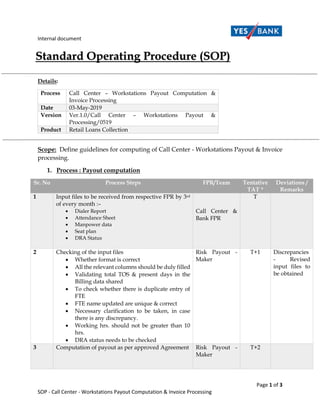

This document outlines the standard operating procedure for call center workstation payout computation and invoice processing. It details the key steps and timelines involved, which include:

1) Receiving input files by the 3rd of each month from call centers containing details like dialer reports, attendance sheets, and seat plans.

2) Computation of payout amounts according to agreements by the 5th day of the month, including quality checks.

3) Processing of invoices received from call centers, including validation checks and uploading approved invoices into the payment system by the 9th day.

4) Payment is then processed and credited to vendor accounts by the 24th day of the month.