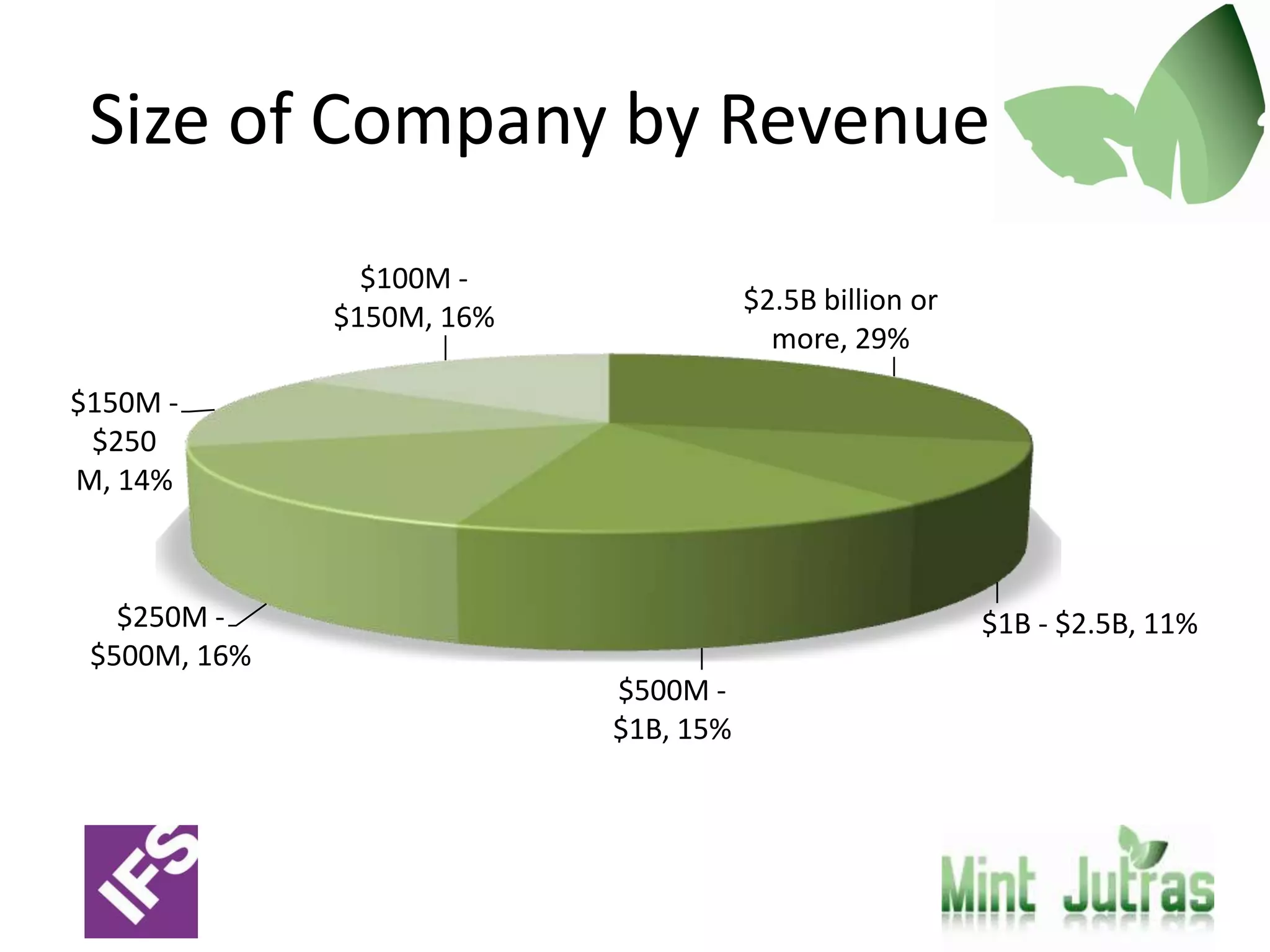

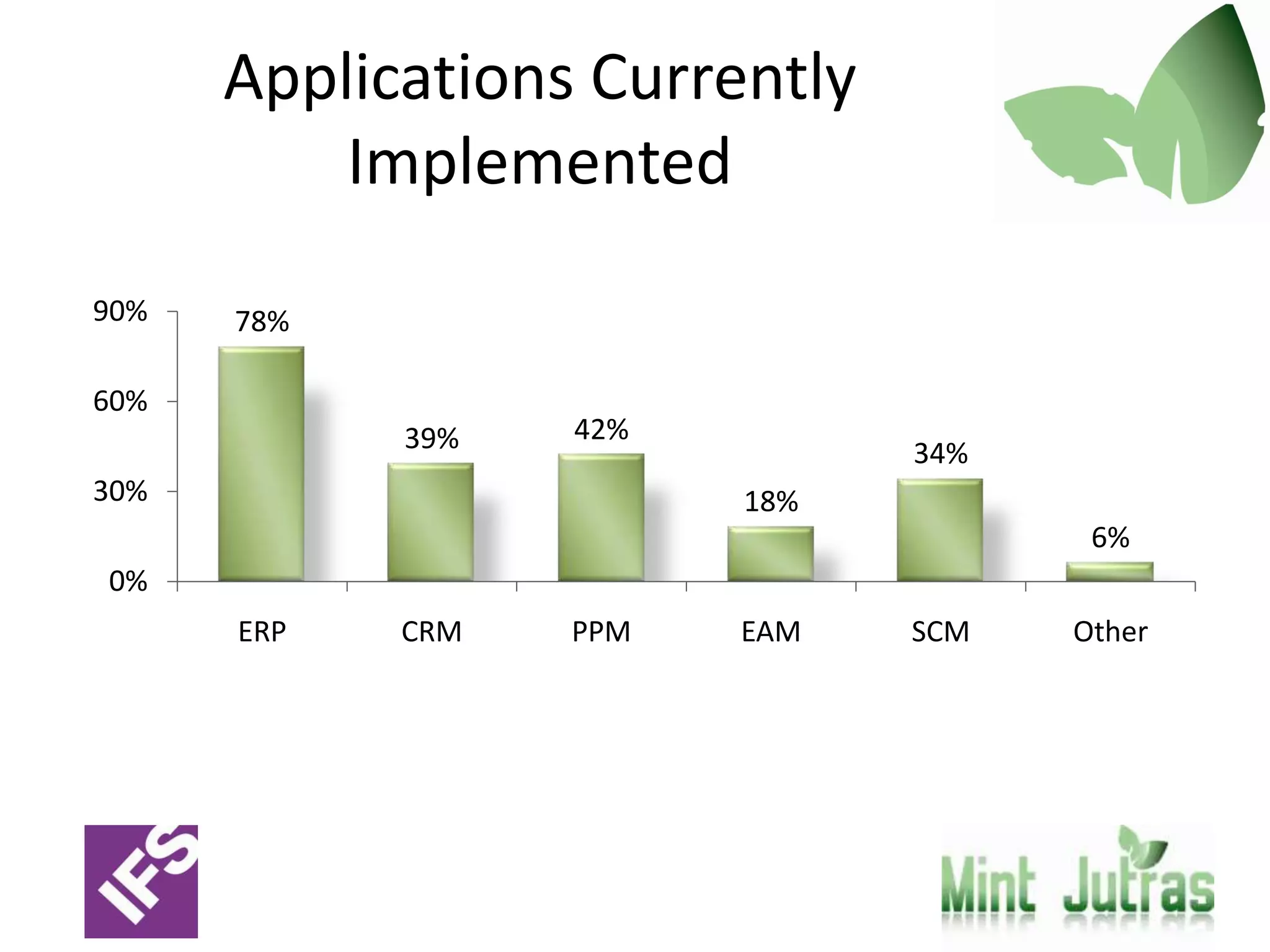

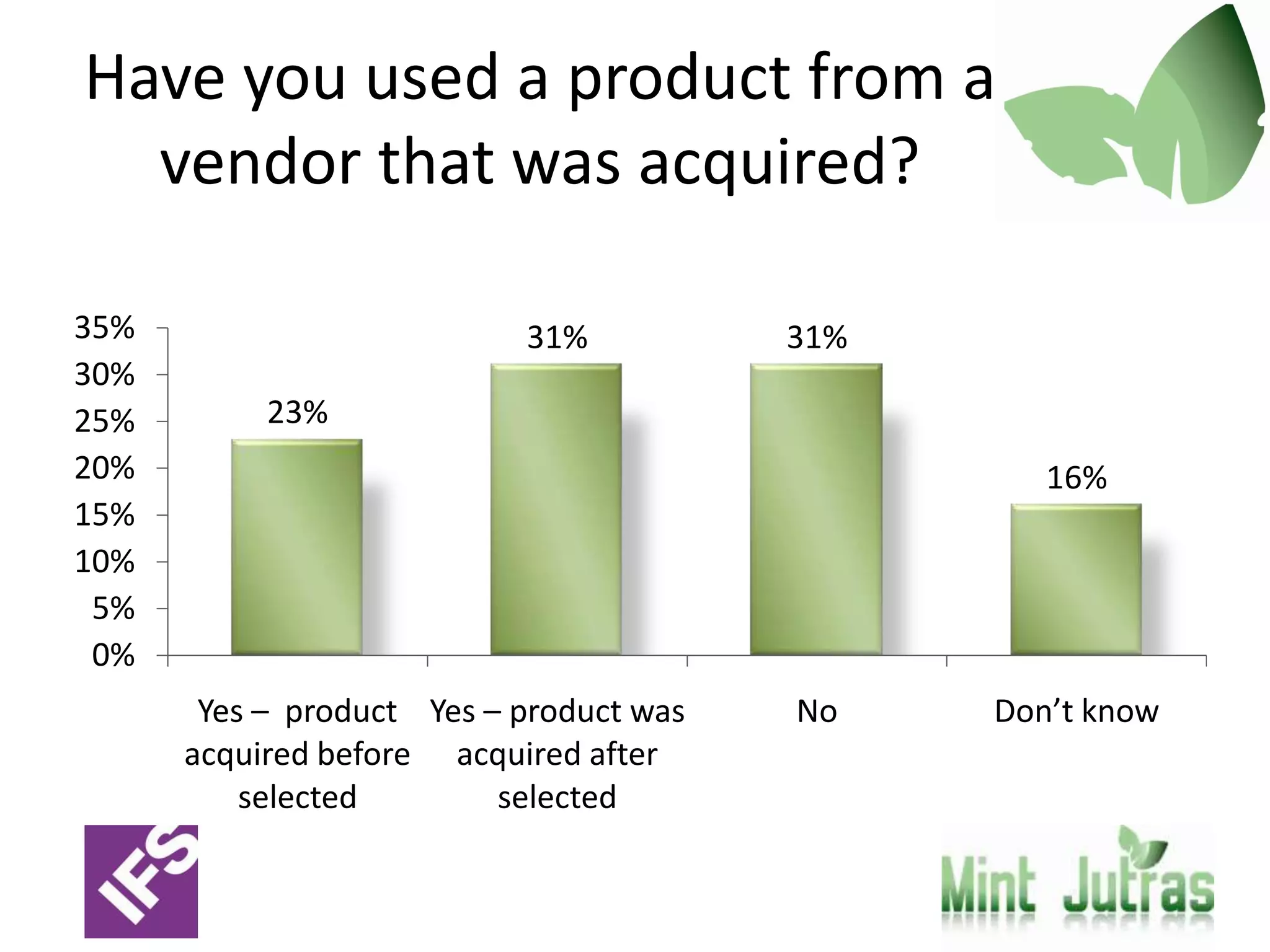

