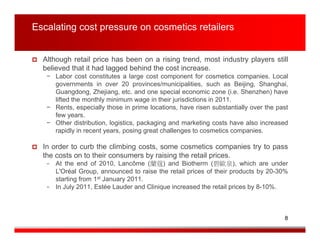

This document provides an overview of China's cosmetics market in 2011. It discusses the market size reaching 110.3 billion yuan, an 18.7% increase from 2010. It also examines distribution channels like department stores, supermarkets, and the growing popularity of online retailers. Rising costs are putting pressure on retailers as minimum wages and rents increase. Overall the market shows strong growth, especially in lower-tier cities, but first- and second-tier cities still capture over half of sales.