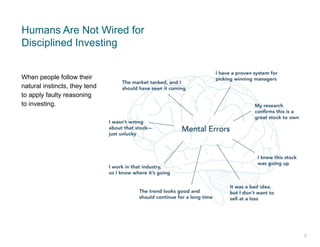

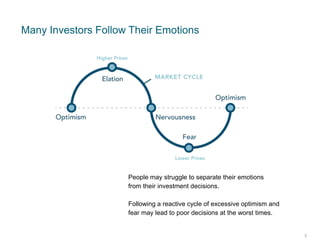

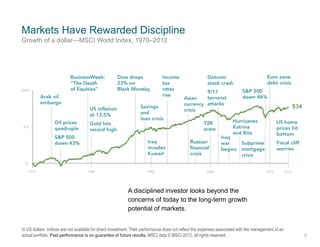

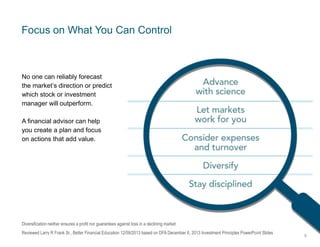

Humans are not naturally wired for disciplined investing and tend to make decisions based on emotions instead of reason. Many investors follow emotional cycles of optimism and fear that can lead them to make poor choices, especially during periods of market volatility. However, research shows that maintaining a long-term, disciplined investment strategy focused on diversification and ignoring attempts to time the market has been rewarded with strong returns. The key is focusing on the factors within an investor's control, such as their asset allocation and sticking to a thoughtful plan, rather than trying to predict unpredictable market movements.