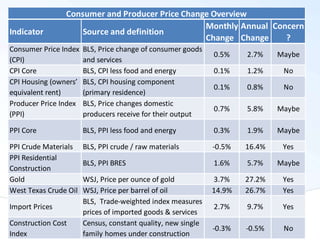

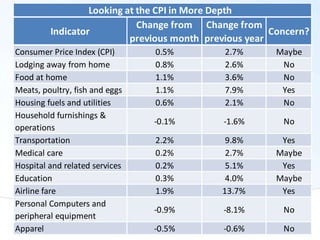

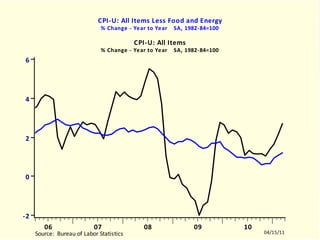

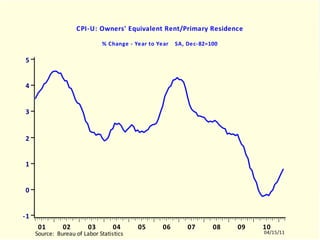

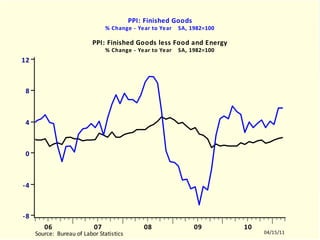

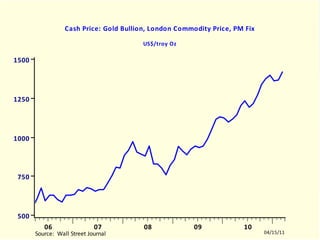

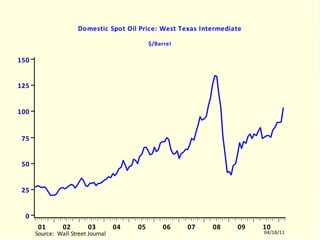

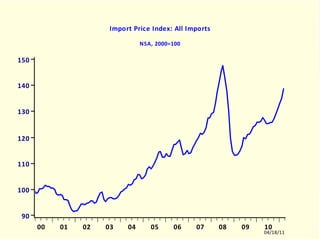

Inflation is important for real estate agents because it can influence interest rate policy set by the Federal Reserve. The Fed typically lowers rates to stimulate the economy but higher rates may be used to combat inflation. This document discusses recent inflation trends, including rising producer and energy prices beginning to impact consumer prices. There is an expectation among economists of further price and cost increases. Some fear that high inflation or stagflation, with high unemployment and inflation, could occur.