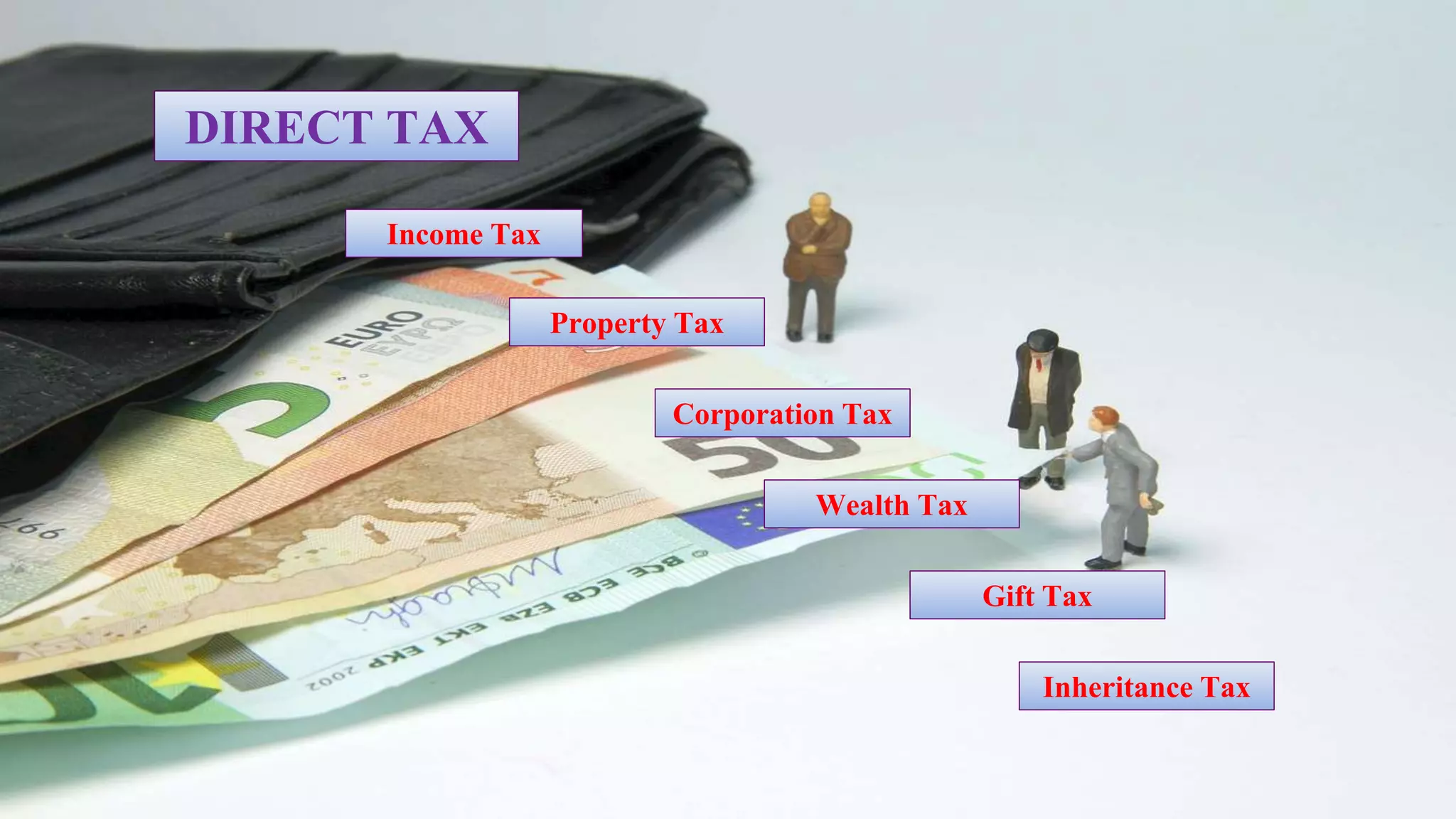

This document provides information on direct and indirect taxes in India including Goods and Services Tax (GST). It discusses the types of taxes such as income tax, sales tax, and excise duty. It also outlines the key aspects of GST including the different types of GST (CGST, SGST, IGST), return filing requirements, and tax rates applied to various goods.