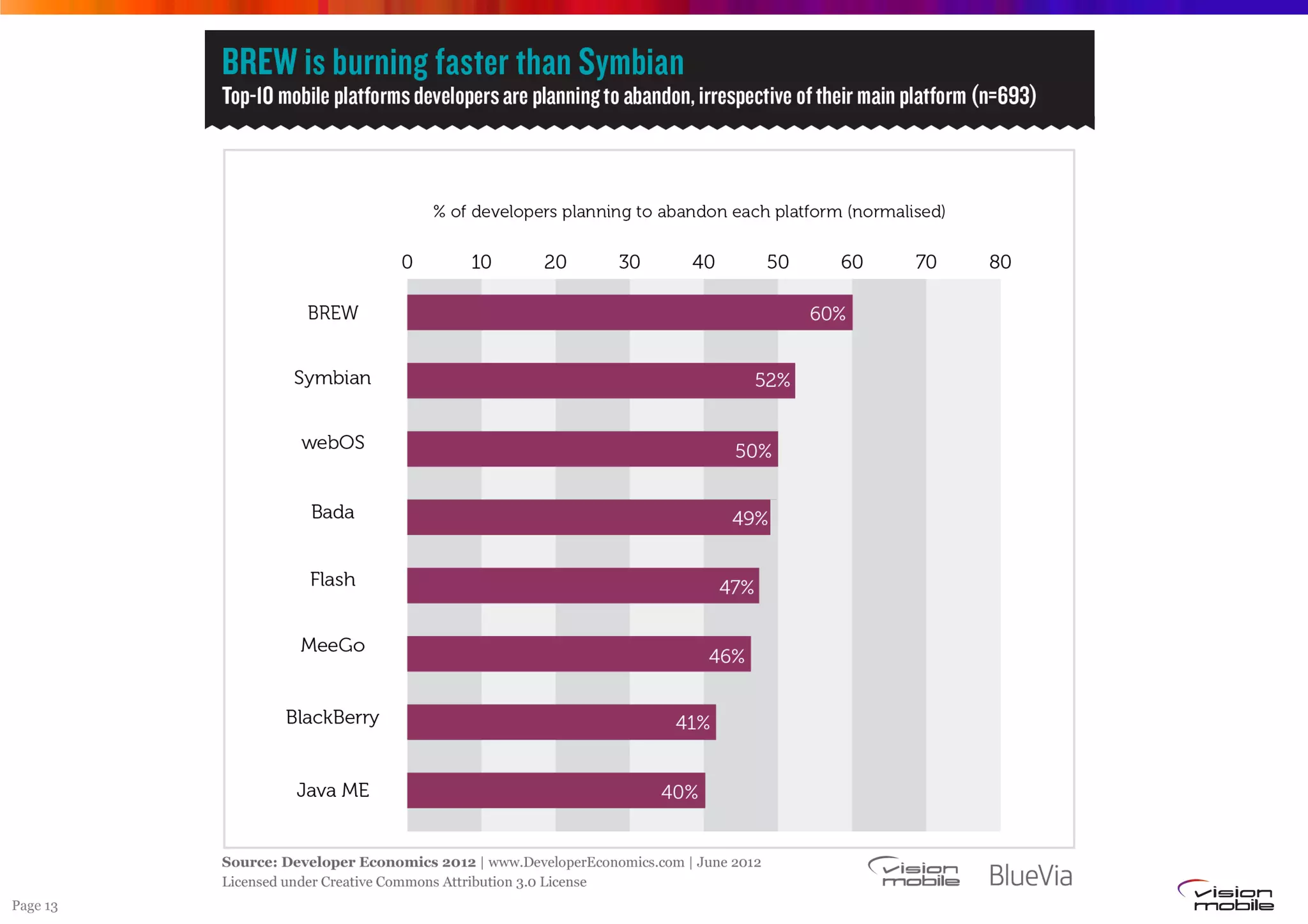

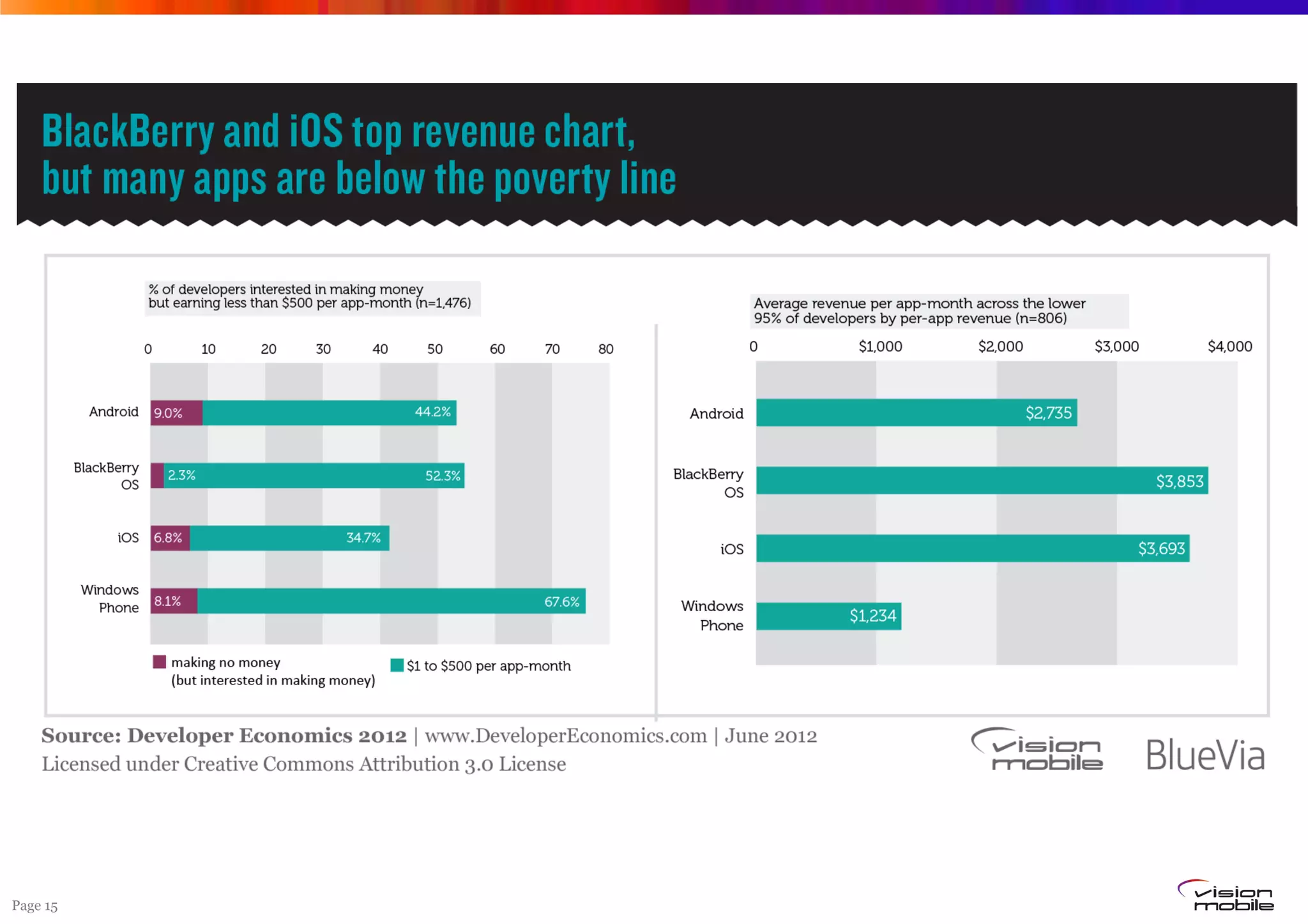

