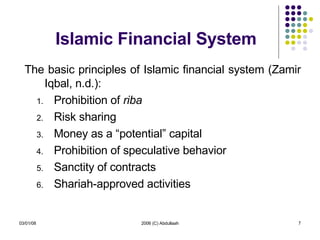

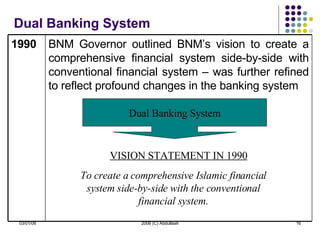

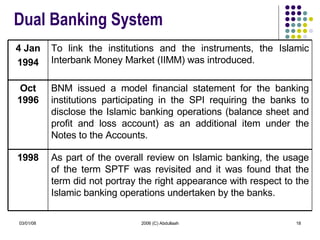

This document provides an overview of the Malaysian Islamic financial system. It discusses the key players and markets in the Malaysian financial system as well as the basic principles of Islamic finance. The history and development of Islamic banking in Malaysia is then outlined, including the establishment of the first Islamic bank in 1983 and the adoption of a dual banking system. Current statistics on Islamic banking and takaful in Malaysia are also presented.