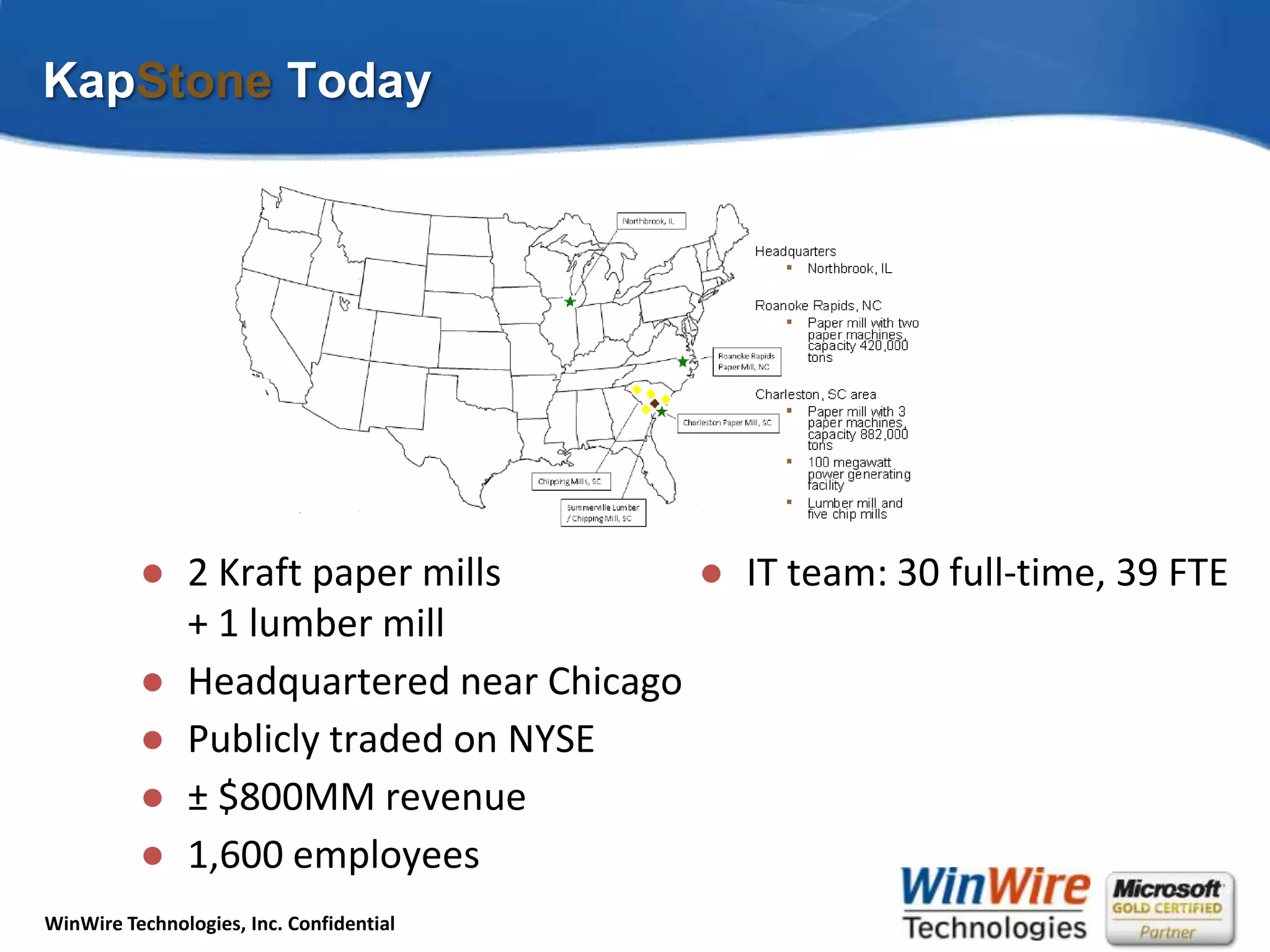

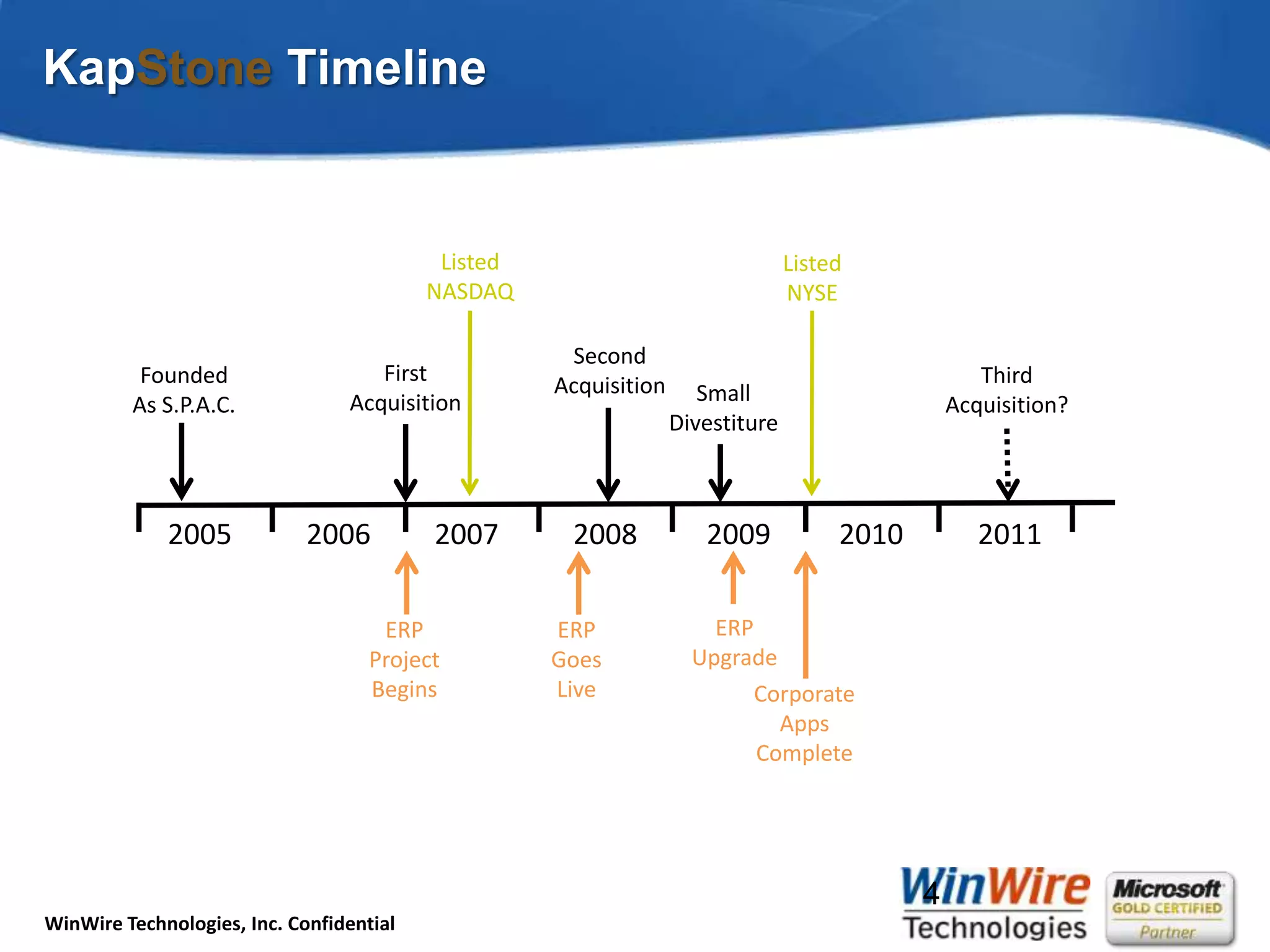

1) KapStone is a paper and packaging company that plans to grow through acquisitions to $2-5 billion in revenue within 2-5 years.