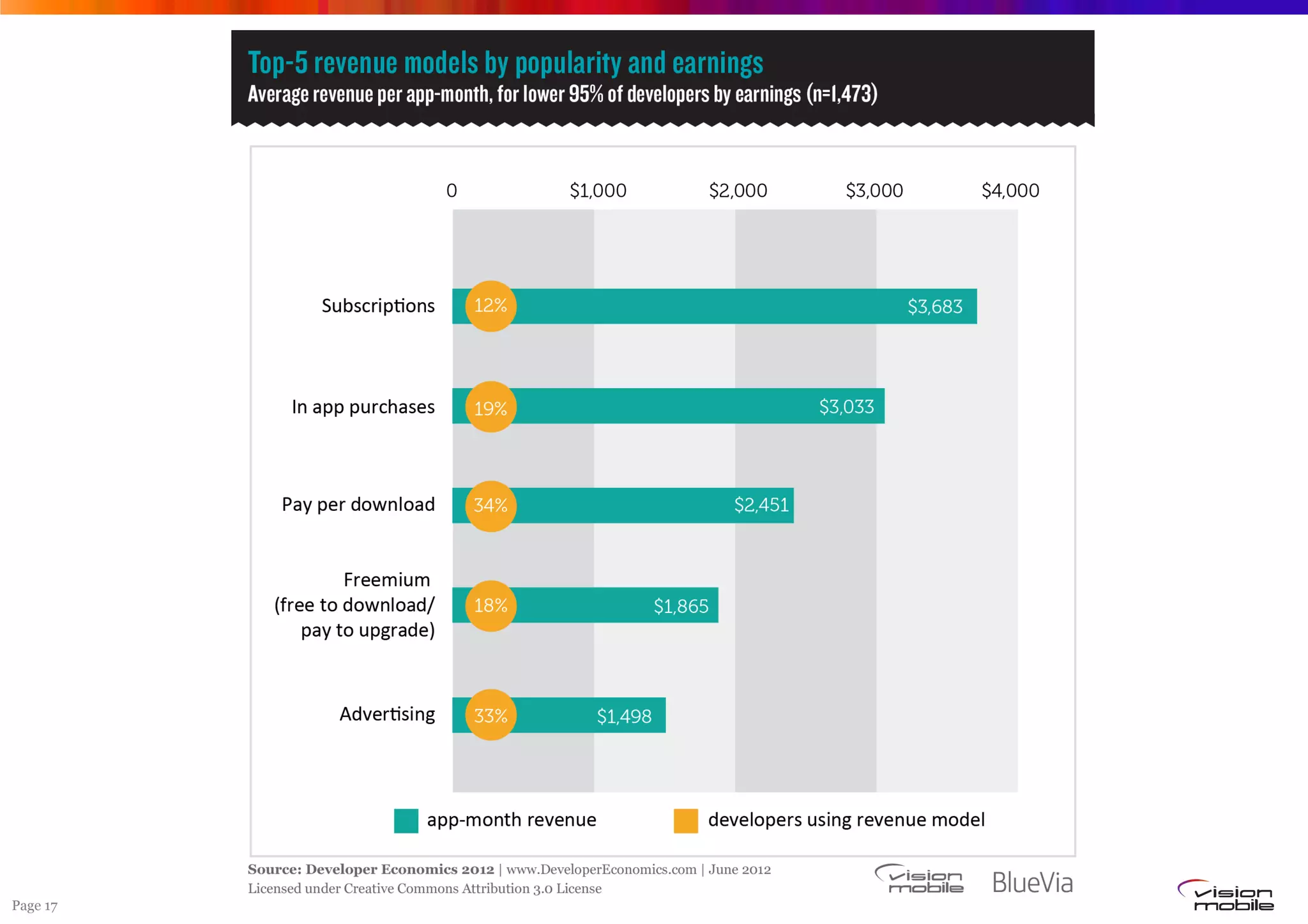

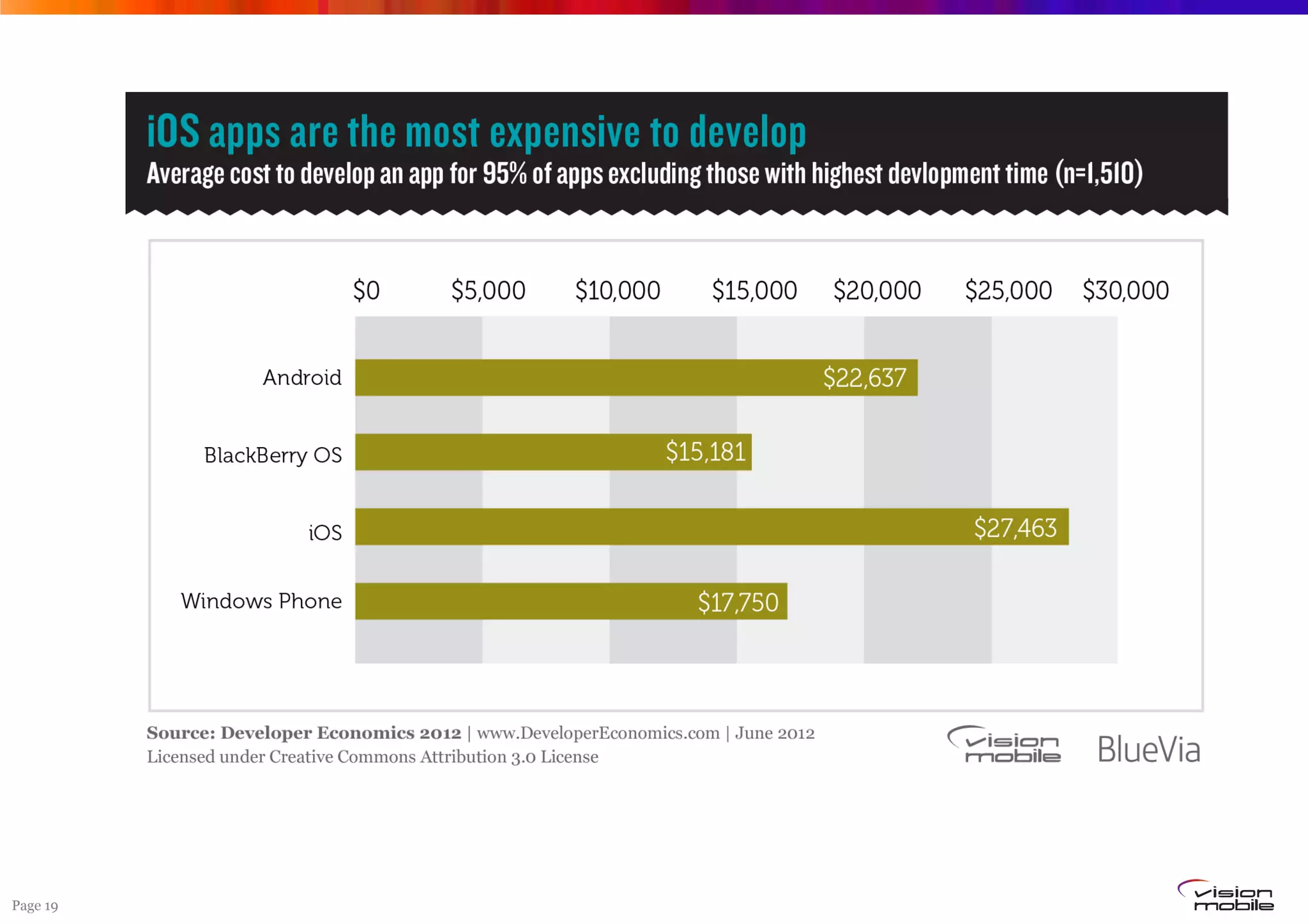

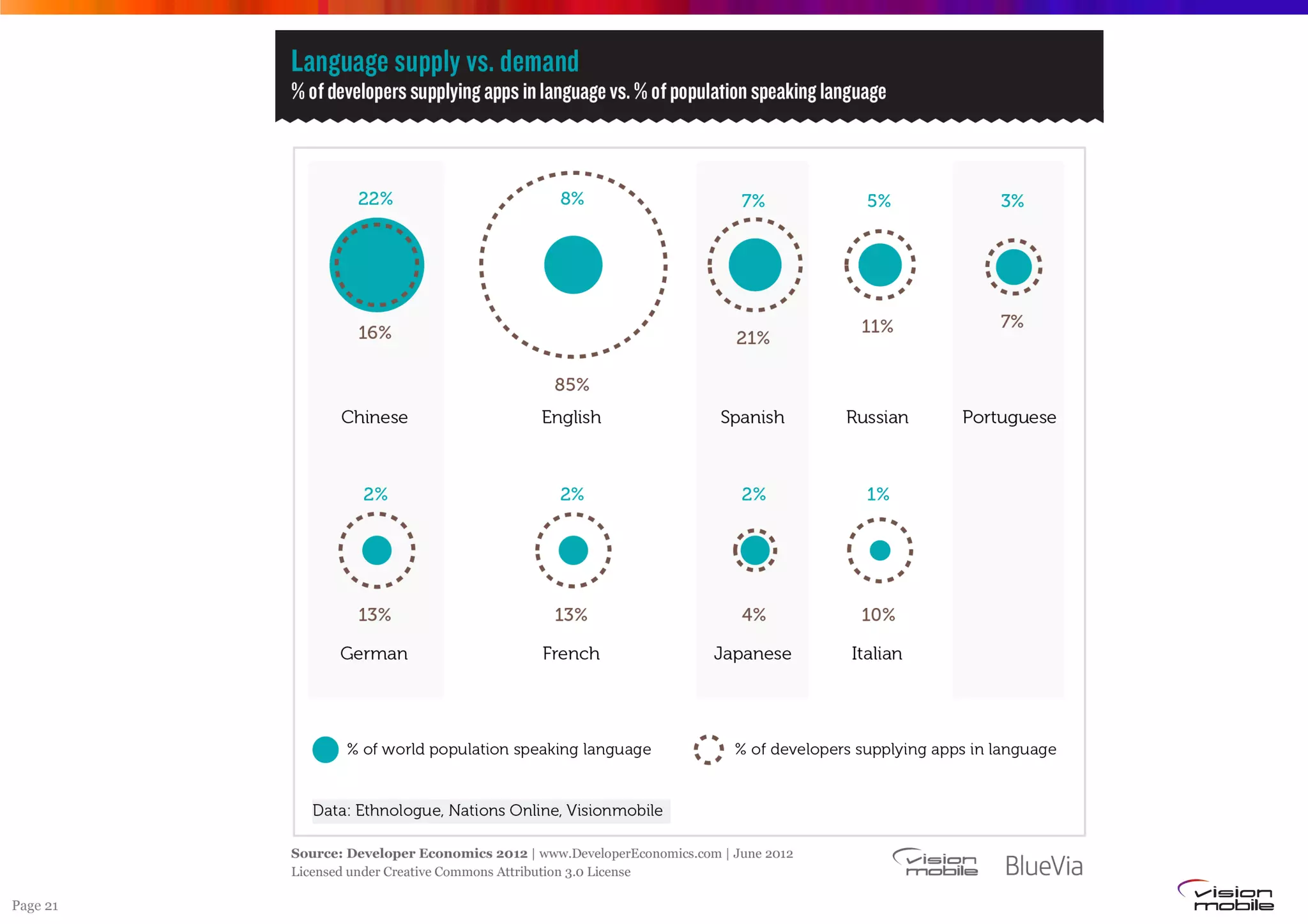

