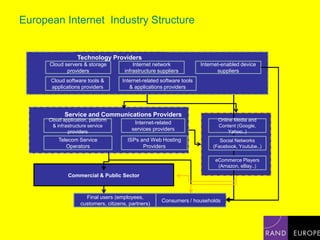

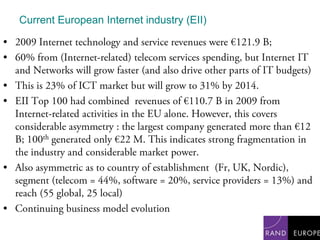

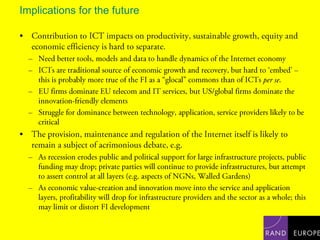

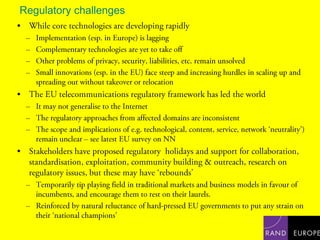

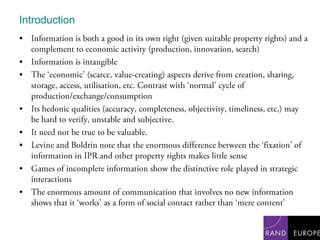

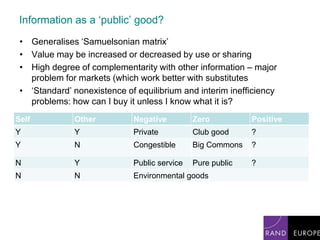

This document discusses information as an economic good and its relationship to the future internet. It notes that information is both a good in itself when property rights exist, and a complement to economic activity. As an economic good, information has qualities like accuracy and timeliness that are difficult to verify. The value of information often depends on its distribution and how it is shared through networks. The future internet will change how information is distributed and shared, affecting markets and their ability to efficiently process information. The document also discusses the European internet industry and implications for its future structure and regulatory challenges.

![FI3PStudy in support of a Future Internet Public-Private Partnership (FI3P)Ongoing study to identify in quantitative and qualitative terms the potential economic and societal longer-term impacts of the application driven public-private partnership on Future InternetCore institutions: IC Focus, IDC, ISMB, RAND Europe , WIK Consult[Operational definitions of FI]Assessment of current European Internet industry, sector, economyAnalysis of near-term and post-2013 FI PPP policy options Rendition in modelsDevelopment of scenariosImpact AssessmentNext slide: brief introduction to last two items](https://image.slidesharecdn.com/0830cave-110110053334-phpapp01/85/J-Cave-Information-as-an-economic-good-in-the-future-internet-7-320.jpg)