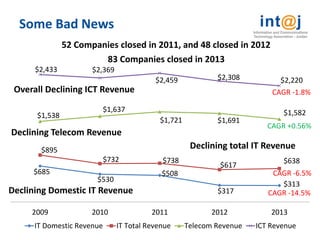

The document summarizes Jordan's ICT industry and opportunities in the sector. It notes that Jordan's ICT sector has grown rapidly since 1999 and now contributes around 12% to GDP, with over 84,000 jobs. The sector includes IT, telecom, outsourcing, content and internet/mobile businesses. While the sector faces some challenges like declining telecom revenue, there are significant opportunities in areas like e-learning, e-health, business process outsourcing, online/mobile content and gaming by capitalizing on Jordan's advantages in Arabic language and skilled workforce. The ICT association aims to promote Jordan as a regional ICT leader and exporter.