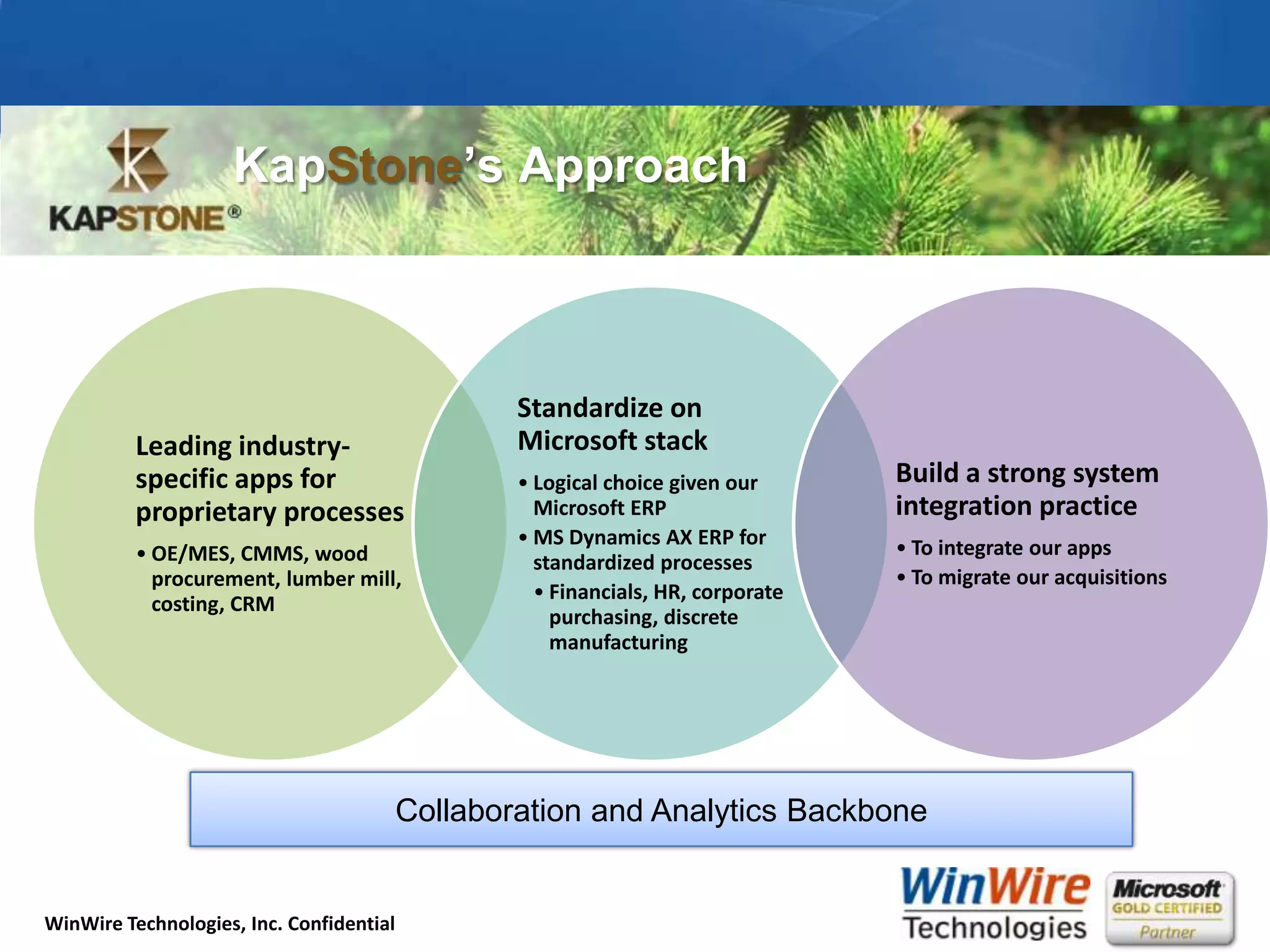

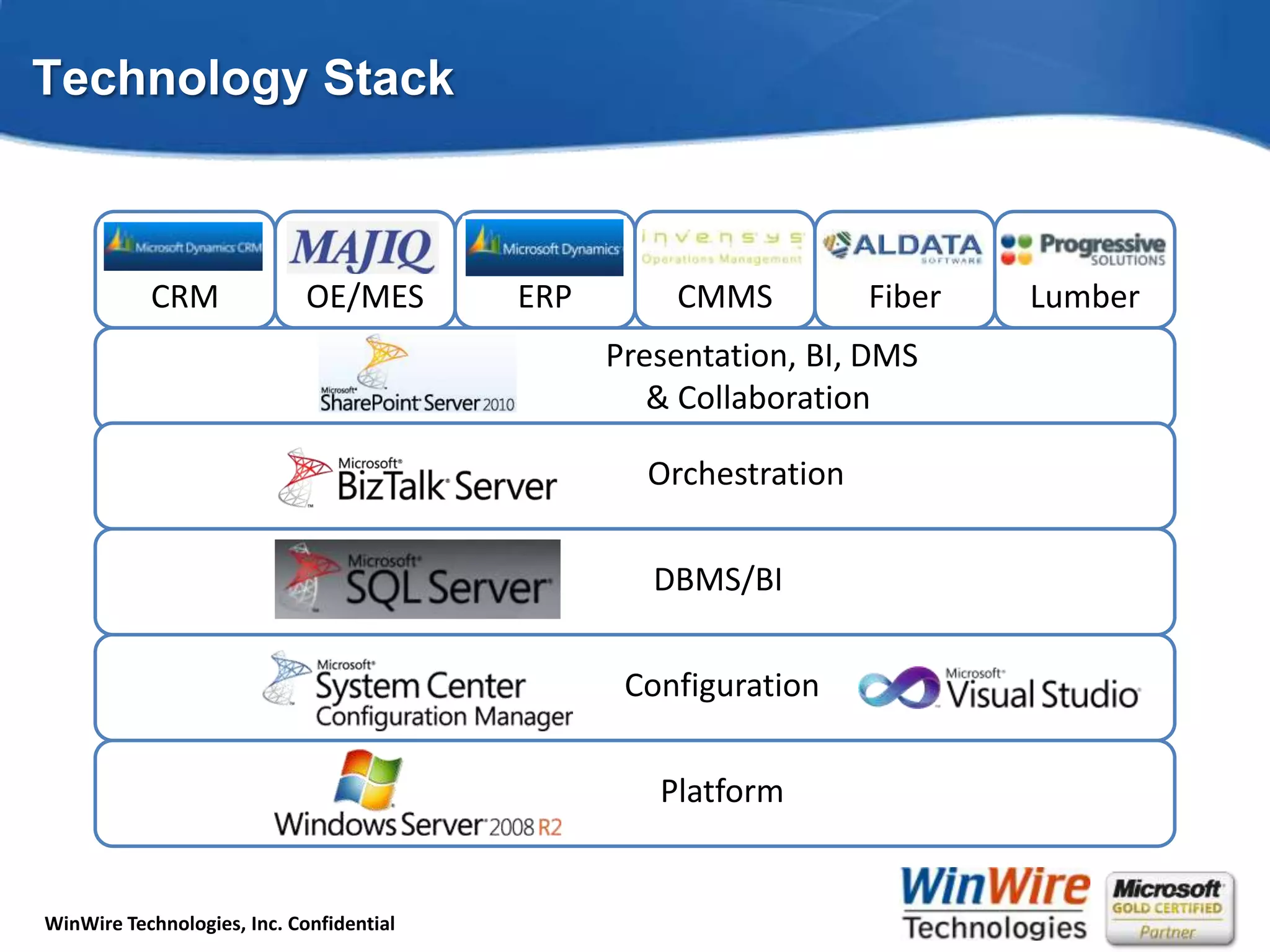

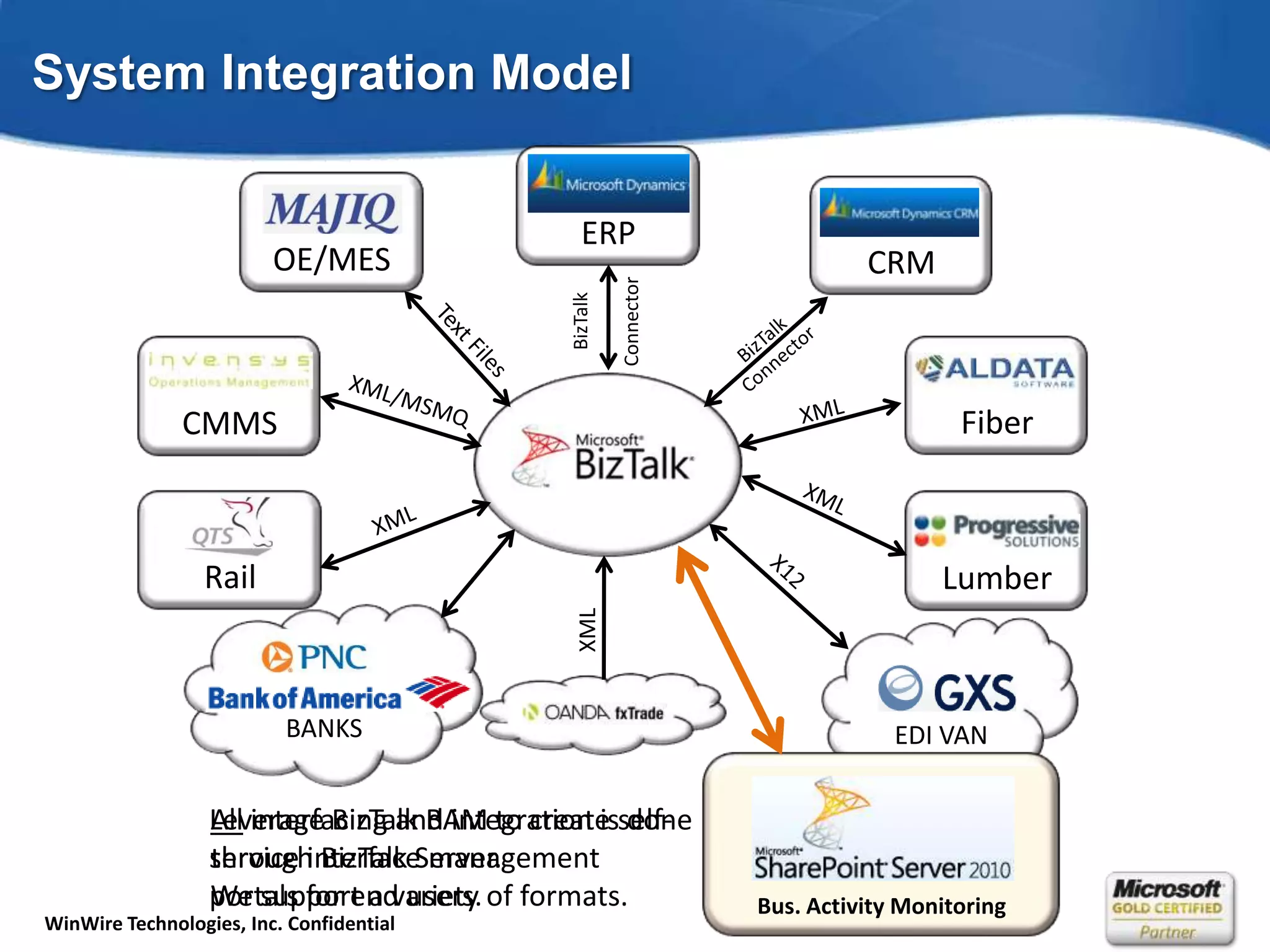

