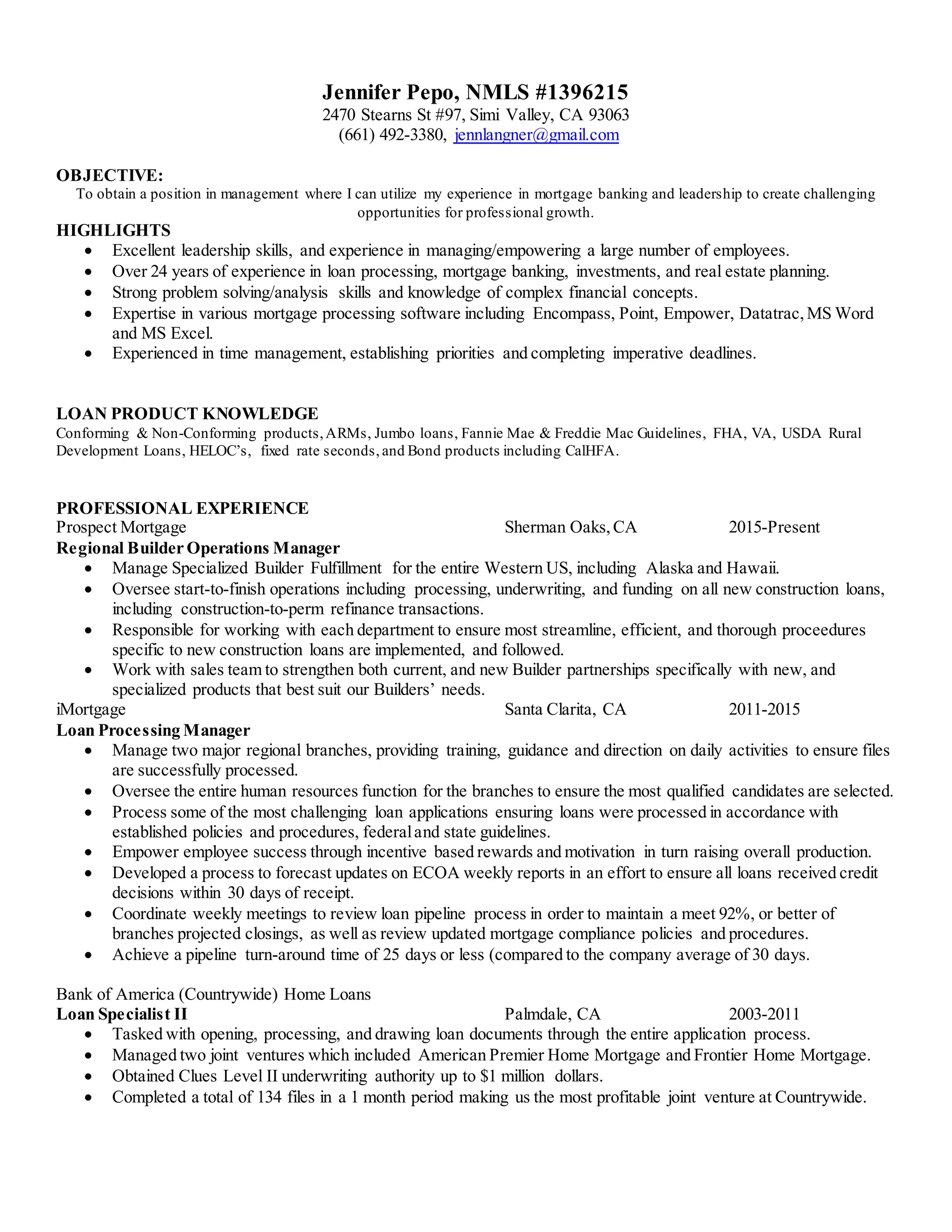

Jennifer Pepo is a Regional Builder Operations Manager at Prospect Mortgage with over 24 years of experience in mortgage banking, loan processing, investments, and real estate planning. She manages specialized builder fulfillment for the Western US, overseeing processing, underwriting, and funding for new construction loans. Previously, she was a Loan Processing Manager at iMortgage, managing regional branches and ensuring loans were processed according to policies and procedures. She has expertise in various mortgage software and strong problem solving skills.