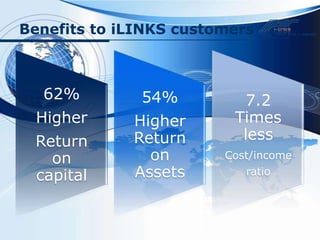

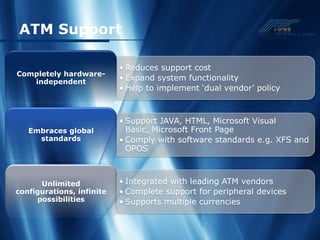

i-links is a leading provider of banking software systems headquartered in Chicago with 68 offices worldwide. It has been the best selling core banking solution for the past three years and has successfully implemented over 600 systems globally. Its software is equipped with modern technology and support and provides benefits like higher returns on capital and assets for customers. It offers a single view of business, reduced infrastructure costs, and a reliable platform through centralization.