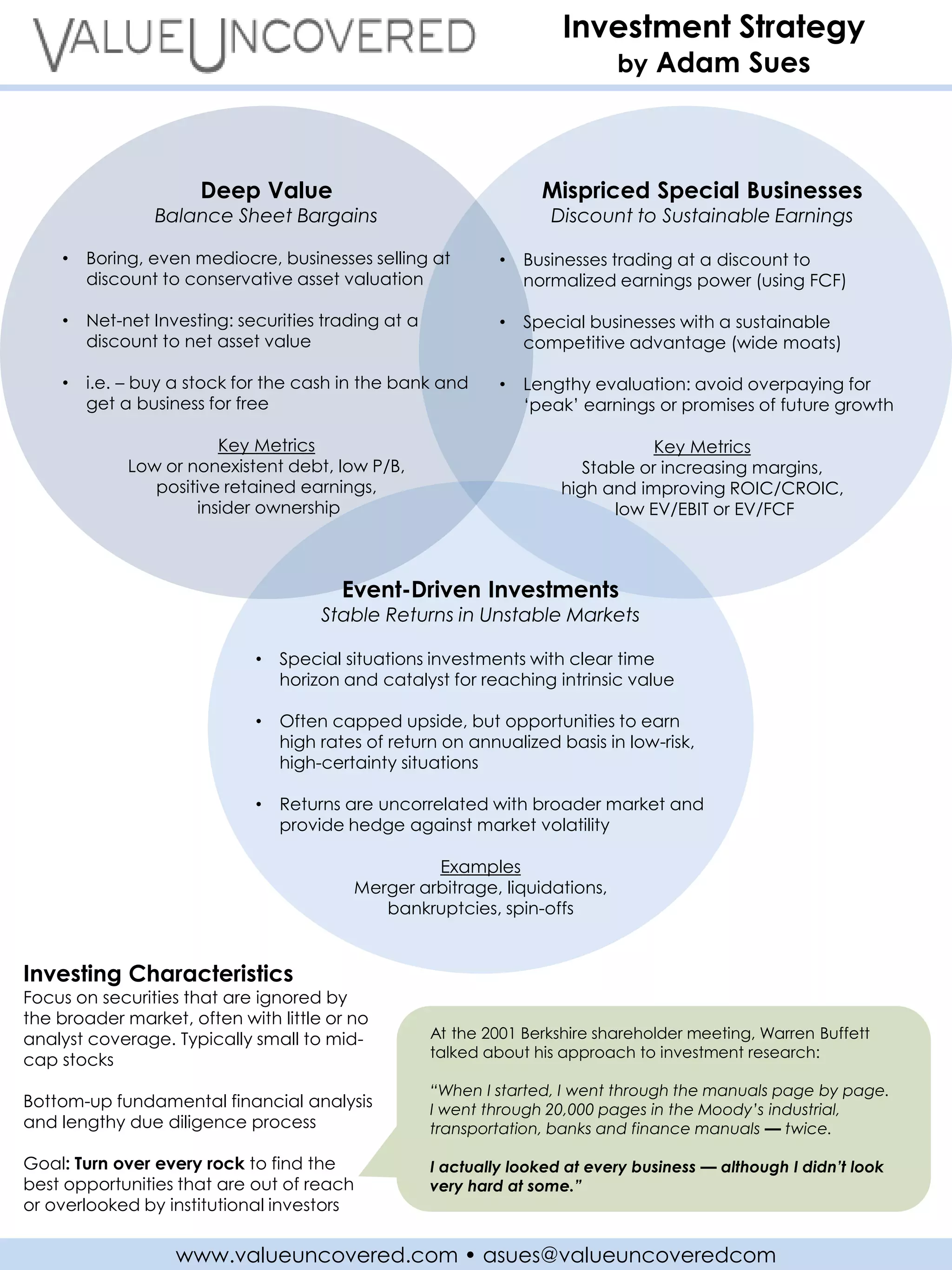

Adam Sues outlines an investment strategy focused on deep value stocks, mispriced special businesses, and event-driven investments. The strategy seeks balance sheet bargains trading below asset value, stable businesses with sustainable competitive advantages selling at a discount to normal earnings, and special situations with a clear catalyst for intrinsic value realization. Key metrics for deep value include low debt and positive retained earnings, while metrics for special businesses include stable margins and high returns on capital. Event-driven investments aim to earn stable, uncorrelated returns from mergers, bankruptcies, and other time-bound opportunities.