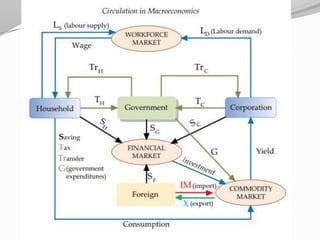

This document discusses the differences between microeconomics and macroeconomics. Microeconomics examines specific markets and how individual supply and demand affects prices. Macroeconomics looks at overall economic trends and how monetary policy impacts the whole economy. The document then provides details on inflation, including causes like demand-pull and cost-push inflation. Effects of inflation include reduced purchasing power and discouragement of savings. Ways to combat inflation include fiscal and monetary policies at the national level and conservative spending at the individual level. The document also briefly discusses deflation.