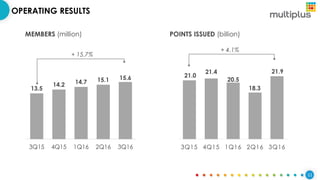

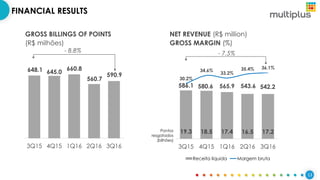

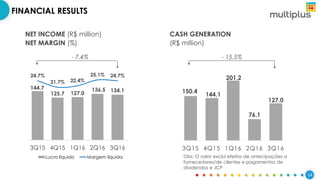

Multiplus reported its 3Q16 earnings. It issued 21.9 billion points, a 4.1% increase over 3Q15. Gross billings of points were R$590.9 million, down 8.8% from 3Q15 but up 5.4% from 2Q16. Net income was R$134.1 million, a 7.4% reduction from 3Q15 and 1.7% decrease from 2Q16. The company saw increases in members, points issued, and gross margin percentage, but decreases in gross billings of points and net income compared to the prior year.