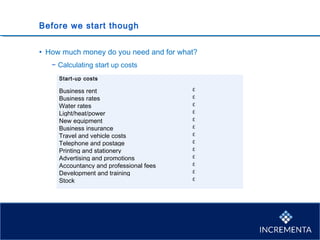

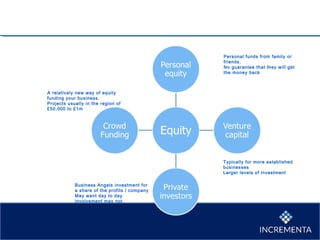

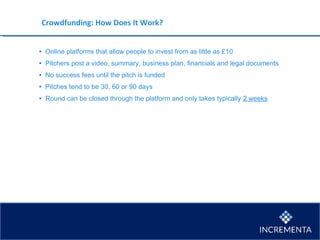

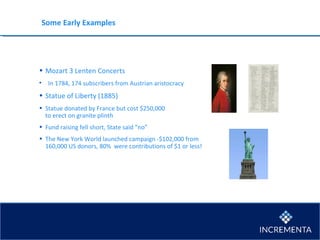

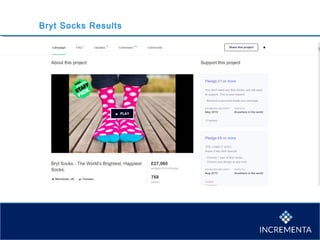

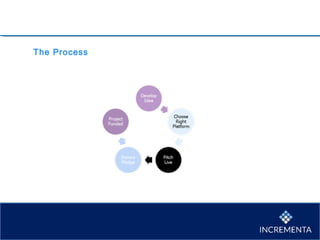

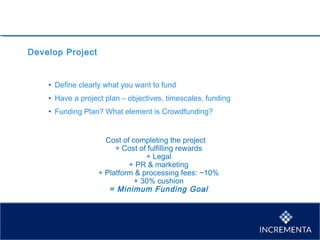

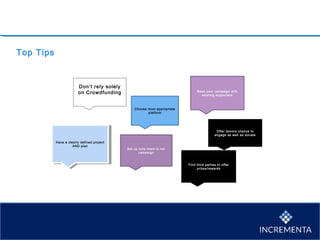

This document provides guidance on finding funding for a new business. It discusses four main sources of funding: equity, debt, public sector grants, and crowdfunding. For crowdfunding, it defines the models of donations, rewards, debt, and equity crowdfunding. It emphasizes having a clear project plan and costs, choosing the right platform, creating a compelling pitch, engaging supporters, and maintaining communication. Key tips for funding applications include having clarity, concision, realism, and understanding the funder's objectives.