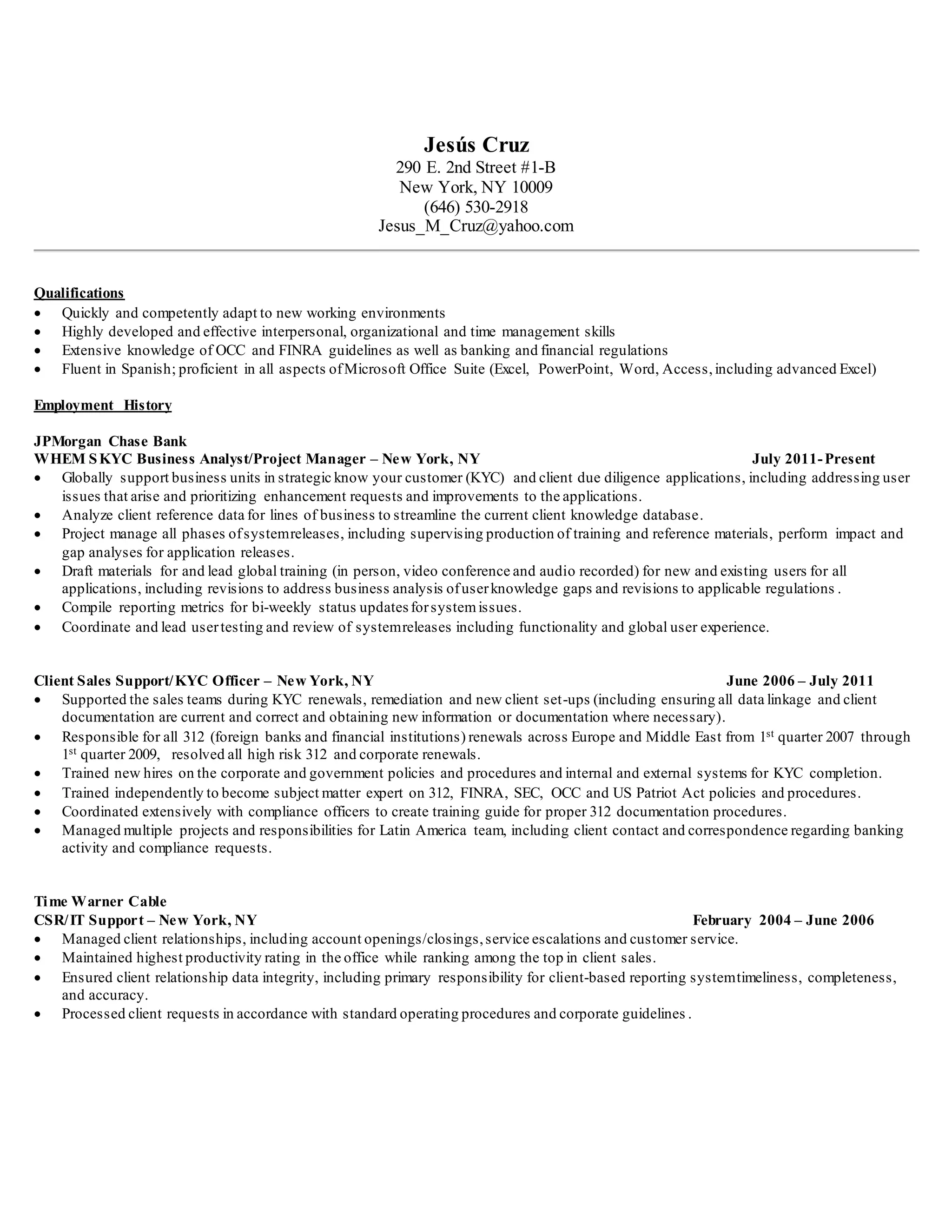

This document is a resume for Jesus Cruz that outlines his qualifications, employment history, education, and interests. Cruz has over 20 years of experience in banking and financial services in roles such as business analyst, project manager, client services representative, and compliance officer. He is fluent in Spanish and proficient in Microsoft Office. Cruz holds certificates in areas such as the Patriot Act, corporate standards, and six sigma. He has worked for employers including JPMorgan Chase Bank, Time Warner Cable, Citibank, and Fleet Bank.