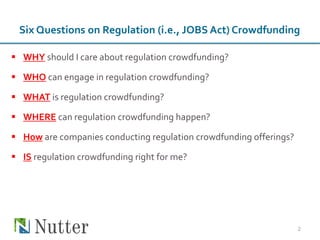

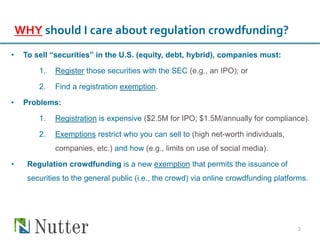

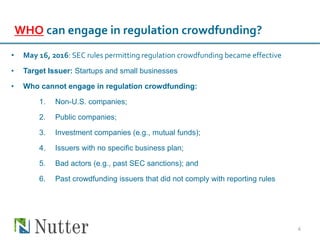

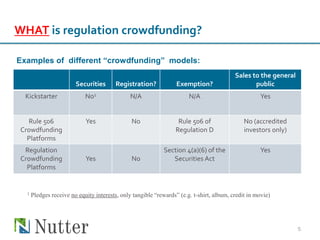

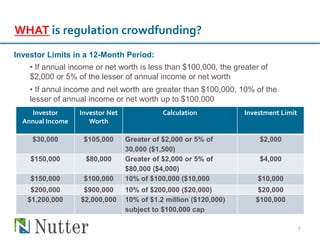

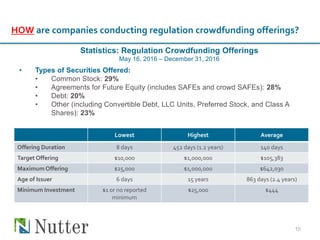

This document outlines key aspects of regulation crowdfunding, which allows startups and small businesses to sell securities to the general public through online platforms. It discusses eligibility, investment limits, disclosure requirements, and the operational frameworks necessary for conducting regulation crowdfunding offerings. The document also addresses the advantages and challenges associated with this fundraising method, particularly in relation to compliance costs and reporting obligations.