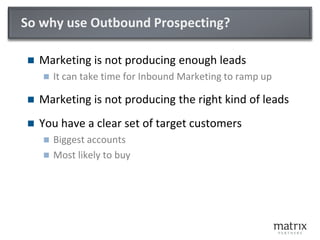

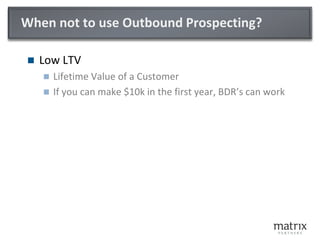

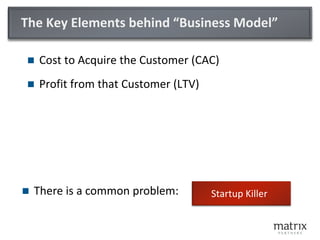

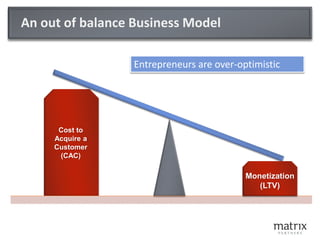

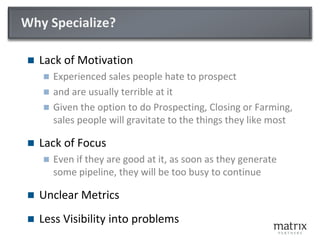

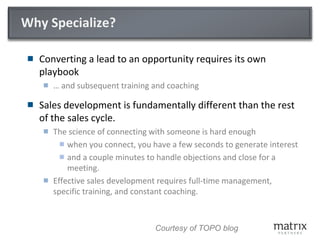

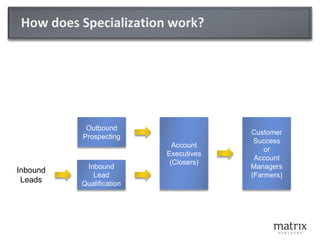

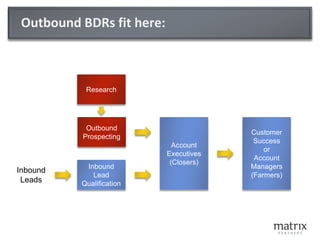

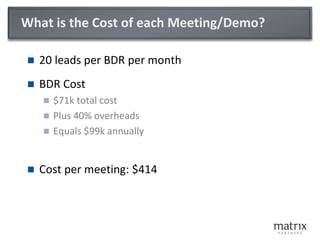

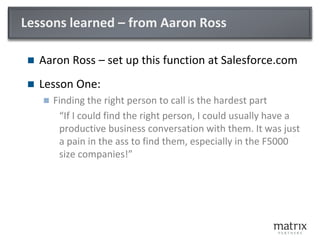

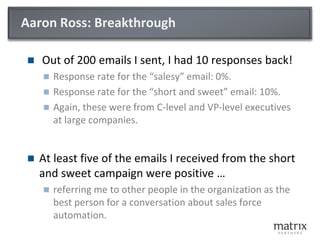

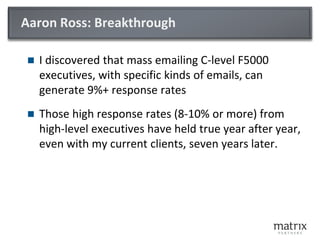

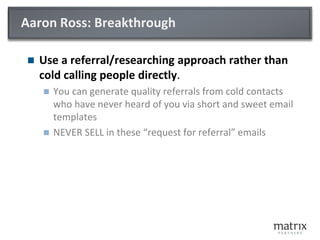

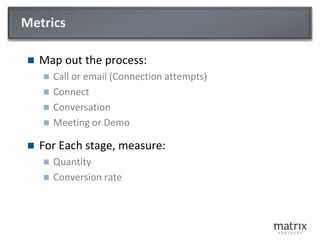

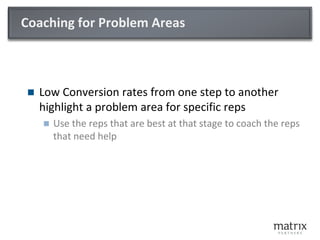

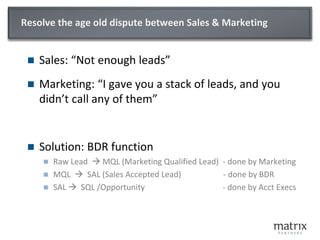

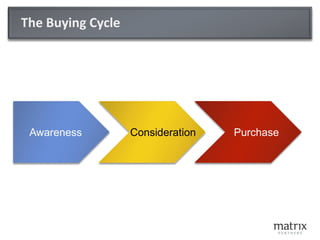

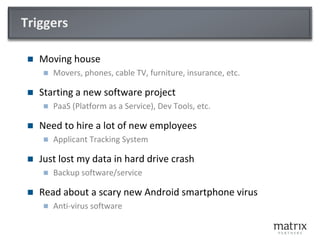

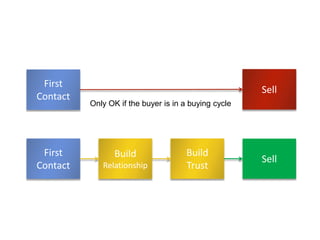

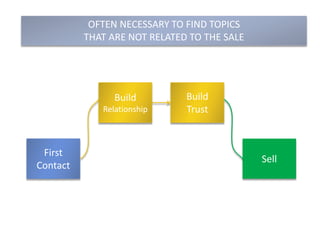

A business development representative (BDR) focuses on outbound prospecting, which is essential when inbound marketing is insufficient or slow to yield quality leads. Specialization in sales roles is crucial for effectiveness, as sales development requires distinct skills and processes compared to closing and account management. Tools and metrics for measuring performance, alongside strategic outreach methods, are necessary for generating qualified leads and maximizing revenue potential.