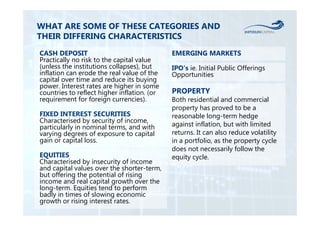

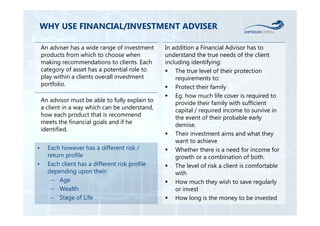

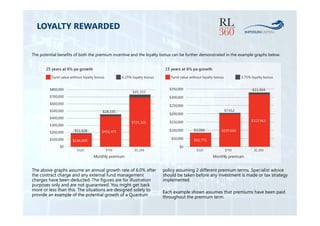

The document discusses various investment and protection services available through RL360. It begins by summarizing the Isle of Man's history and reputation as an offshore financial center. It then discusses RL360's regulation and client protection schemes. The document goes on to provide examples of regular contribution investment plans, single sum investments, and independent discretionary management services. It also introduces a new emerging market equity income fund and describes international protection plans.

![1999 2001 2003 2005 2007 2009 2011 2013

500,000

450,000

400,000

350,000

300,000

250,000

200,000

150,000

100,000

50,000

0

Demonstrating Diversification PIMS TR in GB [363,378.33]

IMA Technology & Telecoms TR in GB [186.602.54] 01/11/1998 - 30/07/2013 © Data provided by Morningstar 2014

Past performance may not be repeated and must not be used as a guide to future performance.](https://image.slidesharecdn.com/investmentpresentation-140913233959-phpapp02/85/Investment-presentation-11-320.jpg)