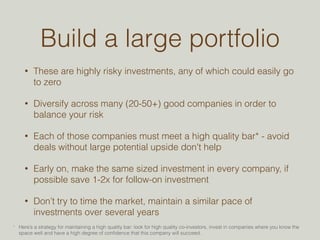

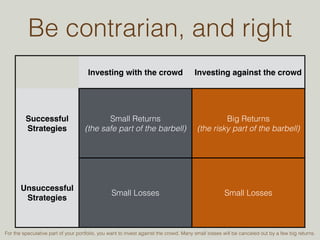

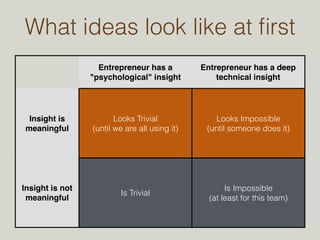

This document provides advice for new angel investors. It recommends adopting a "barbell strategy" of maintaining a diversified portfolio with most funds in safe investments and a small percentage in highly risky startup investments. It also advises building a large portfolio of 20-50 startup investments to balance risk, focusing on deals that could provide "power-law returns" of 100x gains. The document emphasizes the importance of developing expertise, reputation, and brand to attract high-quality founders and deals.

![SAM ALTMAN

“The real risk is missing out on that one outstanding

investment, not failing to get our money back on all

your other companies.”

“The best angel investors take bets on ideas/founders

that can be really huge and cheerfully lose your money

most of the time.”

“Invest in a reasonable number of companies […] bias

all your efforts towards attracting great founders.”

“Proprietary deal flow and networks are almost over,

you – and your references – are going to have to be

able to explain to a founder how you’re going to help

them.”

Read/Watch these:

• Sam Altman at PreMoney

• Upside Risk

• Venture Funds Fret as YC Soars](https://image.slidesharecdn.com/growingwings-140803180642-phpapp02/85/How-to-be-an-Angel-Investor-Part-3-22-320.jpg)

![PETER THIEL

“There is only so much we can do to help the

companies in which we invest. And because

of this, the act of making the investment

(rather than the ability to fix things later)

remains by far the most important thing to

do.”

“[My biggest loss was not also investing in

the B round of Facebook,] whenever a tech

startup has a strong up round led by a top

tier investor, it is generally still undervalued.

The steeper the up round, the greater the

undervaluation.”

Read/Watch these:

• Zero to One (book)

• Peter Thiel AMA

• Tim Ferriss Podcast (go to 9:40 min)](https://image.slidesharecdn.com/growingwings-140803180642-phpapp02/85/How-to-be-an-Angel-Investor-Part-3-23-320.jpg)

![CHRIS DIXON

“[Invest in good companies and

work your ass off. The next time

you’re competing for a deal, tell the

founder to call your prior

investments].

Think of it like a video game, where

you do this, and you level up. As

you level up, you can invest in

more companies and [can be more

helpful to them].”

Watch this:

• Chris Dixon on Brand Building](https://image.slidesharecdn.com/growingwings-140803180642-phpapp02/85/How-to-be-an-Angel-Investor-Part-3-24-320.jpg)

![JOE LONSDALE

“You are betting on their drive /

determination to succeed. […]

Don’t bet on any team, or any

fund for that matter, that is not

obsessed and determined to

prevail.”

Read this:

• Angel Investing](https://image.slidesharecdn.com/growingwings-140803180642-phpapp02/85/How-to-be-an-Angel-Investor-Part-3-25-320.jpg)

![MARC ANDREESSEN

“4000 startups a year are founded … 15 of those

will generate 95% of all the economic returns”

“if you are doing it right, you are continuously

investing in things that are non-consensus at the

time of investment. And let me translate ‘non-consensus':

in sort of practical terms, it translates

to crazy.”

“We are looking for a magic combination of

courage and genius .… Courage [“not giving up

in the face of adversity”] is the one people can

learn.”

Read this:

• 12 things I learned from…](https://image.slidesharecdn.com/growingwings-140803180642-phpapp02/85/How-to-be-an-Angel-Investor-Part-3-27-320.jpg)

![MAX LEVCHIN

“For HVF, cutting only ‘big’ checks

leads to more rigorous, more

exciting investments.

Removing the option of mitigating

risk by reducing check size means

the only way to discern between

investments is to thoroughly

understand [them].”

Read this:

• Big Checks](https://image.slidesharecdn.com/growingwings-140803180642-phpapp02/85/How-to-be-an-Angel-Investor-Part-3-28-320.jpg)