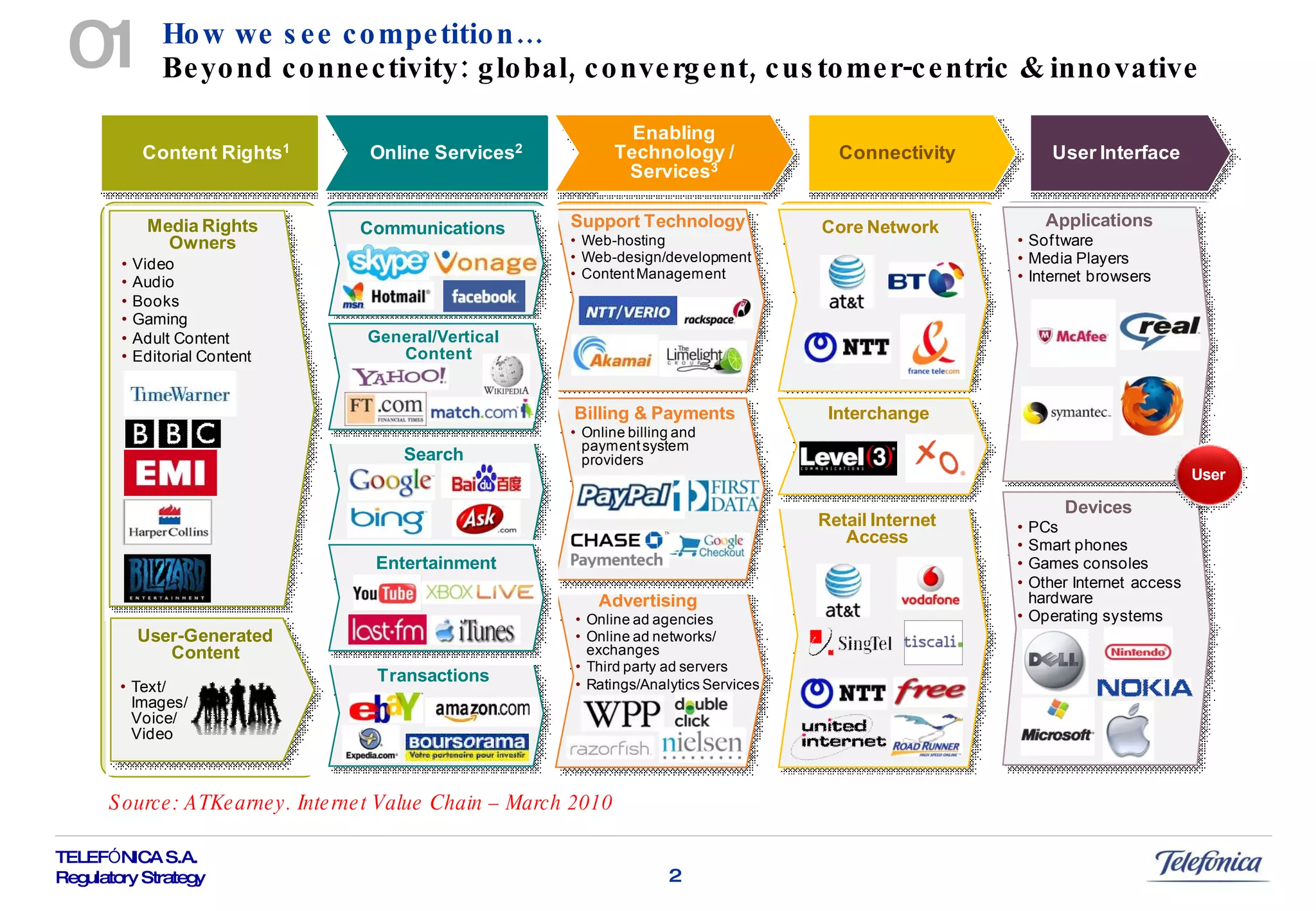

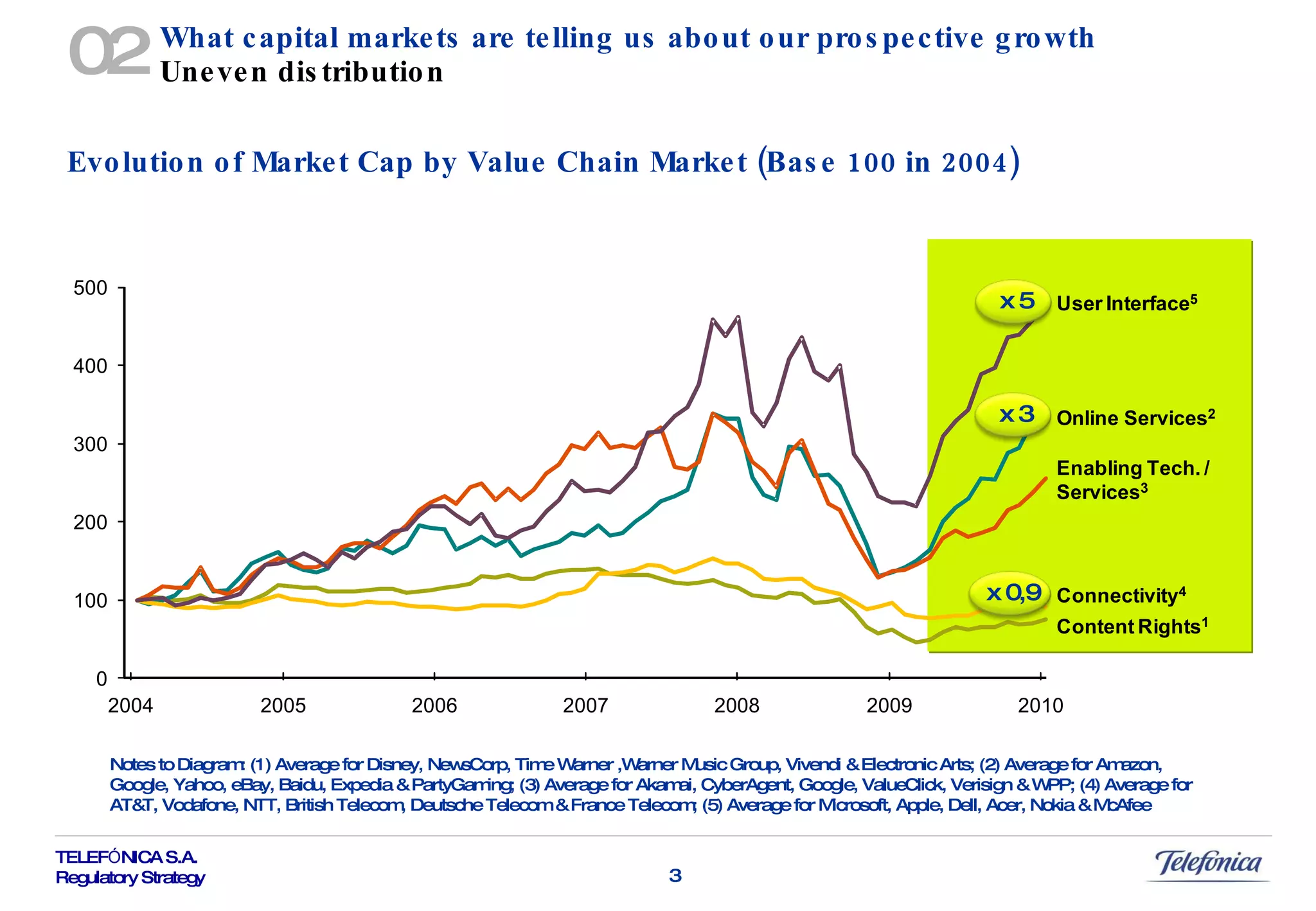

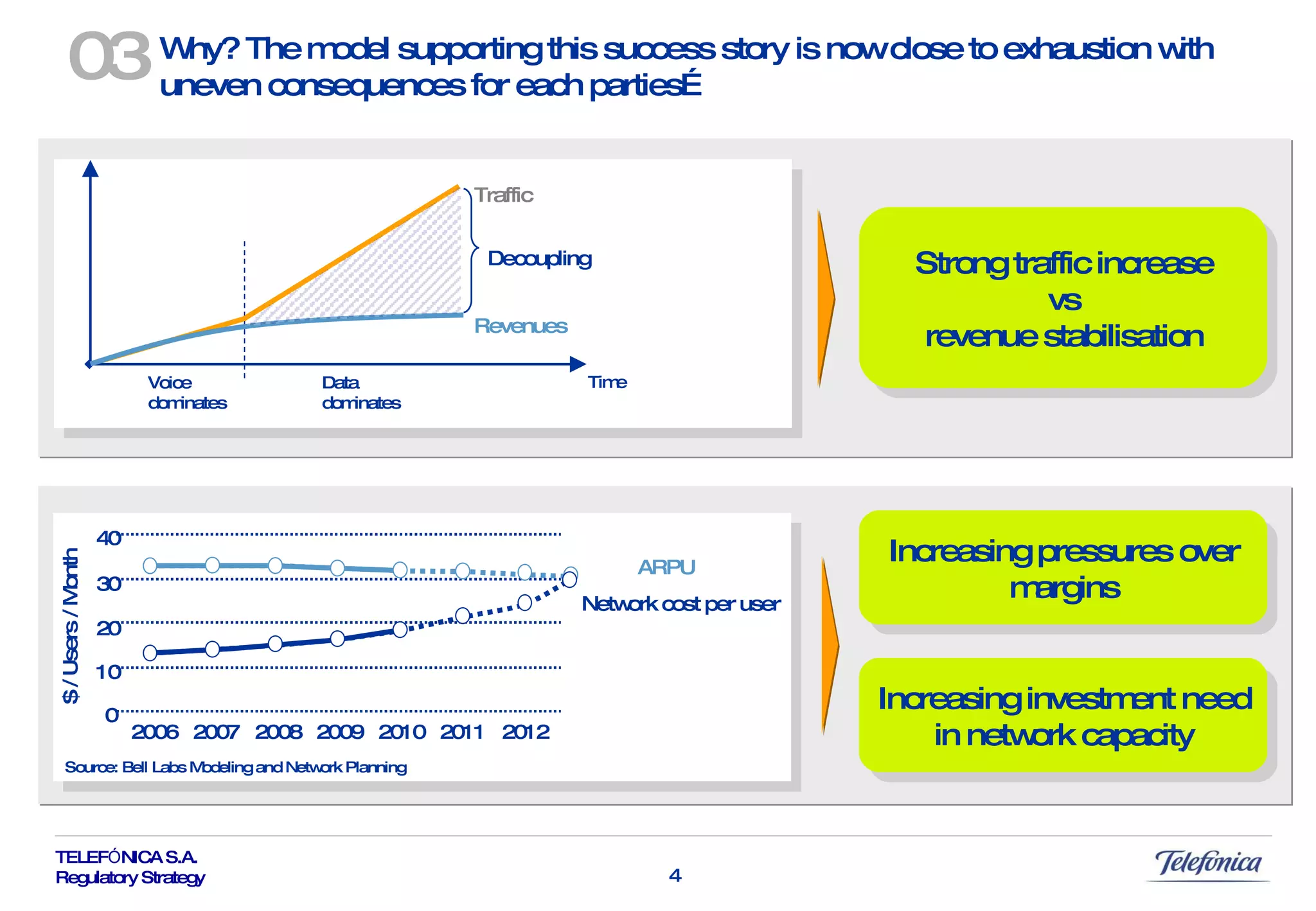

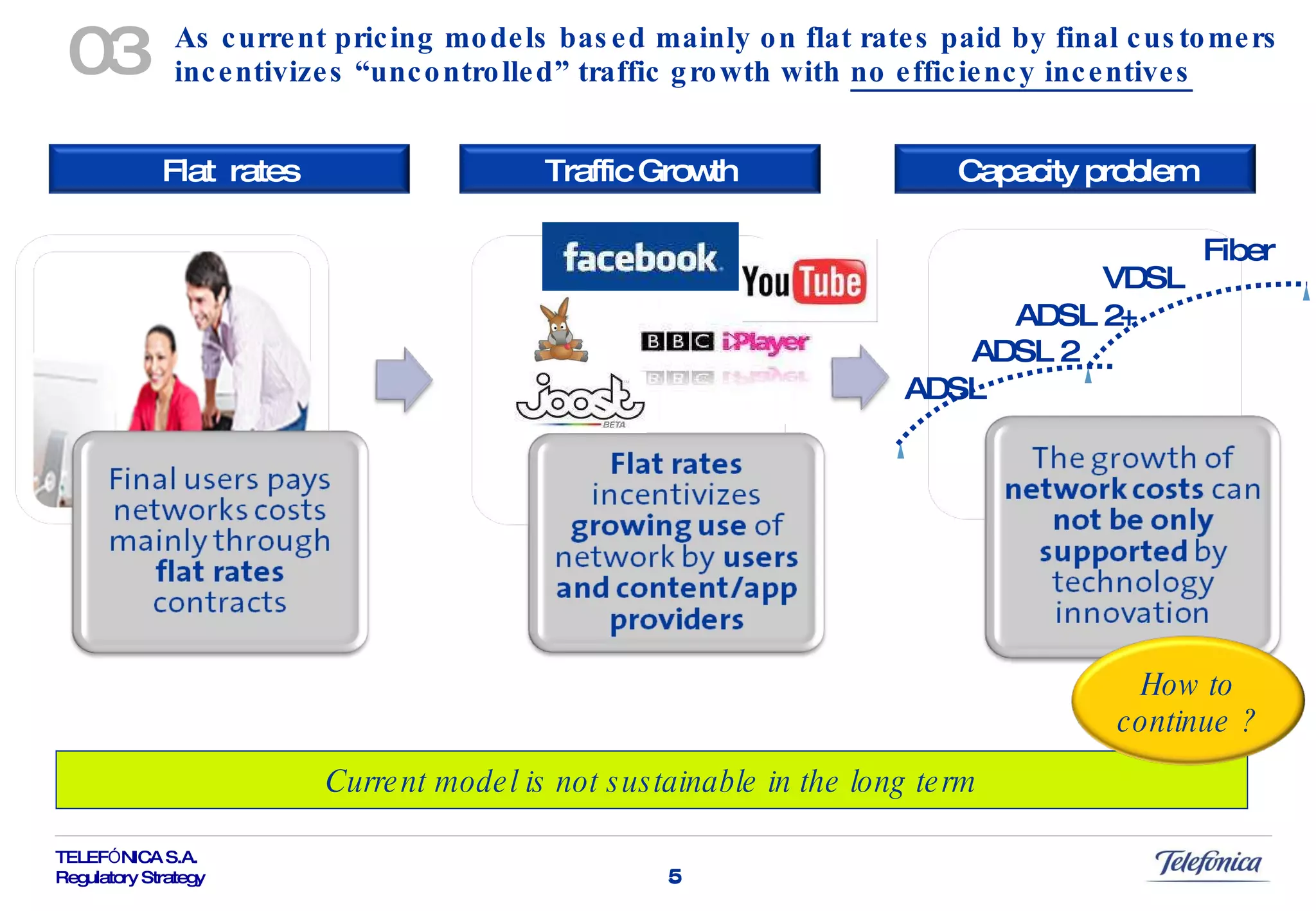

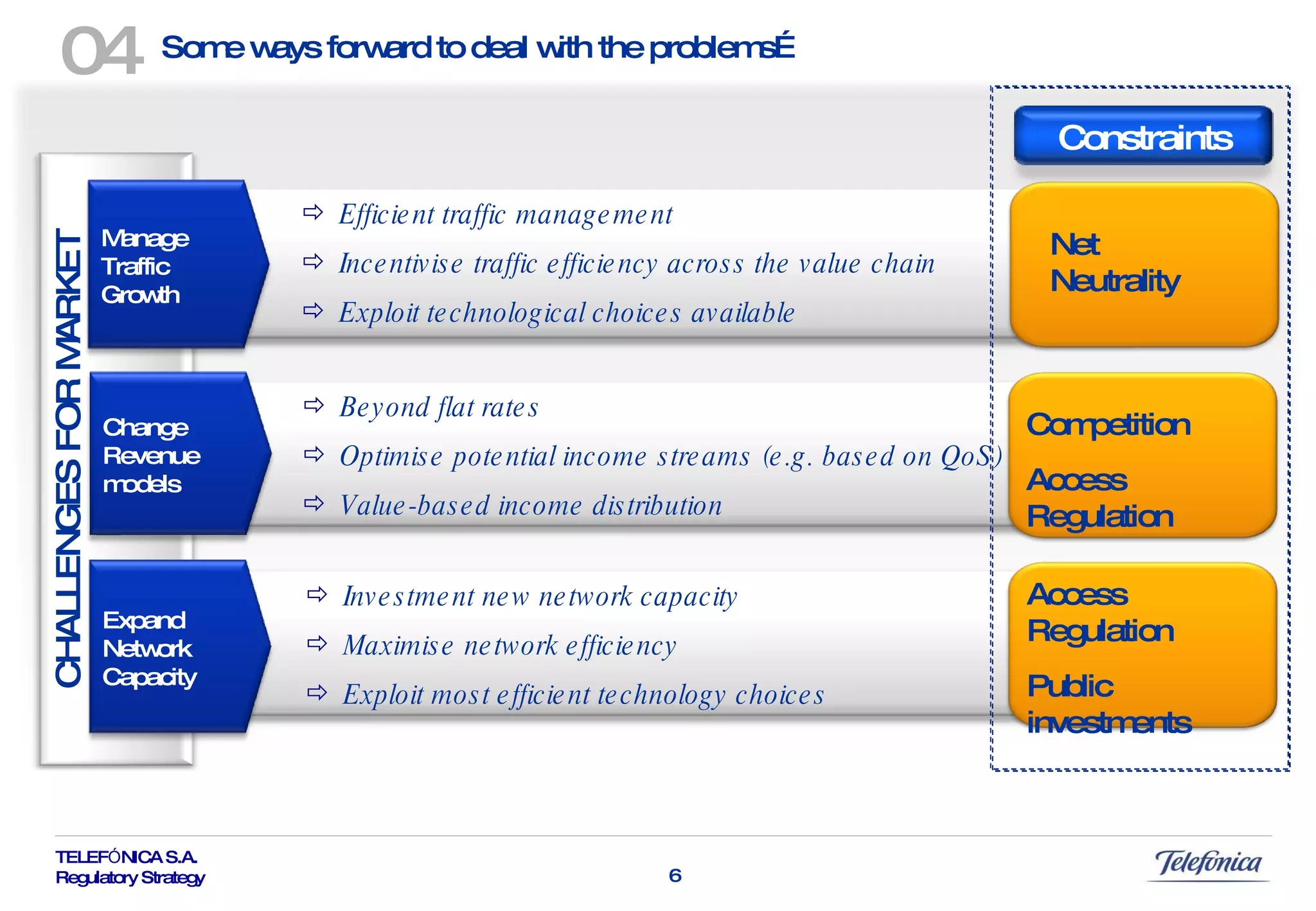

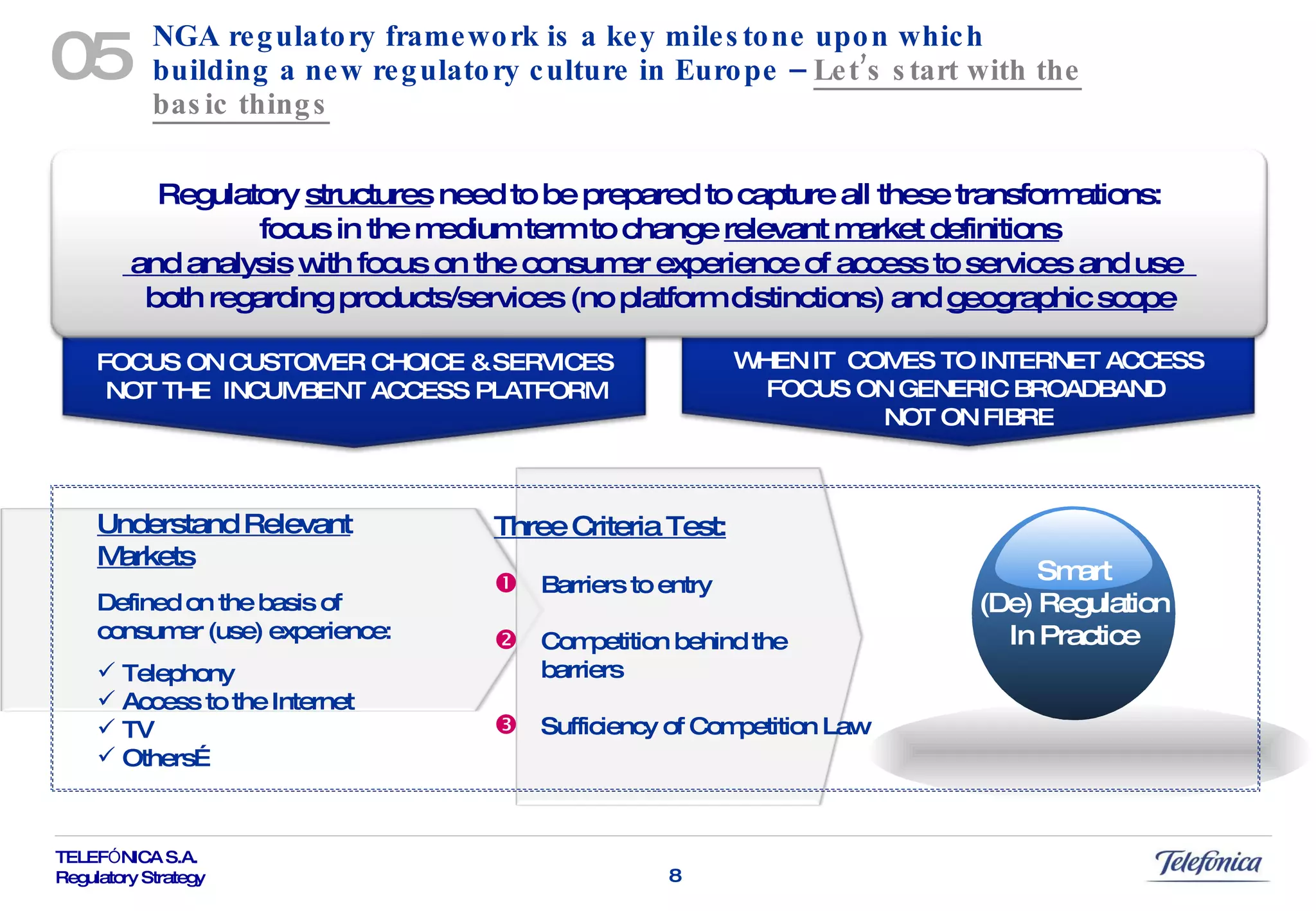

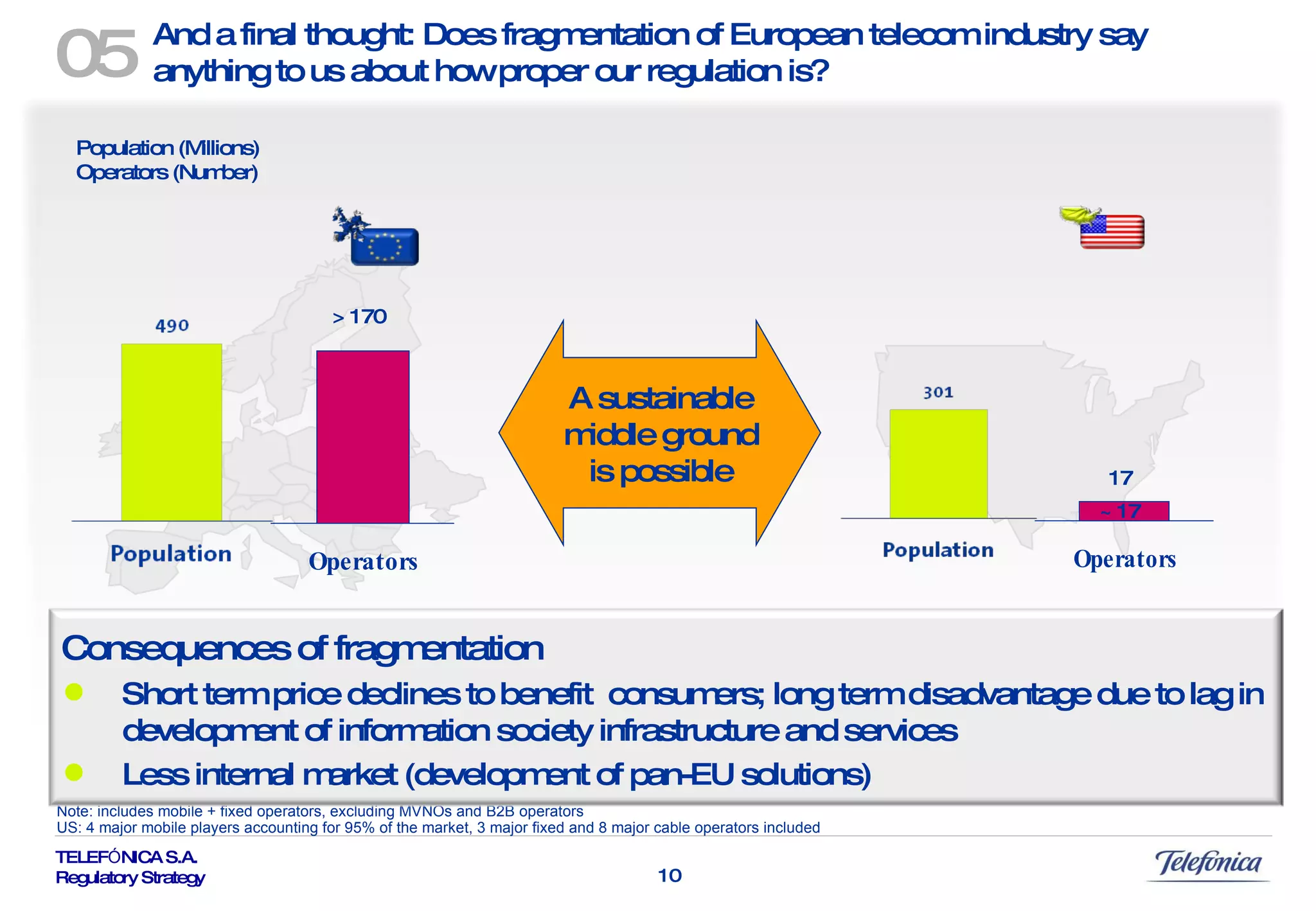

