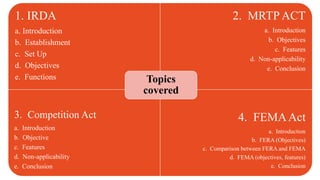

IRDA,FEMA, FERA, MRTP and Competition Act

- 1. 1. IRDA a. Introduction b. Establishment c. Set Up d. Objectives e. Functions 2. MRTP ACT a. Introduction b. Objectives c. Features d. Non-applicability e. Conclusion 3. Competition Act a. Introduction b. Objective c. Features d. Non-applicability e. Conclusion 4. FEMAAct a. Introduction b. FERA (Objectives) c. Comparison between FERA and FEMA d. FEMA (objectives, features) e. Conclusion Topics covered

- 2. Presented by •Poonam Choudhary •MBA •Medicaps University

- 3. What is IRDA ? •In order to provide better insurance coverage and also to augment the flow of long-term resources for financing infrastructure, the Government of India opened the insurance sector to foreign and Indian companies. Insurance Regulatory and Development Authority Act, 1999 was passed. A statutory body is set up to monitor the working of insurance companies.

- 4. IRDA (INSURANCE REGULATORY DEVELOPMENT AND AUTHORITY) •Established in1999. •Passed upon the recommendations of Malhotra Committee report, headed by Mr. R.N. Malhotra (Retired Governor, RBI) •In April, 2000, it was set up as statutory body, with its headquarters at New Delhi. •The headquarters of the agency were shifted to Hyderabad, Telangana in 2001.

- 5. Organizational Setup of IRDA: • IRDA is a ten member body consists of: • One chairman ( For 5 years and maximum AGE-60 years.) • Five whole time members ( for 5 years and minimum age 62 years) • Four part time members ( For 5 years) • The chairman and members of IRDA are appointed by Government of India. • The present chairman of IRDA is MR T.S Vijayan.

- 6. To promote the interest and rights of policy holders. To promote and ensure the growth of insurance industry. To bring transparency and orderly conduct of in financial markets dealing with insurance. To ensure speedy settlement of genuine claims and to prevent frauds and malpractices. OBJECTIVES OF IRDA

- 7. Some of Private Insurance Companies under IRDA Star health insurance Shree Ram General Insurance Co. Ltd TATAAIG General Insurance Co. Ltd Reliance General Insurance Co. Ltd

- 8. Section 14 of the IRDAAct, 1999 lays down the duties, powers and functions of IRDA.

- 9. • Registering and regulating insurance companies. • Protecting policyholder’s interests. • It ensures the maintenance of solvency margin by insurance companies. Functions/Duties of IRDA

- 10. • Undertaking inspection, conducting enquiries etc. on insurance companies. • It regulates and supervise the premium rates and terms of insurance covers. • Ensuring insurance coverage in rural areas and of vulnerable sections of society.

- 11. • Licensing and establishing norms for insurance intermediaries. • Qualification and the code of conduct, training for agents and intermediaries.

- 12. • All insurance companies have to register with IRDA compulsorily. • IRDA has power to levy penalty. POWERS • Accounts and balance sheets of companies have to be submitted to IRDA. • All insurance agents must obtain license from IRDA. OF • All insurance agents must obtain license from IRDA.IRDA

- 13. Insurance Ombudsman Scheme by IRDA Created by govt of India on 11th November, 1998. There are 17 insurance Ombudsman in different location. Complaints are settled out of the courts system in a cost-effective, efficient and impartial way. Meant for solving the disputes between insured and insurer.

- 14. MRTP (Monopolistic and Restrictive Trade Practice) • Enacted in 1969. • Act aims to prevent concentration of economic power in hands of few. • Protect consumer interest. • To provide for the control of monopolies. • To prohibit monopolistic and restrictive trade practices. • Extends to the whole of India except Jammu and Kashmir. • Repealed in competition act, 2002 with few changes in it.

- 15. Prevention of concentration of economic power to the common detriment Control of monopolies Prohibition of Monopolistic Trade Practices (MTP) Prohibition of Restrictive Trade Practices (RTP) Prohibition of Unfair Trade Practices (UTP) OBJECTIVES OF MRTP

- 16. (Monopolistic Trade Practice) MTP Firms involved in MTP tries to eliminate competition from market. Then take advantage of their monopoly and charge reasonably high prices. Deteriorate the product quality, limit technical development, prevent competition and adopt unfair trade practices.

- 17. Restrictive Trade Practice •Refusal to deal •Tie-up sales •Full line forcing •Price discrimination •Re-sale price maintenance •Area restriction

- 18. False representation and misleading advertisement of goods and services. Falsely representing second- hand goods as new. Giving false facts regarding sponsorship, affiliation etc. of goods and services. Misleading representation regarding usefulness, need, quality, standard, style of goods and services. False claims or representation regarding price of goods and services. Giving false guarantee or warranty on goods and services without adequate tests. Unfair Trade Practices (UTP)

- 19. Monopolies and Restrictive Trade Commission (MRTPC) •Set up under section 5 of the Monopolies and Restrictive Trade Practices Act, 1969. •Quasi-judicial body. •Enquire and take action in respect of unfair trade practices and restrictive trade practices. •Upon its own knowledge or information and submit its findings to Central Government for further action.

