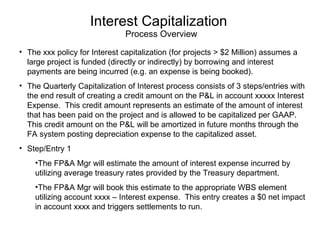

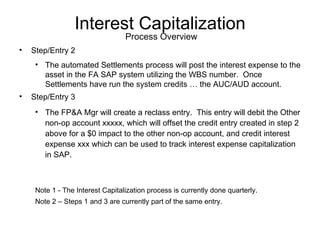

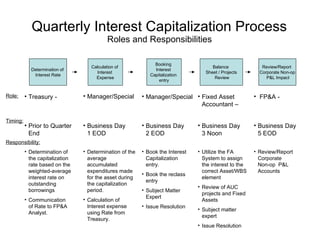

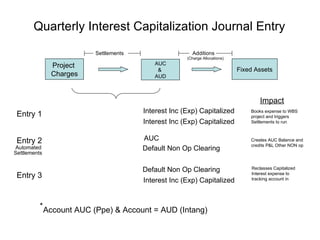

The document describes a company's policy and process for quarterly capitalization of interest for large projects over $2 million that are funded by borrowing. It involves three steps: 1) estimating interest expense and booking it, 2) an automated system posting the expense to assets, and 3) a reclass entry debiting a non-op account and crediting interest expense to track amounts capitalized. Key roles include Treasury calculating interest rates, FP&A booking entries, and fixed asset accounting ensuring proper asset assignment.