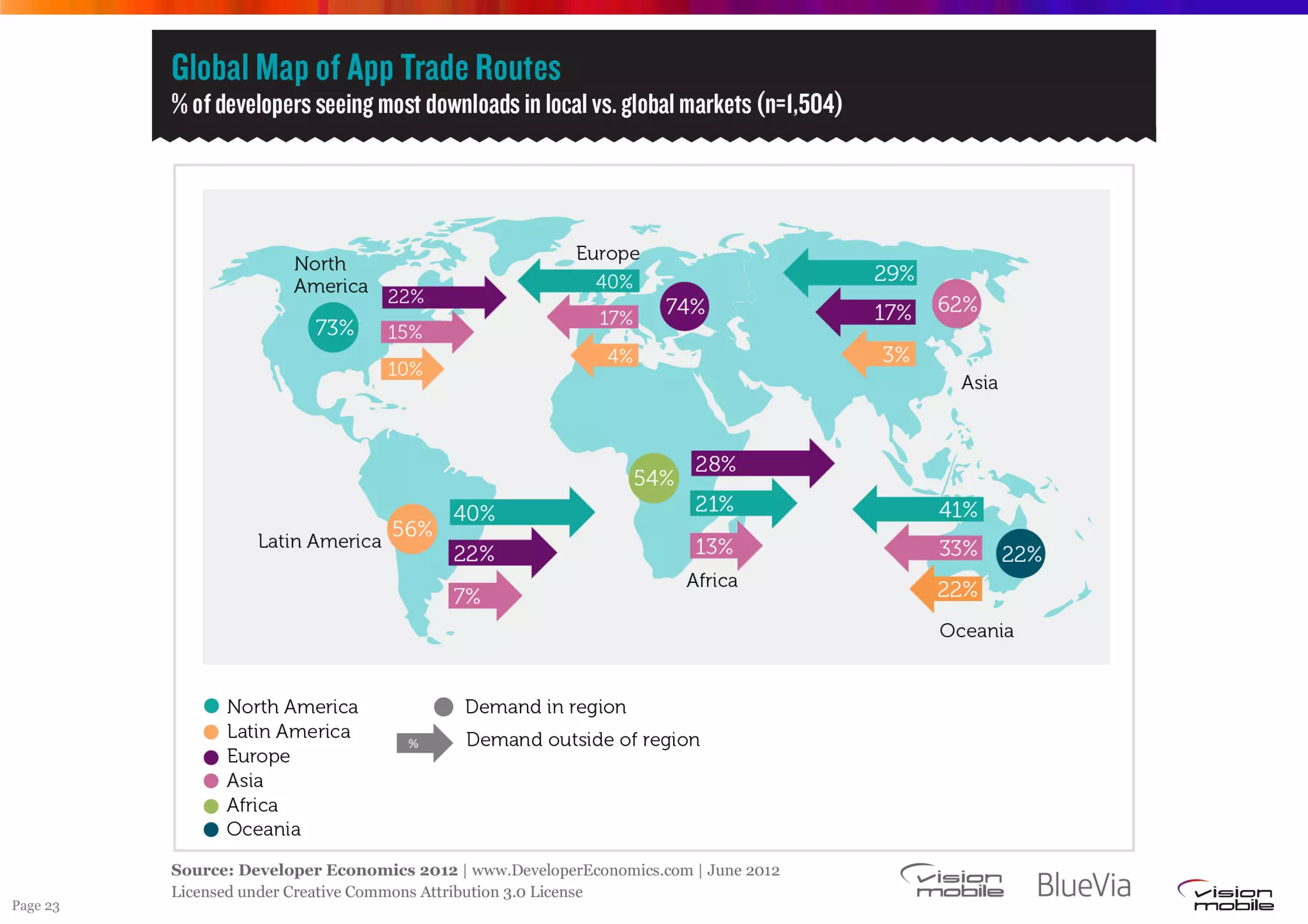

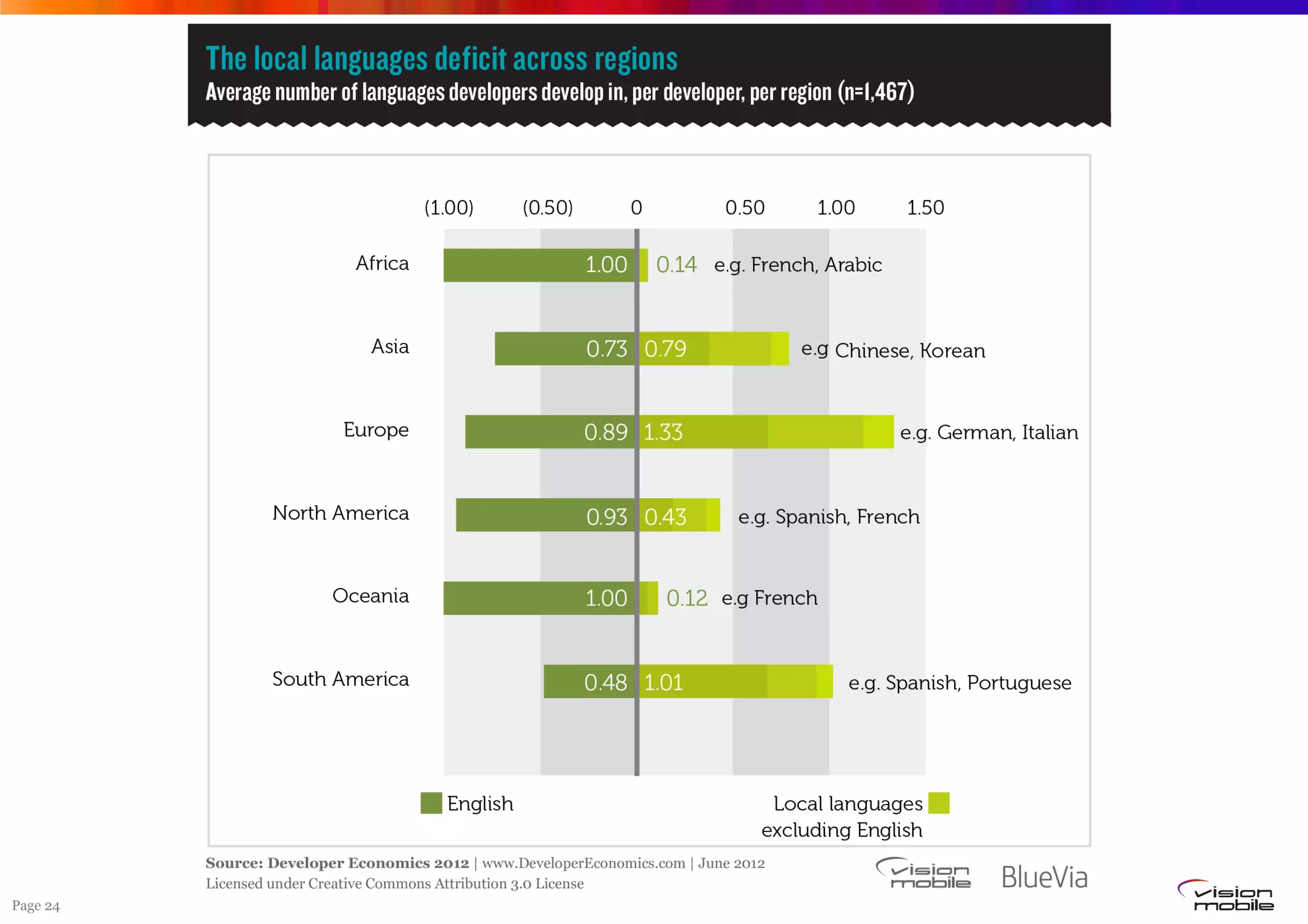

