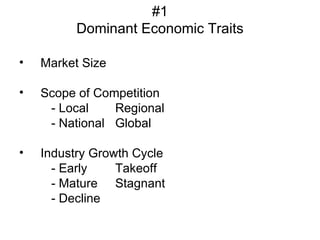

This document outlines key factors for analyzing industry attractiveness:

1. Economic traits like market size, growth cycle, and profitability.

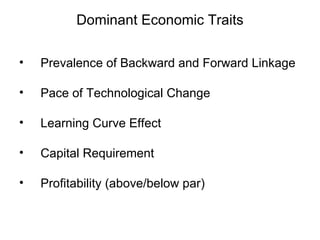

2. Porter's five competitive forces including substitutes, suppliers, buyers, potential entrants, and rivalry among sellers.

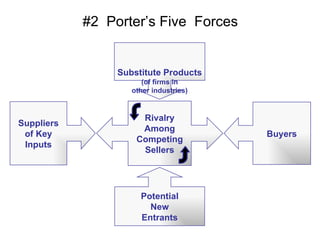

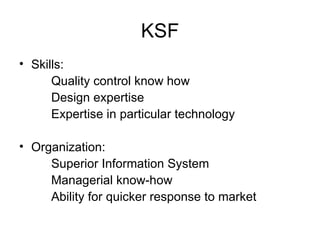

3. Key success factors such as technology and product innovation capabilities, manufacturing skills, distribution networks, marketing abilities, and organizational competencies.

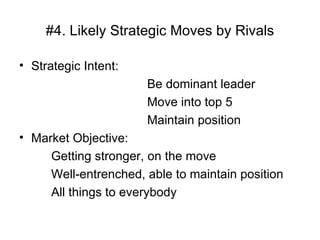

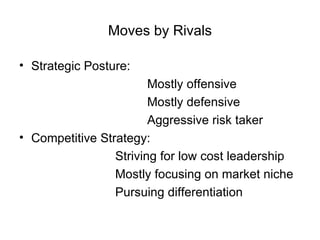

4. Potential strategic moves by rivals regarding market objectives, strategic posture, and competitive strategies.