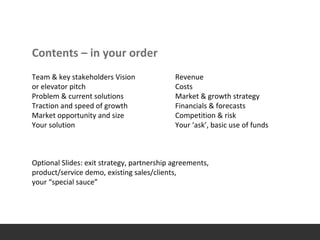

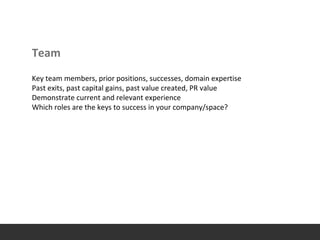

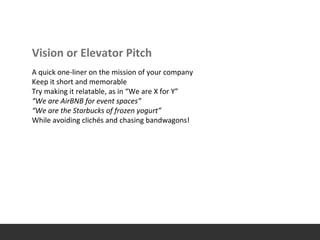

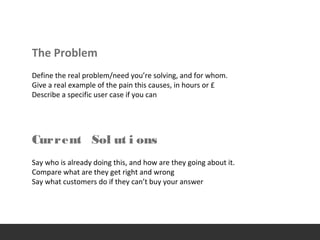

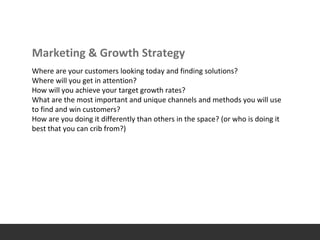

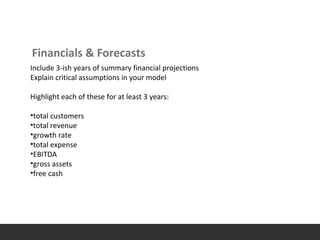

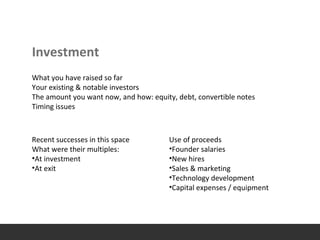

The document provides a comprehensive guide for creating an investor pitch deck that should be concise, visually appealing, and clearly narrate your business opportunity. It outlines key elements such as the team, vision, market opportunity, solution, traction, financials, and competitive landscape, emphasizing the importance of engaging storytelling and avoiding common pitfalls like excessive detail and unsupported assumptions. The goal of the pitch deck is to generate interest and secure further meetings rather than close an immediate investment.