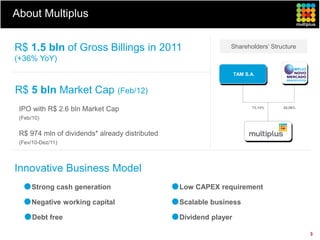

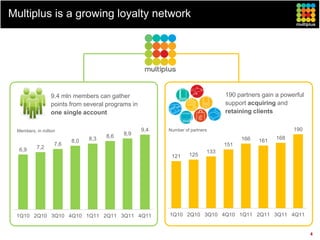

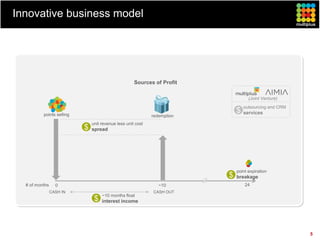

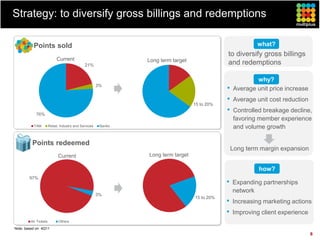

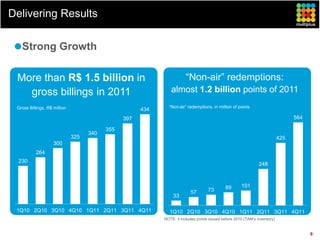

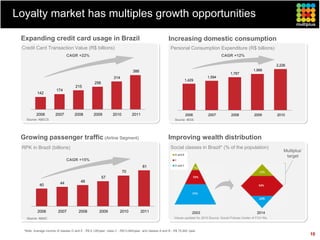

This investor presentation summarizes Multiplus S.A., a loyalty program company. It discusses Multiplus' growth in gross billings and market capitalization. Multiplus has an innovative business model with strong cash generation, low capital expenditures, and scalability. The presentation outlines Multiplus' strategy to diversify its sources of points sold and redemptions to different industry partners to control costs and breakage while improving the member experience.

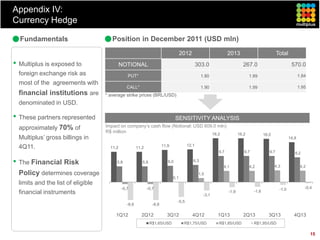

![Appendix III:

Air tickets pricing model

Flights with Flights with

Simple and high load factor low load factor

robust model

Unit cost = [Revenue Displacement + Marginal Cost] / # of points

Unit cost of standard redemptions

DEC/11: periodic review

FEB/10: R$622M prepayment (~10% reduction)

(~13% discount)

Unit Cost (R$)

AUG/10: R$400M prepayment

(~4% discount)

Jan

Jun

Jul

Jan

Jun

Jul

Jan

Jun

Jul

Aug

Feb

Aug

Sep

Feb

May

Aug

Sep

Feb

Sep

Apr

May

Oct

Oct

Nov

Dec

Apr

Nov

Dec

Apr

May

Oct

Nov

Dec

Mar

Mar

Mar

2010 2011 2012

Contractual cost (model) Cost after commercial discounts (prepayments)

NOTE: assuming current unit cost for 2012

14](https://image.slidesharecdn.com/120214-investorpresentationfull-120305115110-phpapp01/85/Investor-Presentation-February-2012-14-320.jpg)