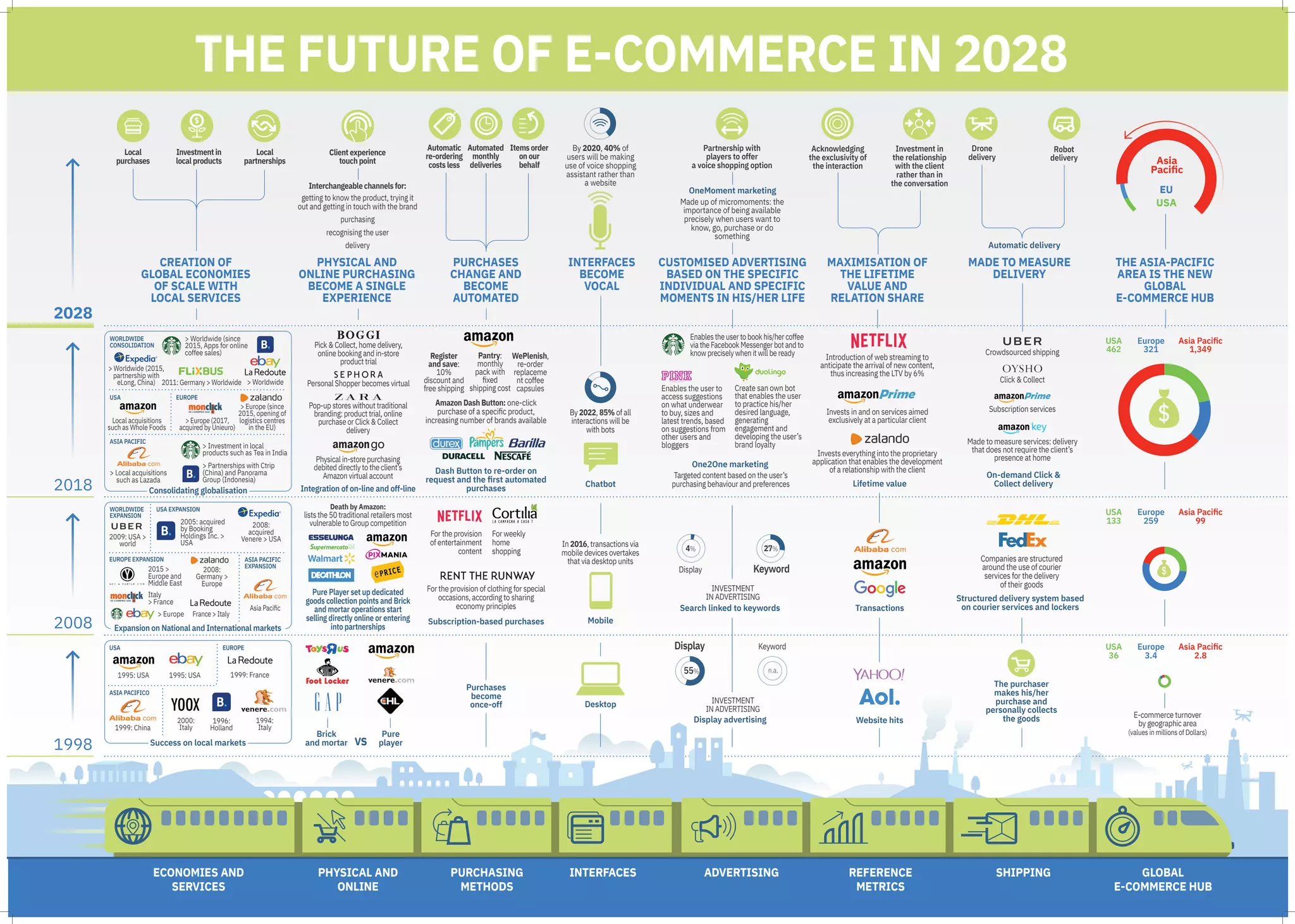

The document discusses the evolving landscape of global e-commerce, highlighting the integration of online and physical purchasing experiences, with a focus on personalized advertising and automated purchases. It outlines the rise of the Asia-Pacific region as a key e-commerce hub and the impact of technology, such as chatbots and voice shopping, on consumer behavior. Additionally, it covers the strategies of various companies to adapt and consolidate in a rapidly changing market, projecting future trends and innovations through 2028.