Embed presentation

Downloaded 34 times

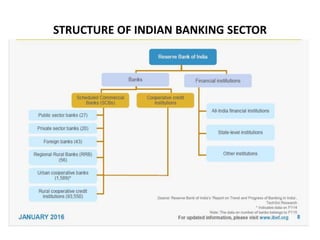

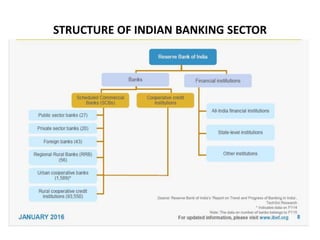

The Indian banking sector consists of 26 public sector banks, 25 private sector banks, 43 foreign banks, 56 regional rural banks, 1,589 urban cooperative banks and 93,550 rural cooperative banks. Public sector banks control around 80% of the market. The document discusses the structure, market size, areas of banking (such as retail, corporate, microfinance), and provides a SWOT analysis of the Indian banking sector. It notes strengths like employment, GDP growth, and diversified services, as well as weaknesses like high non-performing assets and inability to reach underpenetrated markets.