The document discusses challenges facing competition policy and regulation in the telecommunications sector due to increasing traffic, stagnating revenues, and the need to expand network capacity. It argues that policy should focus on enabling consumer choice and access to services rather than specific platforms. Regulatory structures need to capture ongoing transformations and changing market definitions based on consumer experience rather than technology. Fragmentation in Europe's telecom industry may disadvantage long-term development of infrastructure and services compared to larger markets like the US.

![What about [Competition & Regulatory] Policy ? Competition policy and telecom regulation should play an enabling role while protecting consumers from abuse First and Foremost, see the wood for the trees: Frame the policy challenge in the right context Understand what the problems are and what they are not Second, be consistent with the challenges we need to face: Challenge nº1: Expand the market Challenge nº2: Set win-win relationships amongst players in the new Internet ecosystem, i.e. solving current conflicts (decoupling, investment incentives, etc). 05 Revenues Generated by the Internet Industry (2008) Source: ATKearney. Internet Value Chain – March 2010 Both challenges are yet unmet !](https://image.slidesharecdn.com/jeronimogonzalezbrussels2010-100429101338-phpapp02/75/Jeronimo-gonzalez-brussels-2010-7-2048.jpg)

![Many Thanks for your attention ! Jerónimo González E: [email_address] M: + 34 669856098](https://image.slidesharecdn.com/jeronimogonzalezbrussels2010-100429101338-phpapp02/75/Jeronimo-gonzalez-brussels-2010-12-2048.jpg)