- 20. Government Company and undertaking owned by Government. Company established by a Central or State Act Trade Unions ( labor union) Non-applicability of MRTP Act

- 21. Competition Act, 2002 • On December 16, 2002, the Lok Sabha passed a bill to replace the MRTP Act. • Also known as Antitrust Law. • Enforced on 13th January 2003. • Govt made some amendments in 2007 and 2009. • Covers whole of India except Jammu and Kashmir. • Industry having assets of Rs. 1,000 cr or more having a annual turnover of Rs. 3,000 cr or more would attract the provisions of the law.

- 22. • Act provides for the constitution of Competition Commission of India (CCI) • Corporate body with quasi-judicial powers. • Orders can be challenged only in the supreme court. • Headed by a chairman and there would not be more than 10 members of the commission to be appointed by the Government of India. • CCI has taken over MRTPC and all pending cases were disposed within 1 year or shifted to concerned consumer courts formed under consumer protection act 1986.

- 23. OBJECTIVES OF COMPETITION ACT To promote healthy competition in the market. To prevent practices which are having adverse effect on competition. To protect the interests of concerns in a suitable manner. To ensure freedom of trade in Indian markets. To prevent abuses of dominant position in the market. Creating awareness and imparting training about the competition act. Regulating the operation and activities of combinations

- 24. Features of Competition Act Very compact and smaller legislation which includes 66 sections. CCI is constituted under the act. Flexible enough to change its provisions as per needs. Civil courts do not have any jurisdiction to entertain any suit which is within the purview of this Act. Possesses penalty provision. Competition fund has been created.

- 25. CONCLUSION •The main aim is to promote competition and curb all anti-competitive agreements. •This act restricts the abuses of dominant enterprises. •Can also regulate any kind of combinations beyond a particular size. •Does not curb monopolies rather it curbs abuses of monopolies. •Protects the interest of the small and medium industries in the country besides giving consumers more powers to redress their grievances.

- 26. FEMAAct Established in 1999. “to consolidate and amend the law relating to foreign exchange with the objective of facilitating external trade and payments and for promoting the orderly development and maintenance of foreign exchange market in India. Replacement of FERAAct. (Foreign Exchange Regulation Act)

- 27. • Enacted in September 1973 and came in force from January 1, 1974. • Amended in 1993 and replaced by FEMA in 1999. • Lays emphasis on the regulation of currencies FERA • Enacted in 29, December 1999 and came in force on June 2000. • Manages the foreign exchange.FEMA

- 28. OBJECTIVESOFFERA Regulate certain payments Regulate dealings in foreign exchange and securities. Regulate transactions indirectly affecting foreign exchange.

- 29. OBJECTIVESOFFERA Regulate import and export of currency and bullion. To conserve the foreign exchange resources of the country and to utilize the same in the interests of the economic development of the country. Regulate employment of foreign nationals.

- 30. OBJECTIVESOFFERA Regulate holding of immovable property outside India. Regulate acquisition, holding etc. of immovable property in India by non residents. Regulate foreign companies.

- 32. Restrictive Not suitable for liberalization policies Hindrance in globalization Threat of criminal offence Challenging condition REASONS WHY FERA WAS REPLACED

- 33. OBJECTIVES OF FEMA To help facilitate external trade and payments in India. To help development and maintenance of foreign exchange market in India. Defines the procedures, formalities, dealings of all foreign exchange transactions in India

- 34. OBJECTIVES OF FEMA To make strong and developed foreign exchange market To maintain good relations with other countries.

- 35. FEATURES OF FEMA It is a civil law. Provides only for monetary penalty for violating the provisions. Conserves precious foreign exchange. It is liberal and flexible in nature. It is more transparent in its application.

- 36. FEMAAct ( Applicable to) • The whole of India • Any branch, office and agency, which is situated outside India, but is owned or controlled by a person resident of India. • Sale, purchase and exchange of any kind. • Banking, financial and insurance services. • NRI (Non Resident Indian) • OCB (Oversees Corporate Body) A company or firm owned at least 60% by NRI’s.

- 37. MAJOR PROVISIONS OF FEMAAct Dealing and holding of foreign exchange Current and Capital account transactions Penalties on contravention Power of RBI to inspect authorized person

- 38. Free transactions on current account subject to reasonable restrictions. Mechanism that enables the RBI and Central Govt to pass regulations and rules relating to foreign exchange in tune with Foreign Trade policy. More concerned with management instead FERA was concerned about exchange regulation or control Sell or draw without prior permission and can later on inform RBI. RBI controls over capital account transactions. Dealing in foreign exchange through authorized persons.

- 39. CONCLUSION • Strongly enforces foreign exchange laws. • All the current account transactions are free. (Sec 3) • Capital account transactions are permitted only to the extent as specified by the RBI. (Sec 6) • RBI have controlling role in its management however it cannot directly handle foreign exchange transaction and must authorize a person to deal with it as per directions. • Provisions of various enforcement, penalties, adjudication and appeals in this area.