The document discusses the history and growth of Islamic banking, particularly in the Middle East. It outlines opportunities for Canadian companies and financial institutions to become involved in Islamic finance. The key points are:

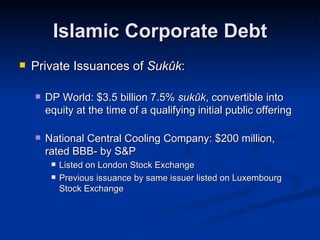

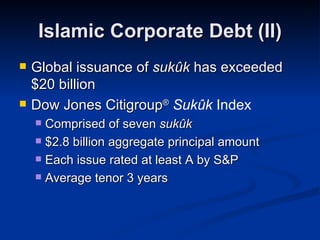

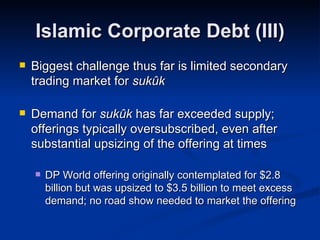

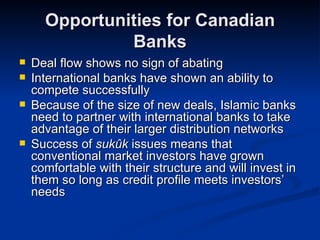

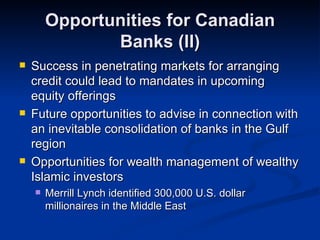

- Islamic banking has grown significantly since the 1970s, especially in Malaysia, the Gulf, and the UK. It provides financing compliant with Sharia law like murabaha and sukuk bonds.

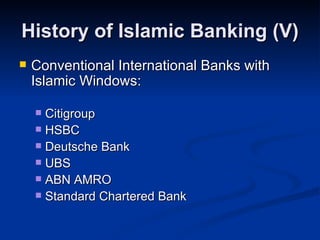

- The sector grew after 9/11 due to reverse capital flight to the Middle East and increased oil prices. Major banks now have Islamic windows to serve Muslim clients.

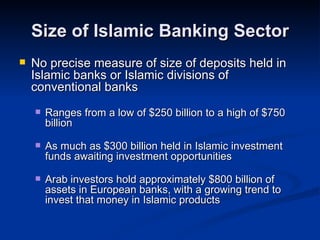

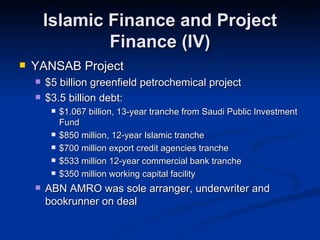

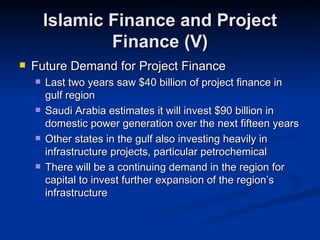

- Islamic finance is a large and growing sector, estimated between $250-750 billion. It provides capital for sovereign and corporate debt, project finance, and