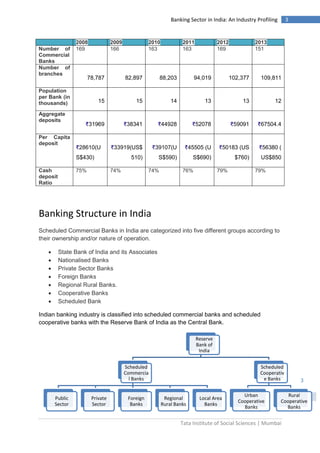

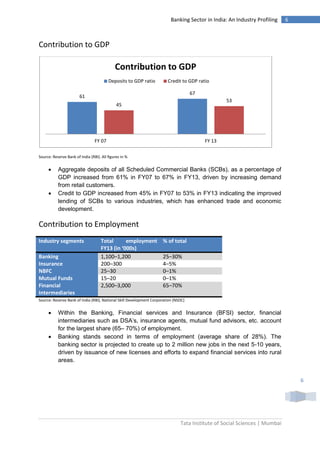

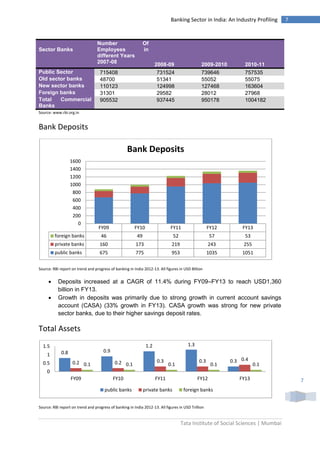

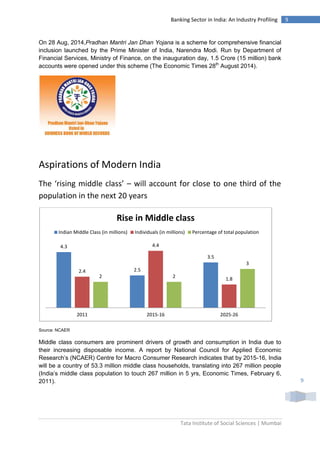

The Indian banking sector has grown significantly in recent years and is sound and well-regulated according to the Reserve Bank of India. It has shown resilience during economic downturns. There are various types of banks operating in India including public sector banks, private sector banks, foreign banks, and cooperative banks. In recent years, government initiatives like Pradhan Mantri Jan Dhan Yojana have expanded access to banking and financial inclusion. However, the banking sector still faces challenges in fully meeting the needs of India's growing middle class and expanding access to rural and agricultural customers.