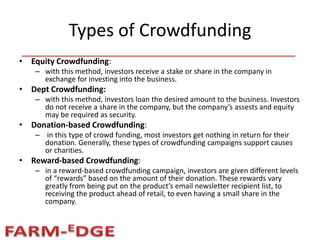

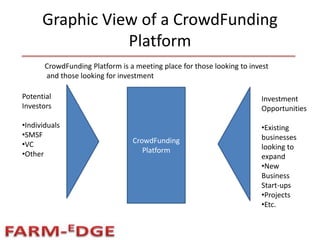

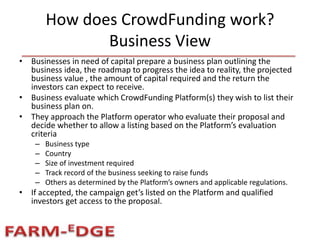

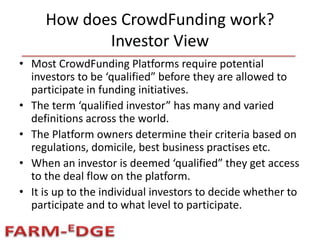

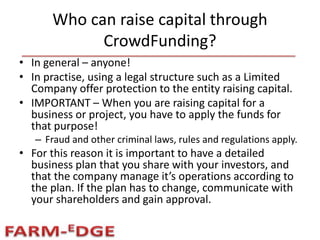

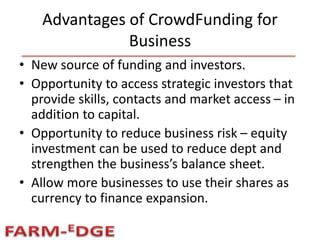

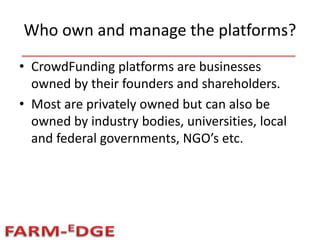

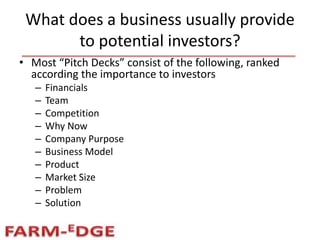

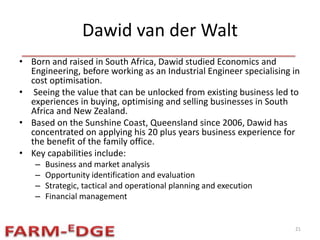

This document provides an introduction to crowd funding and how it can benefit agricultural businesses. It discusses what crowd funding is, the different types (equity, debt, donation, reward-based), and how the process works from the perspective of businesses seeking funding and investors. The document outlines the advantages for both businesses, such as accessing new investors and reducing risk, and investors, such as new investment opportunities. It also provides contact information for those interested in setting up crowd funding platforms or for agricultural businesses wanting to pursue crowd funding.