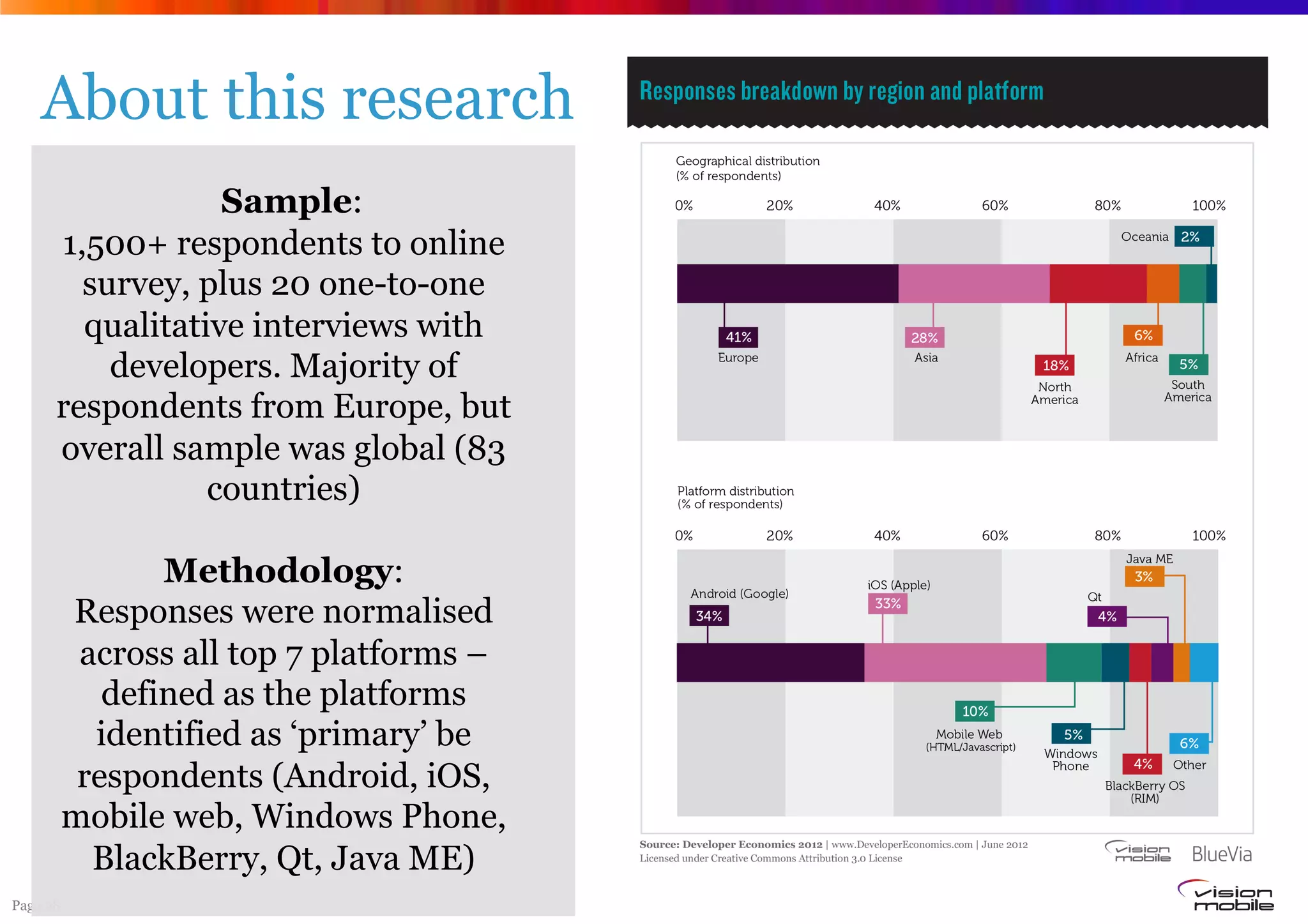

The document presents the findings from the 2012 Developer Economics report, which surveys over 1,500 developers across various platforms. Key insights include the competitive landscape among handset makers, with Apple and Samsung leading, and highlights the growing demand for localized apps from BRIC markets. It also discusses challenges faced by developers, including revenue models, the app poverty line, and the costs associated with app development on different platforms.