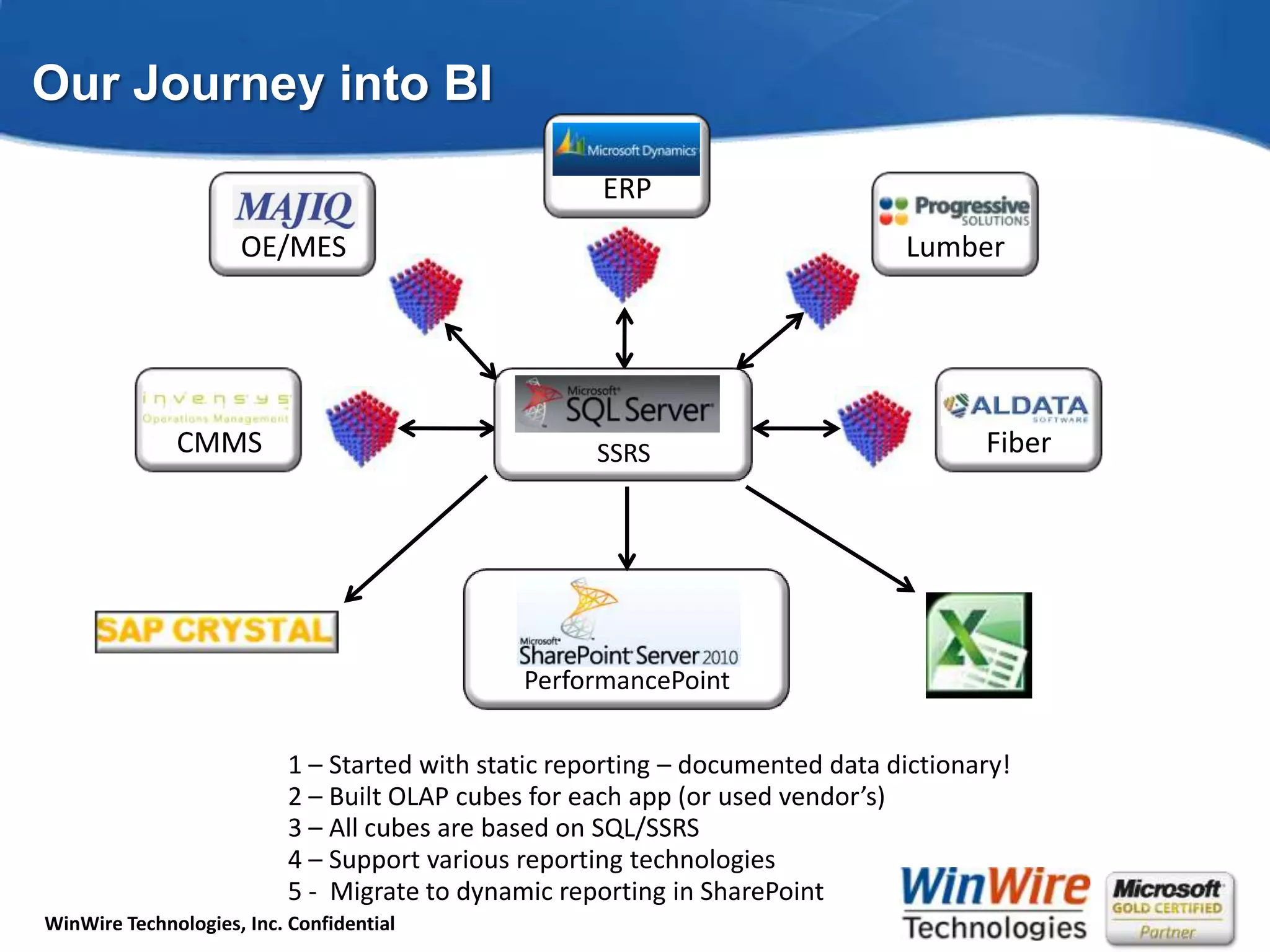

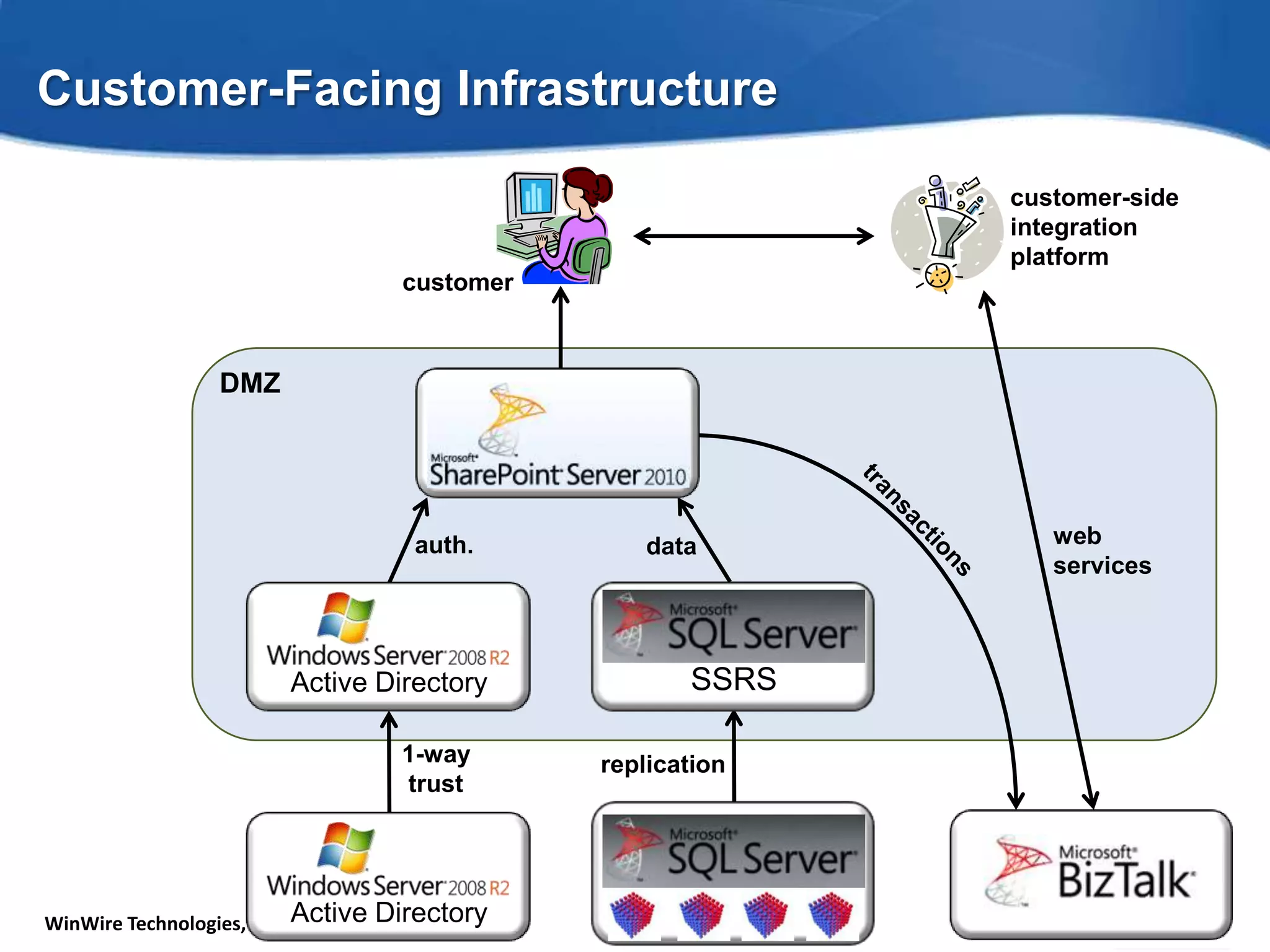

2) KapStone built a flexible IT infrastructure using Microsoft technologies like SQL Server, BizTalk, and SharePoint to easily integrate new acquisitions.

3) When pursuing acquisitions, the CIO must be involved early to plan the IT integration and ensure acquired companies' systems can be migrated efficiently onto KapStone's infrastructure.