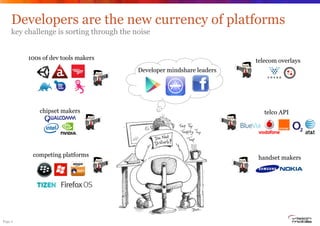

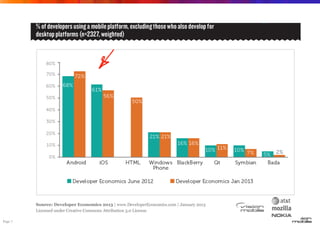

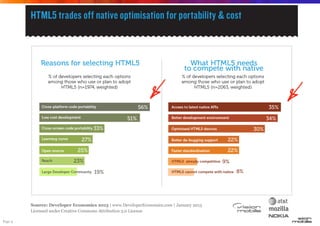

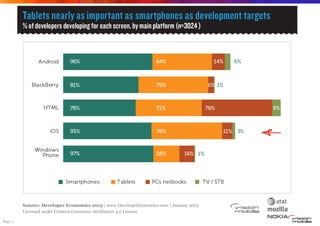

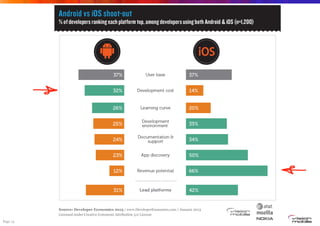

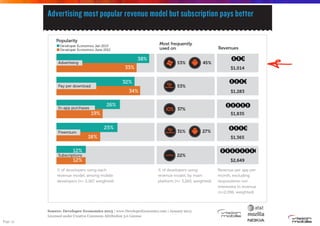

This document discusses the mobile developer ecosystem and economics. It highlights that Android and iOS dominate developer mindshare but there is still interest in alternatives like Windows Phone and BlackBerry. HTML5 is becoming viable for some apps but needs better platform API access and debugging support. Tablets are reaching mindshare parity with smartphones while TV remains niche. Most developers use multiple platforms but money is concentrated in iOS and Android. Advertising is the most popular revenue model but lowest earning while in-app purchases are rising. There are over 500 tools for developers to choose from to support app development.