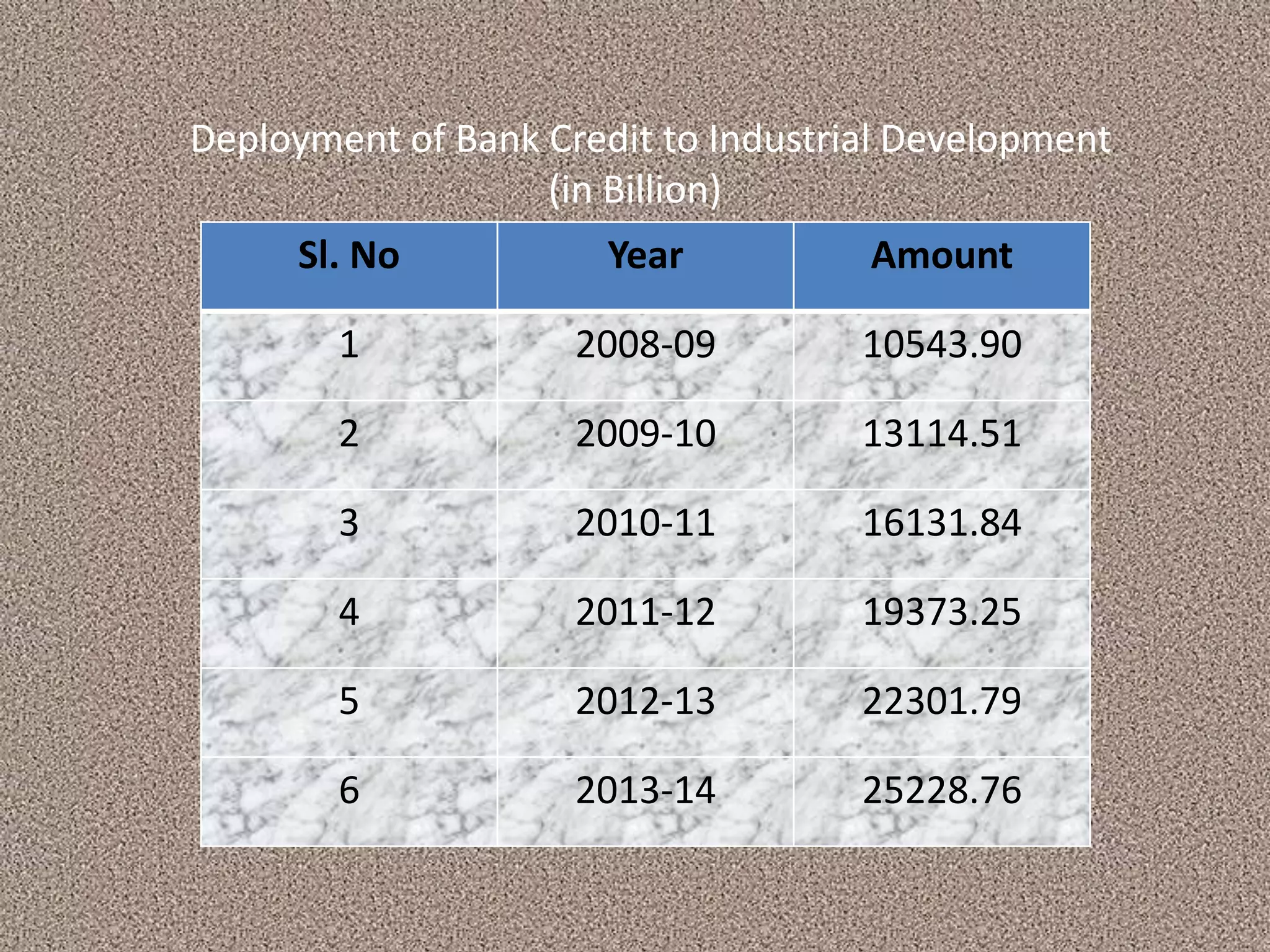

The document discusses the linkages between India's financial sector and industrial development. It provides context on financial sector reforms in India since the 1980s and describes the key components and functions of the Indian financial system. It then analyzes how reforms and developments in the financial system, such as liberalized credit policies, have supported industrial growth by improving firms' access to funding and investment. Statistical data is presented on industrial contribution to GDP, industry growth rates, and bank credit deployed to the industrial sector from 2008-2013, demonstrating the financial sector's role in enabling industrial development.

![INDUSTRIAL LINKAGES WITH

FINANCIAL SECTOR

BY

Dr. C. RAJENDRAN., Ph.D

Dept. of Economics

[Govt. Arts College, Coimbatore]](https://image.slidesharecdn.com/industriallinkagewithfinancialsector-190814025815/75/Industrial-Linkage-with-Financial-sector-1-2048.jpg)