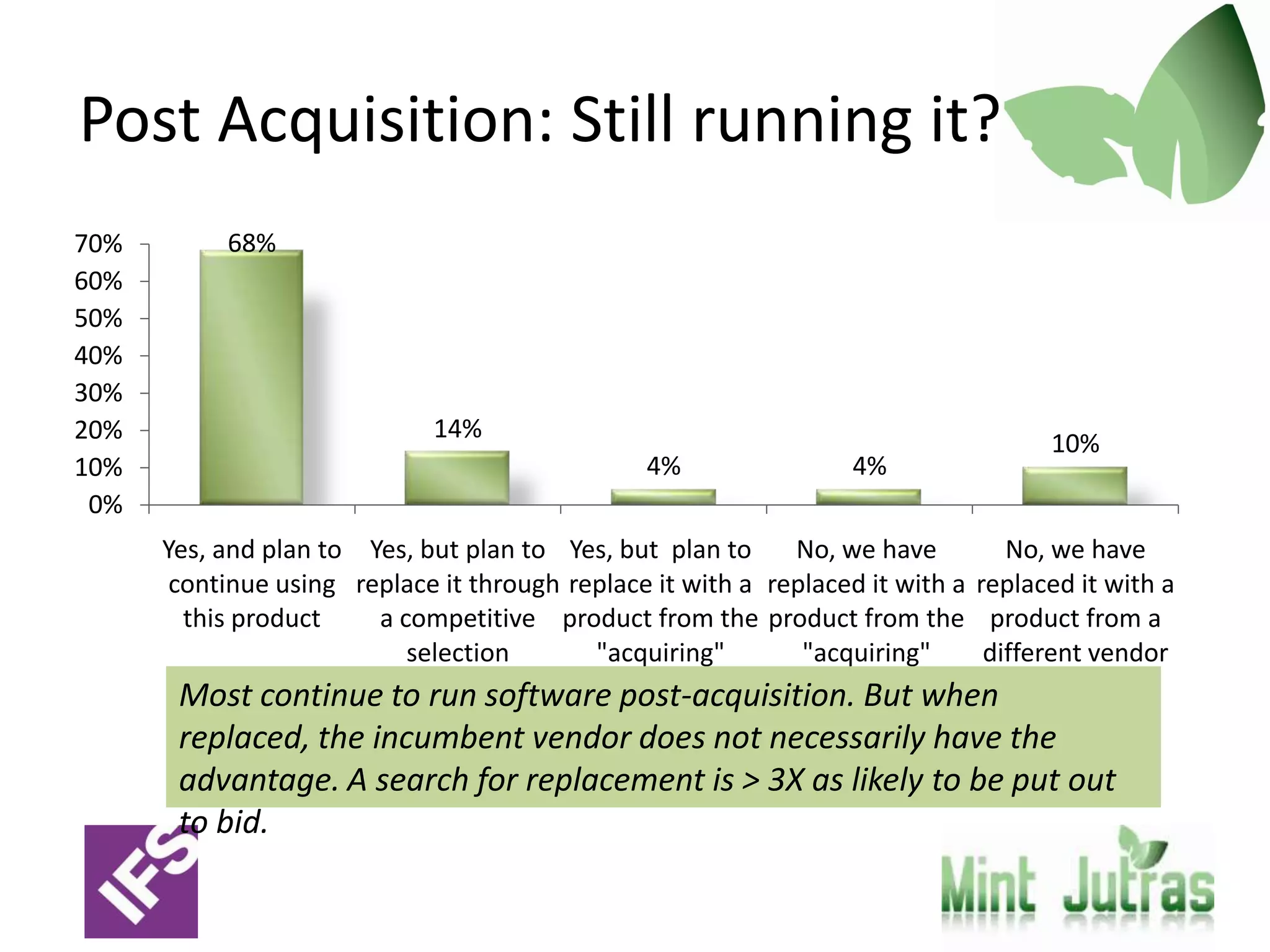

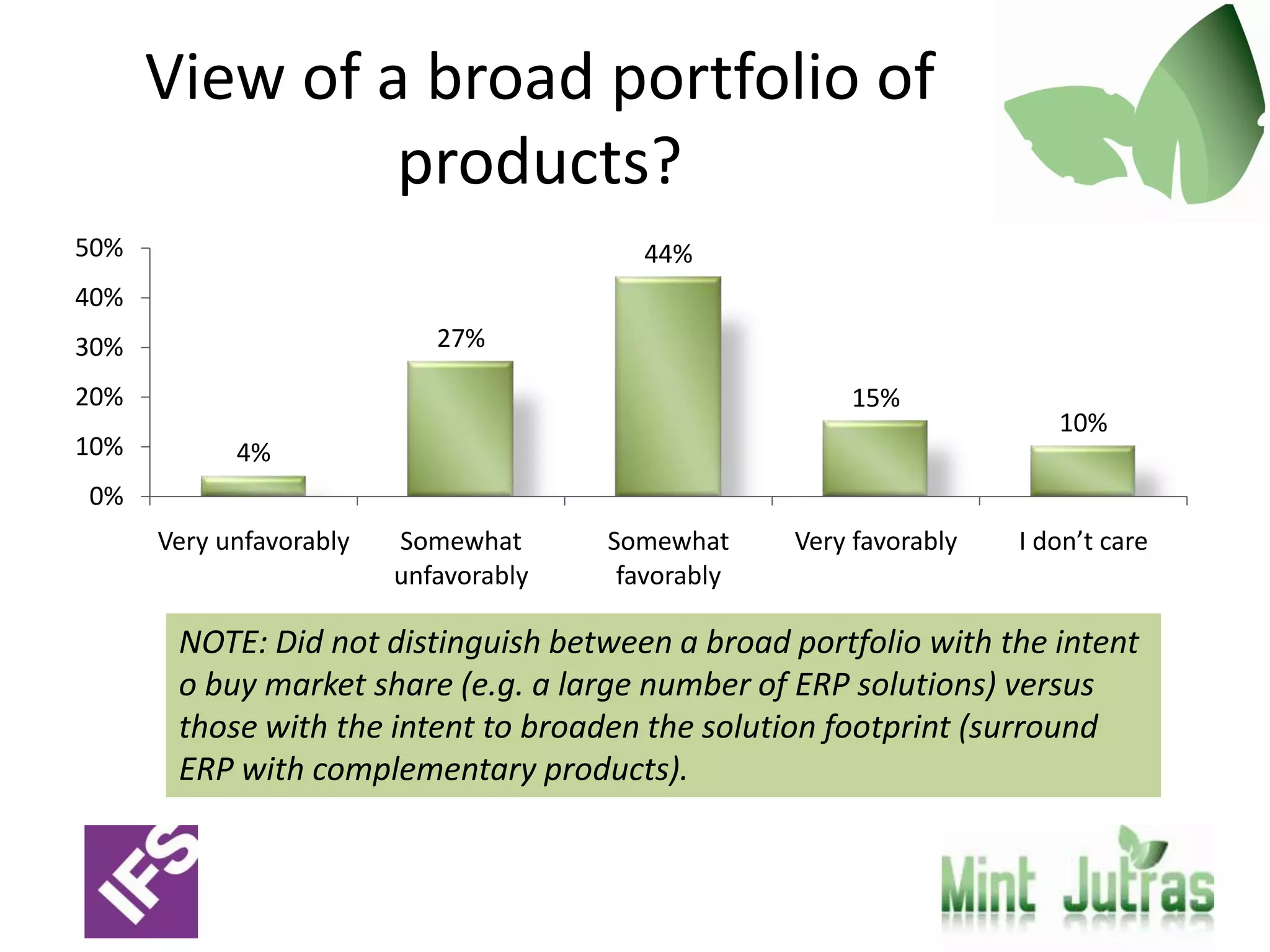

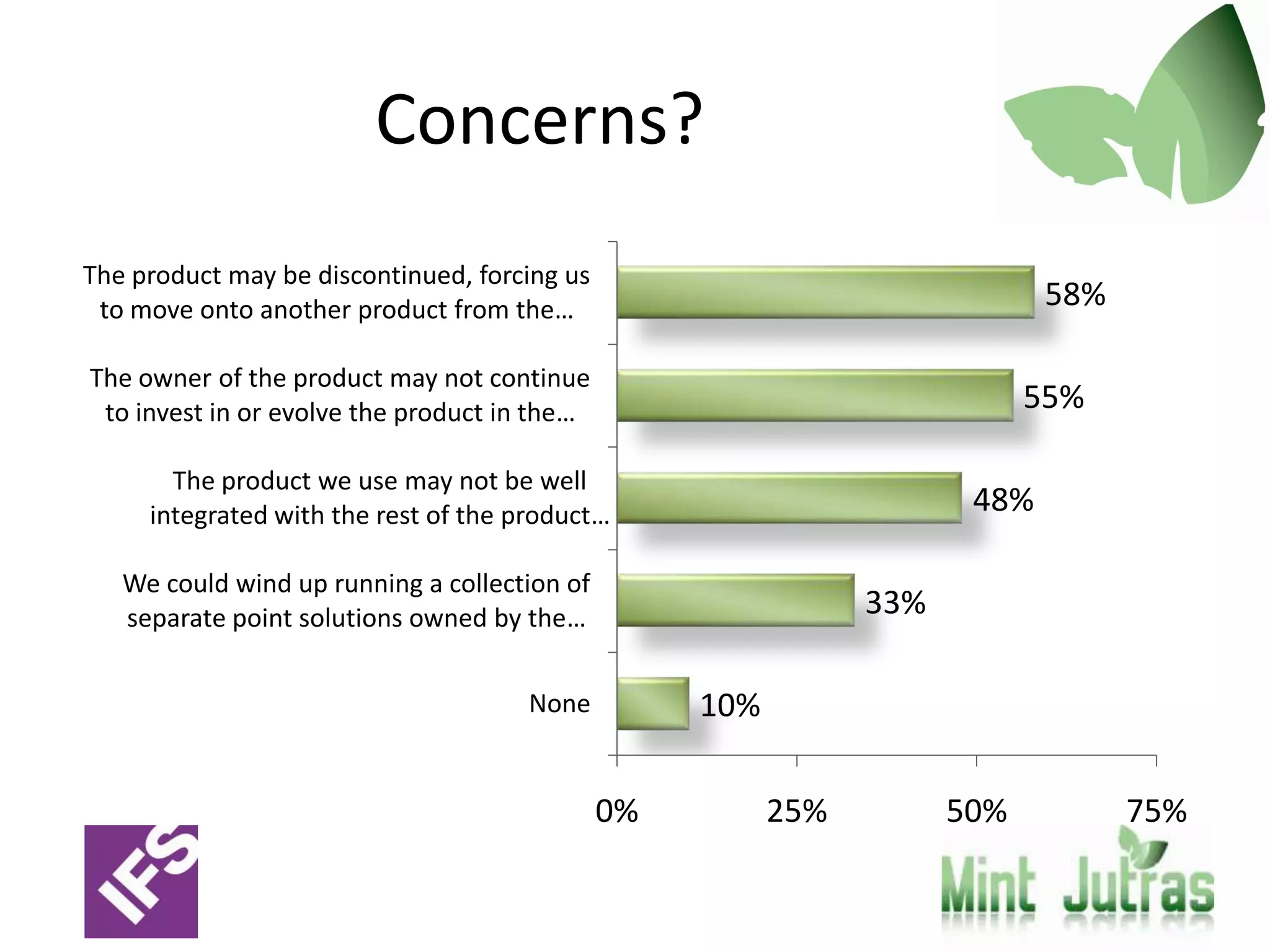

A 2011 survey conducted by IFS North America examined the impact of mergers and acquisitions on customers in the manufacturing sector, revealing that 54% of respondents had experienced an acquisition of their software vendor. Key concerns included the ongoing support and innovation for acquired products, with many customers continuing to use the software despite changes in ownership. The survey highlights the motivations for acquisitions, such as increasing market share and customer wallet share, while identifying both potential benefits and drawbacks from a customer perspective.